154

CDL

HOSPITALITY TRUSTS

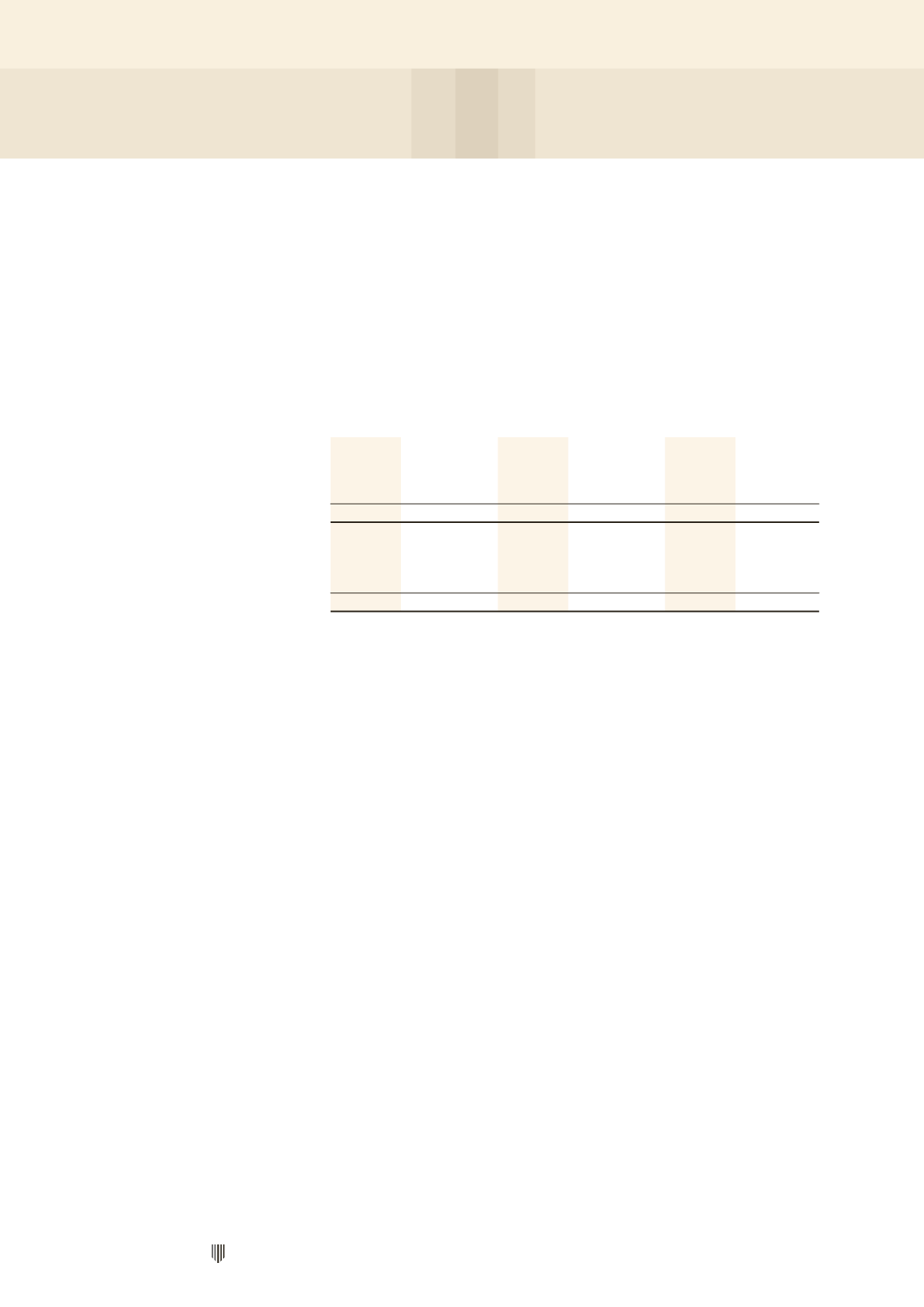

27 FINANCIAL RISK MANAGEMENT (CONT’D)

Interest rate risk

The Stapled Group’s exposure to changes in interest rates relate primarily to interest-earning financial assets and

interest-bearing financial liabilities. At the reporting date, the interest rate profile of the interest-bearing financial

instruments was:

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Fixed rate instruments

Financial assets

3,952

339

71,182

55,468

75,134

55,807

Financial liabilities

–

– (219,233)

(285,048)

(219,233)

(285,048)

Interest rate swap

–

– (100,311)

(105,353)

(100,311)

(105,353)

3,952

339 (248,362)

(334,933)

(244,410)

(334,594)

Variable rate instruments

Financial liabilities

–

– (557,515)

(405,045)

(557,515)

(405,045)

Interest rate swap

–

–

100,311

105,353

100,311 105,353

–

– (457,204)

(299,692)

(457,204)

(299,692)

The H-REIT Manager’s strategy to manage the risk of potential interest rate volatility may be through the use of

interest rate hedging instruments and/or fixed rate borrowings. The H-REIT Manager will regularly evaluate the

feasibility of putting in place the appropriate level of interest rate hedges, after taking into account the prevailing

market conditions.

