162

CDL

HOSPITALITY TRUSTS

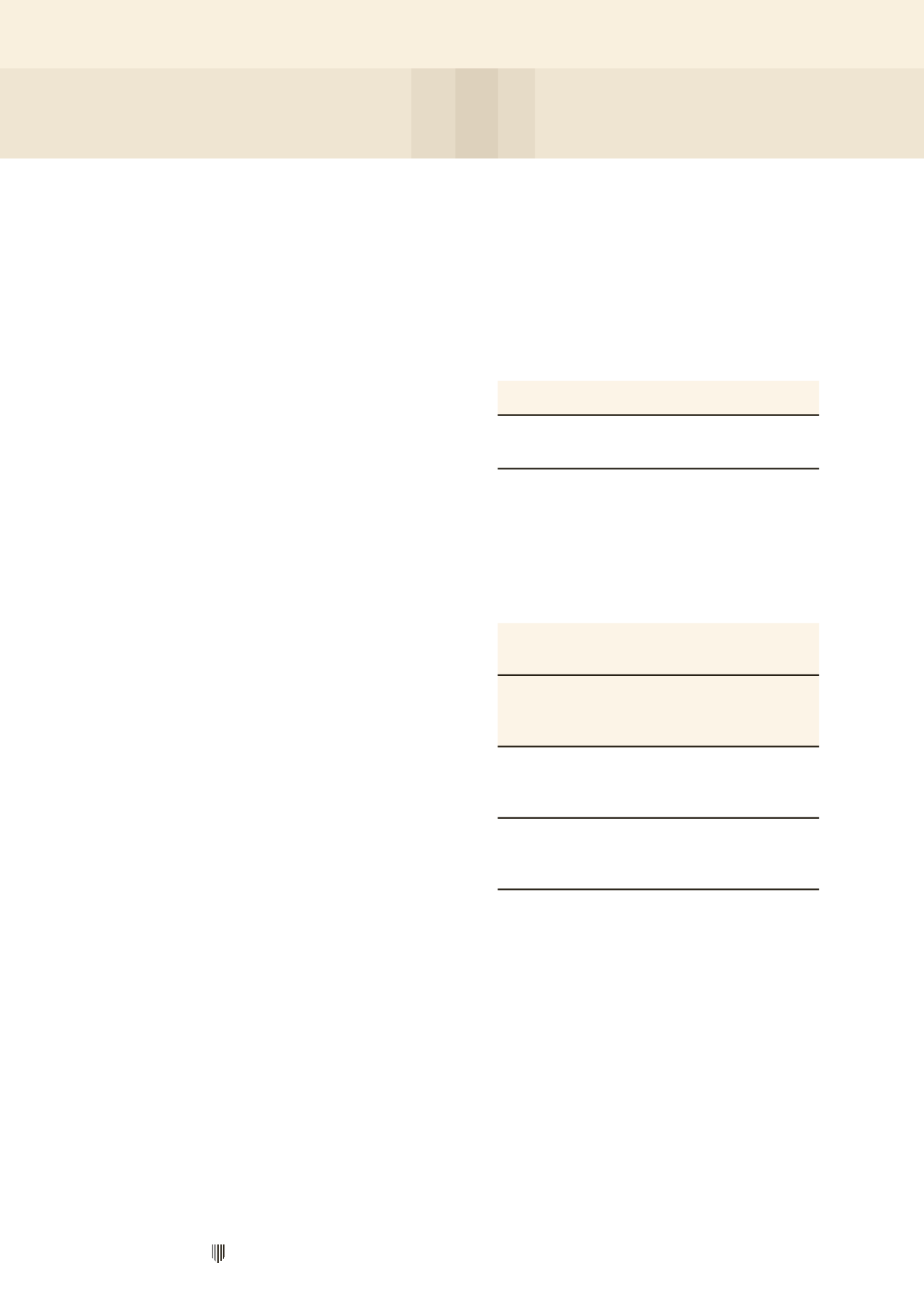

28 DETERMINATION OF FAIR VALUES (CONT’D)

Financial assets and financial liabilities not carried at fair value but for which fair values are disclosed*

Note Level 1 Level 2 Level 3

Total

$’000

$’000

$’000

$’000

HBT Group, H-REIT Group and Stapled Group

2014

Loans and borrowings

12

–

774,932

–

774,932

2013

Loans and borrowings

12

–

688,228

–

688,228

* Excludes financial assets and financial liabilities whose carrying amounts measured on the amortised cost basis approximate their

fair values due to their short-term nature and where the effect of discounting is immaterial.

