164

CDL

HOSPITALITY TRUSTS

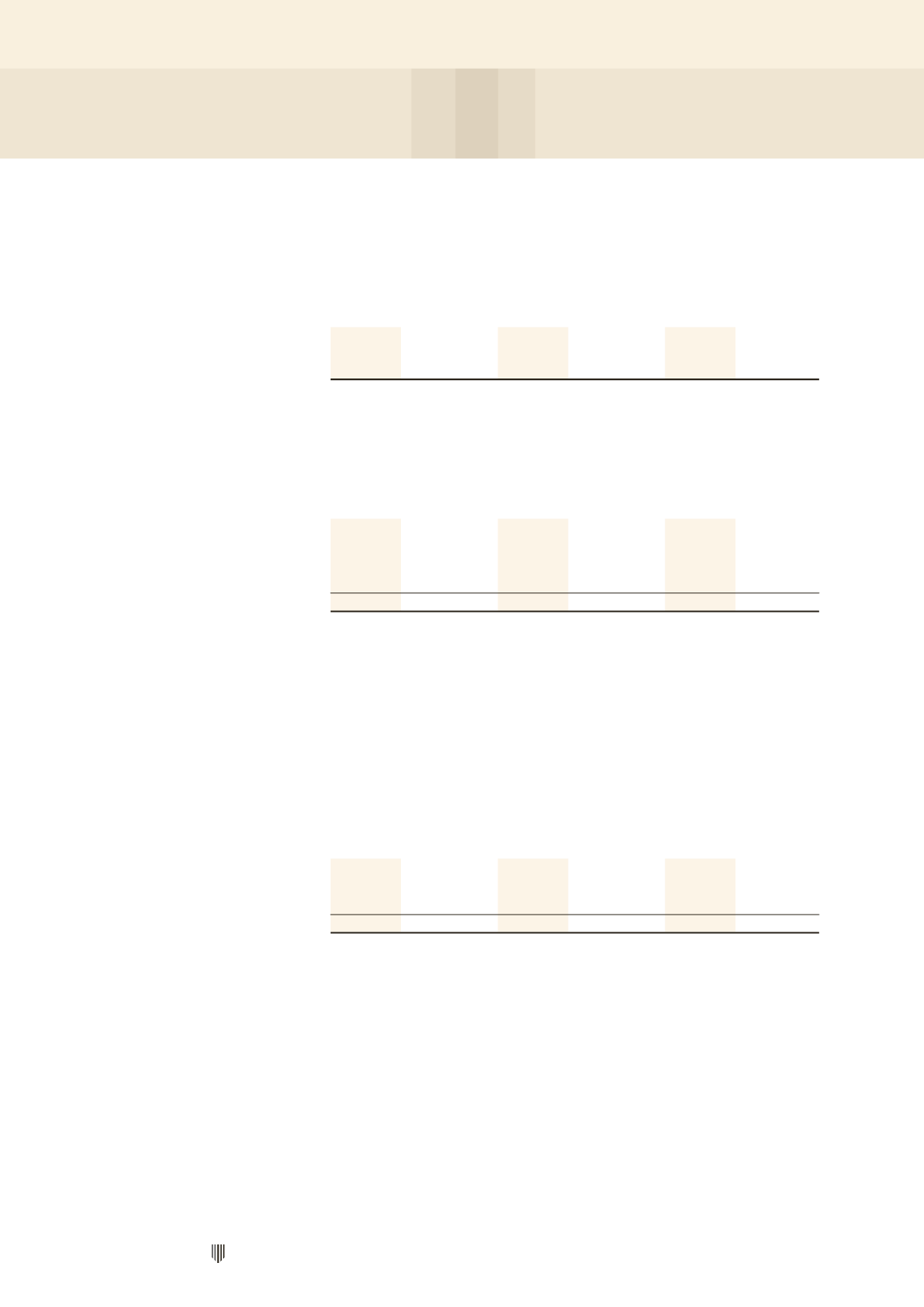

29 COMMITMENTS

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

(a)

Capital expenditure

contracted but not

provided for

–

–

2,803

8,111

2,803

8,111

(b)