Derivative financial instruments are used to manage exposures to interest rate risks arising from financing and

investment activities. Derivative financial instruments are not used for trading purposes. However, derivatives that

do not qualify for hedge accounting are accounted for as trading instruments.

Fair value sensitivity analysis for fixed rate instruments

The Stapled Group do not account for any fixed rate financial assets and liabilities at fair value through profit or loss.

The H-REIT Group and the Stapled Group do not designate interest rate swap as hedging instruments under a

fair value hedge accounting model. Therefore, a change in interest rates at the reporting date would not affect

total return.

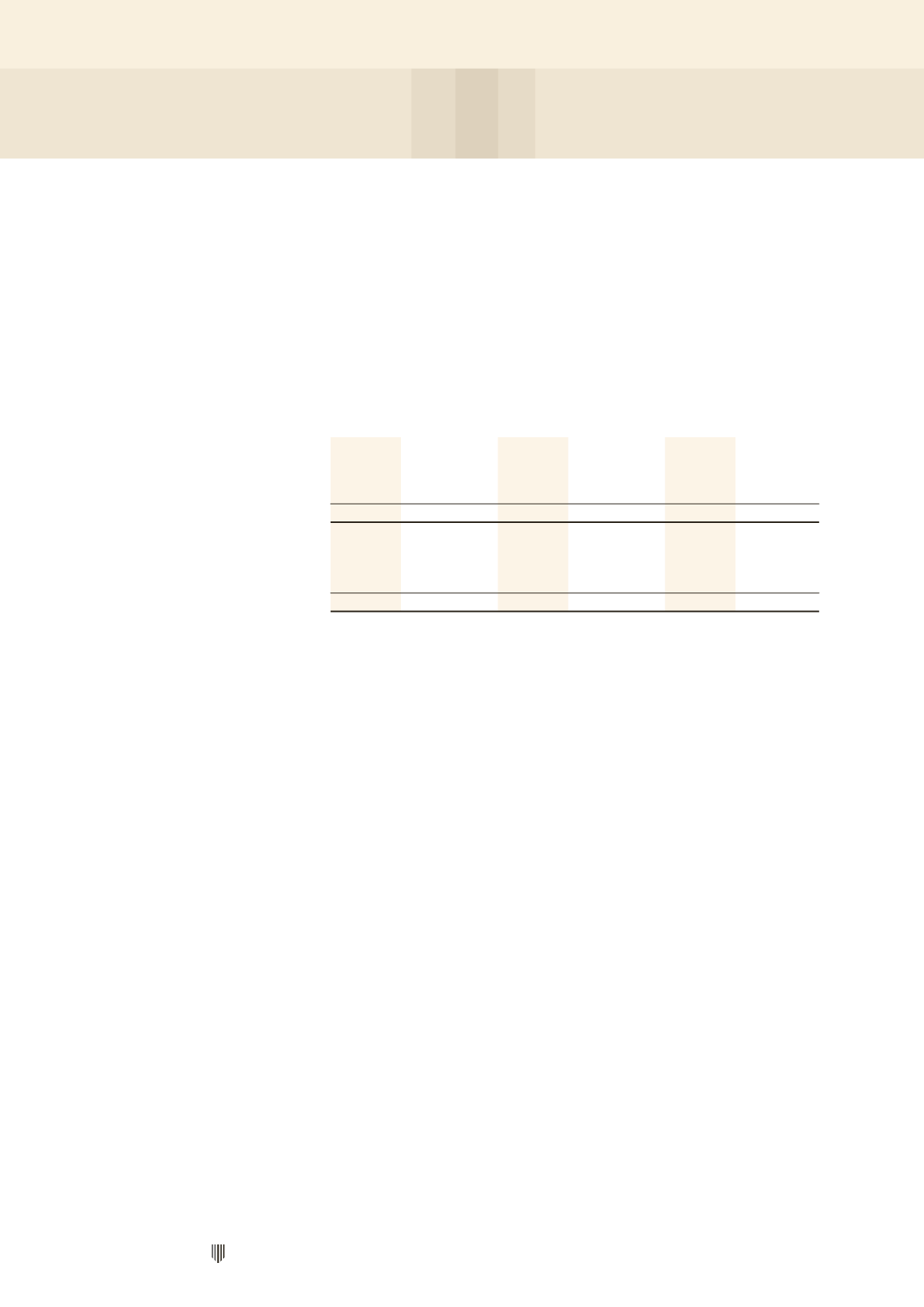

Cashflow sensitivity analysis for variable rate instruments

A change of 100 basis points (bp) in interest rate at the reporting date would increase/(decrease) total return

and unitholders’ funds (before any tax effects) by the amounts shown below. This analysis assumes that all other

variables, remain constant.

NOTES TO THE FINANCIAL STATEMENTS