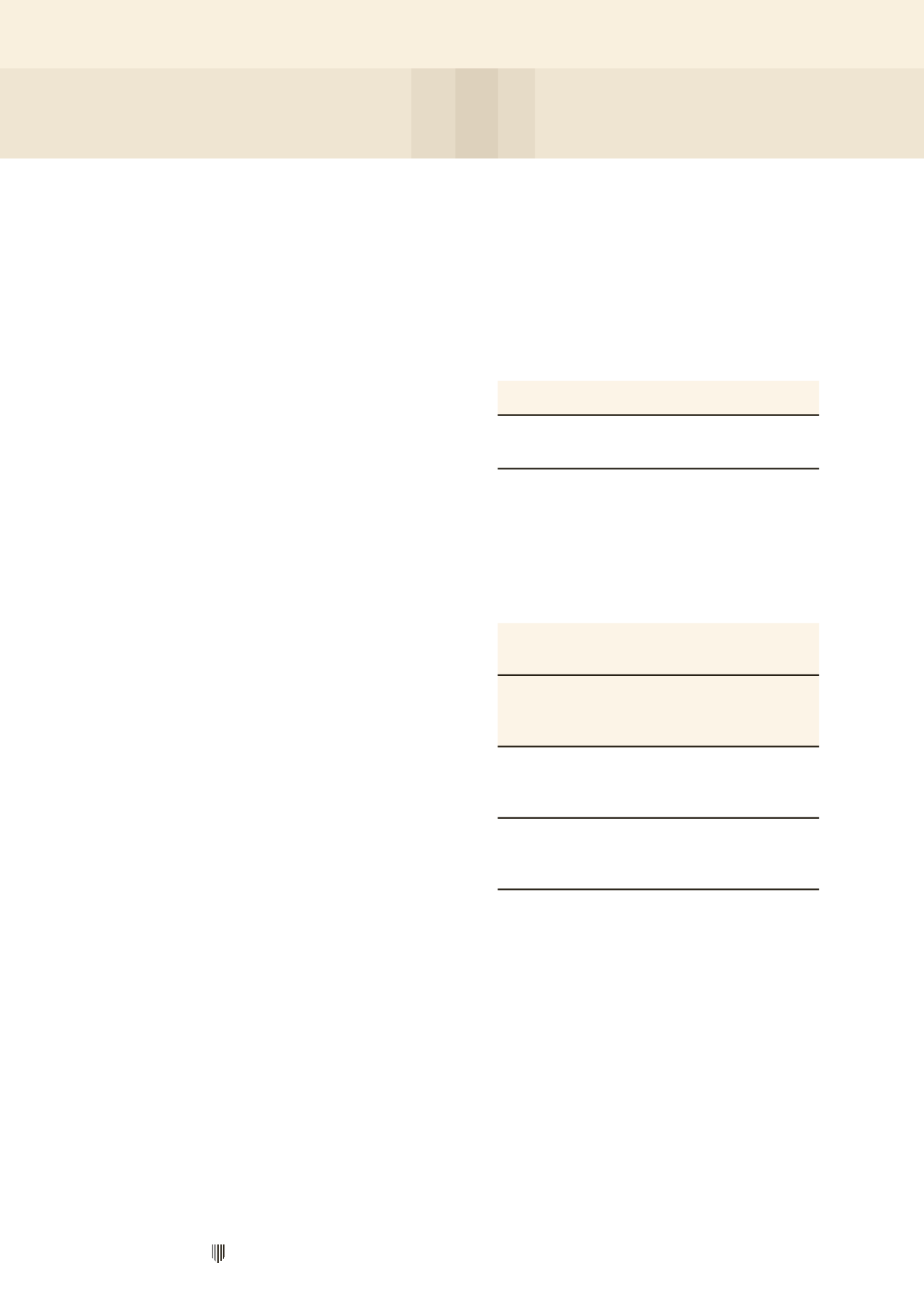

Non-financial assets carried at fair value

Note Level 1 Level 2 Level 3

Total

$’000

$’000

$’000

$’000

H-REIT Group

2014

Investment properties

5

–

– 2,288,455 2,288,455

Stapled Group

2014

Investment properties

5

–

– 2,206,423 2,206,423

H-REIT Group

2013

Investment properties

5

–

– 2,238,770 2,238,770

Stapled Group

2013

Investment properties

5

–

– 2,161,693 2,161,693

For a reconciliation of investment properties from the beginning balances to the ending balances for fair value

measurements in Level 3 of the fair value hierarchy, refer Note 5.

NOTES TO THE FINANCIAL STATEMENTS