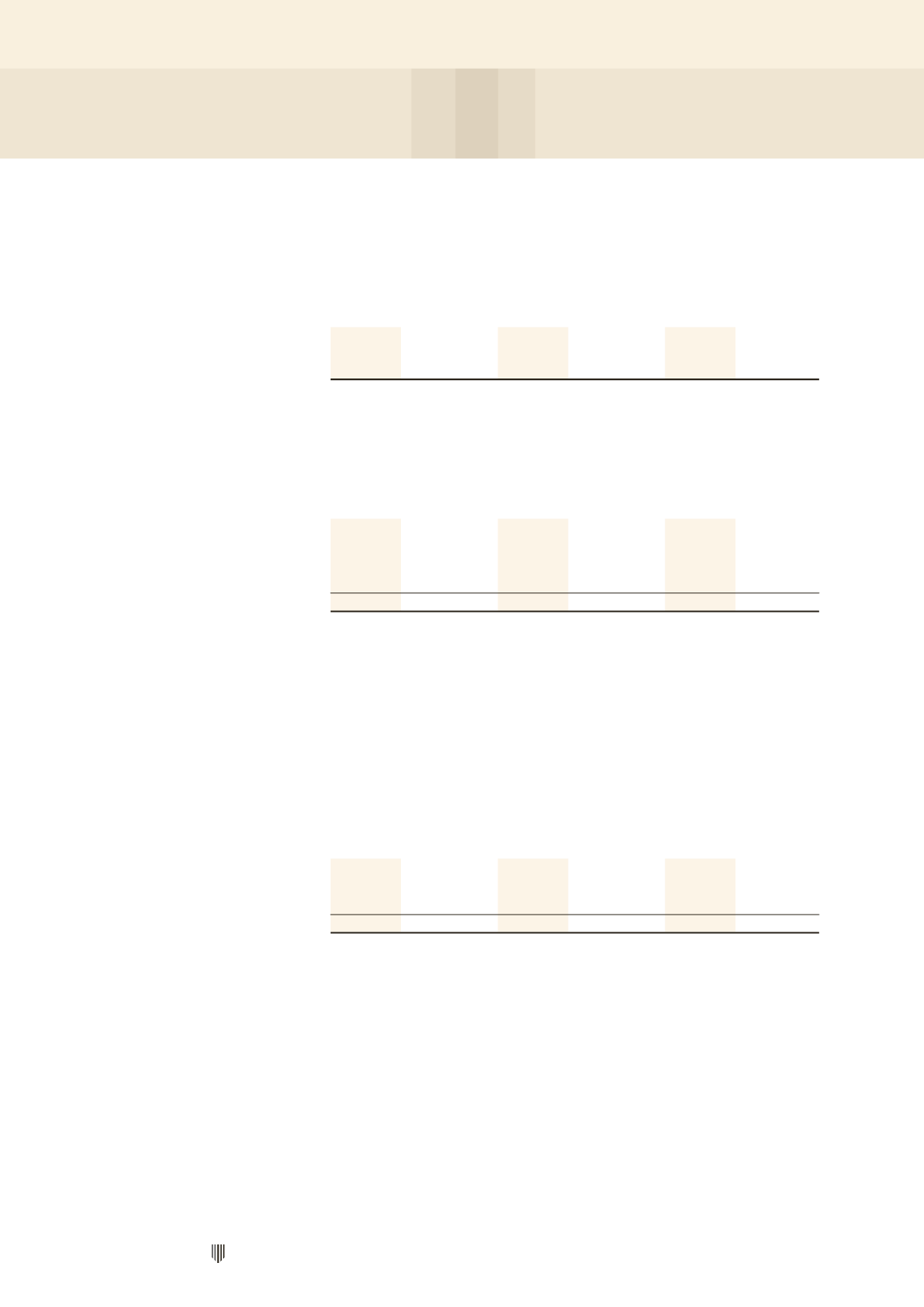

The H-REIT Group and the Stapled Group lease out their investment properties. Non-cancellable operating

lease rentals are receivable as follows:

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Within 1 year

106

–

70,515

66,635

66,651

66,635

After 1 year but

within 5 years

422

–

240,741

237,807

225,286 237,807

After 5 years

508

–

289,516

328,087

274,147 328,087

1,036

–

600,772

632,529

566,084 632,529

The above operating lease receivables are based on the fixed component of the rent receivable under the

lease agreements, adjusted for increases in rent where such increases have been provided for under the lease

agreements.

(c)

The H-REIT Group and the Stapled Group have entered into an operating lease for a conference centre with a

related party. The lease runs for an initial period of 5 years, with an option to renew the lease on expiry of the

initial period. The H-REIT Group’s and the Stapled Group’s commitments for future minimum lease payments

under the non-cancellable operating lease are as follows:

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Within 1 year

–

–

755

755

755

755

After 1 year but

within 5 years

–

–

414

1,170

414

1,170

–

–

1,169

1,925

1,169

1,925

(d)

Under the terms of the lease agreement for Novotel Singapore Clarke Quay and Angsana Velavaru, the

H-REIT Group and the Stapled Group are required to incur expenditure equivalent to 3% of the annual gross

revenue and preceding month’s gross revenue of the hotels/resort respectively to maintain and improve the

hotel’s/resort's furniture and fixtures, equipment and its environment. As at the reporting date, the H-REIT

Group and the Stapled Group is committed to incur capital expenditure of $140,000 (2013: $140,000) under

the terms of the lease agreements.

(e)

H-REIT's subsidiary, CDLHT Oceanic Maldives Private Limited holds a leasehold interest in Meradhoo

in Gaafu Alifu Atoll until the expiry of its land lease on 14 June 2056. On 6 February 2014, the Maldivian

government amended the laws and the lease extension fee is now to be brought forward and paid on eight

quarterly instalments of US$187,500 in 2014 and 2015. As at the reporting date, the future lease extension fee

is approximately $1,189,500 (US$937,500).

NOTES TO THE FINANCIAL STATEMENTS