153

ANNUAL REPORT 2014

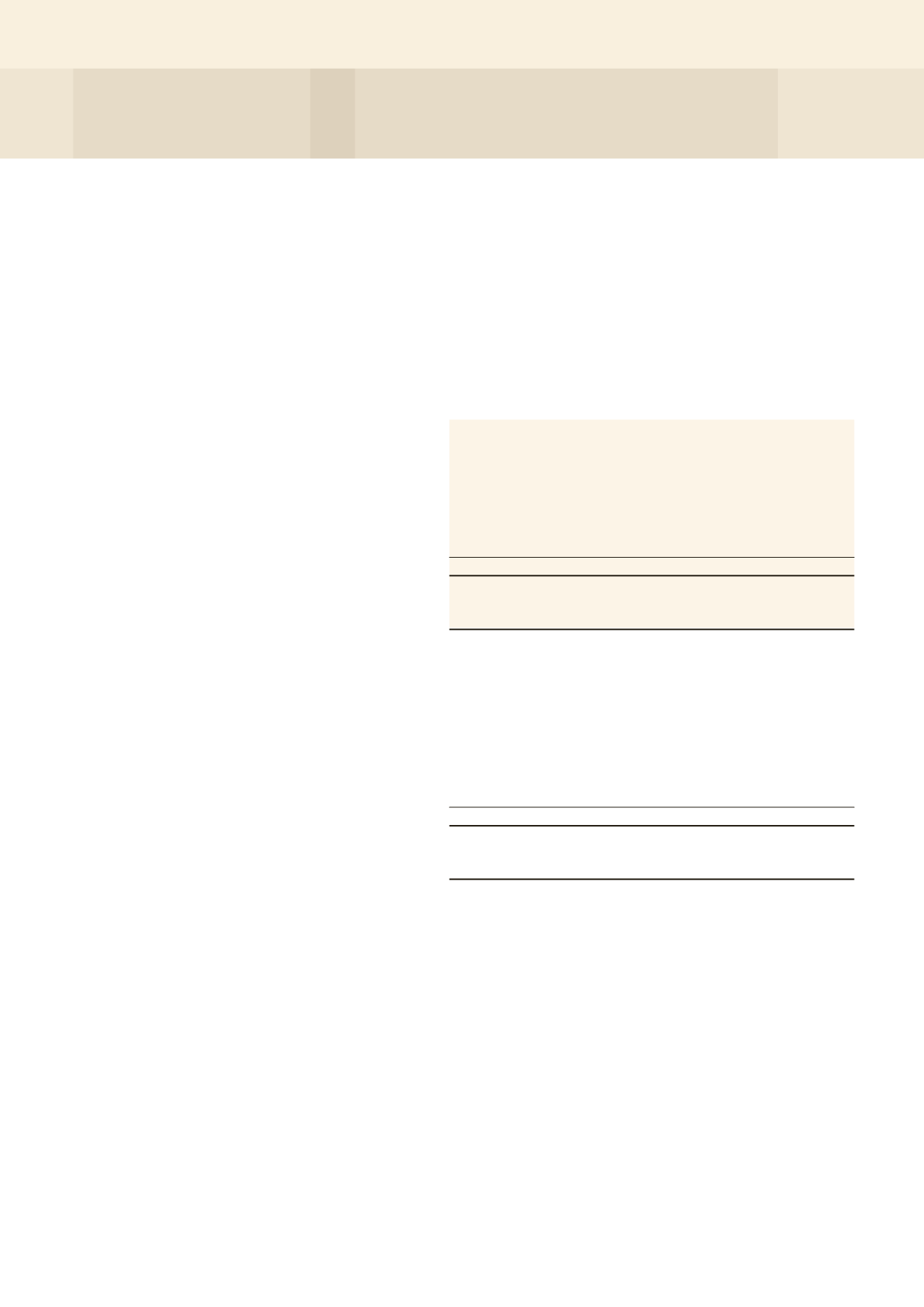

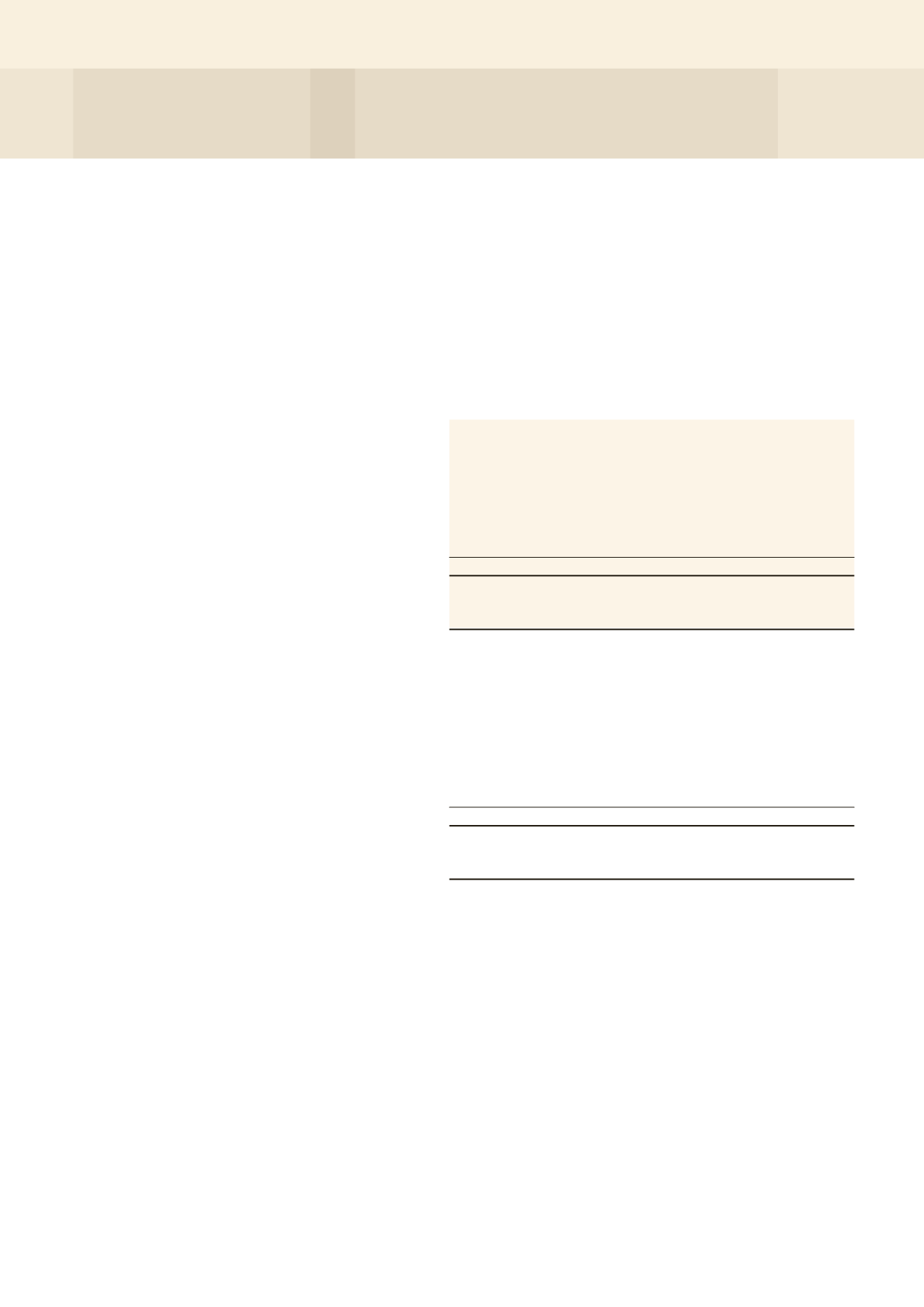

27 FINANCIAL RISK MANAGEMENT (CONT'D)

Liquidity risk (cont'd)

<--------------- Cash flows ----------------->

Carrying Contractual

Within

Within More than

amount cash flows 1 year

1 to 5 years 5 years

$’000 $’000

$’000

$’000

$’000

Stapled Group

2014

Non-derivative financial liabilities

Fixed rate medium term notes

119,932 (130,258)

(3,000)

(127,258)

–

Floating rate medium term note

83,512

(85,318)

(1,064)

(84,254)

–

Variable rate bank loans

472,663 (407,661)

(403,803)

(3,858)

–

Fixed rate bank loan

98,825 (205,197)

(4,629)

(200,568)

–

Trade and other payables*

38,625

(38,625)

(38,625)

–

–

Rental deposits

8,091

(10,314)

(1,026)

(126)

(9,162)

821,648 (877,373)

(452,147)

(416,064)

(9,162)

Derivative financial instrument

Interest rate swap

581

(703)

(703)

–

–

2013

Non-derivative financial liabilities

Fixed rate medium term notes

189,673 (204,137)

(73,714)

(130,423)

–

Floating rate medium term note

83,491

(86,988)

(1,296)

(85,692)

–

Variable rate bank loans

320,484 (329,351)

(80,197)

(249,154)

–

Fixed rate bank loans

94,580 (108,376)

(2,756)

(105,620)

–

Trade and other payables*

20,920

(20,920)

(20,920)

–

–

Rental deposits

8,238

(11,287)

(1,412)

(75)

(9,800)

717,386 (761,059)

(180,295)

(570,964)

(9,800)

Derivative financial instrument

Interest rate swap

421

(193)

(438)

245

–

* Excluding rental deposits

The maturity analyses show the contractual undiscounted cashflows of the Stapled Group’s financial liabilities on

the basis of their earliest possible contractual maturity. Derivative financial instrument held is normally not closed

out prior to contractual maturity. The disclosure shows net cashflows for derivative that is net cash settled.

Derivative financial instrument is designated as cash flow hedge. The table above reflects the periods in which the

cash flows associated with cash flow hedge are expected to occur and impact the total return.

Market risk

Market risk is the risk that changes in market prices, such as interest rates and foreign exchange rates, will affect

the HBT Group's comprehensive income and H-REIT Group’s and the Stapled Group’s total return. The objective

of market risk management is to manage and control market risk exposures within acceptable parameters, while

optimising the return on risk.

NOTES TO THE FINANCIAL STATEMENTS