158

CDL

HOSPITALITY TRUSTS

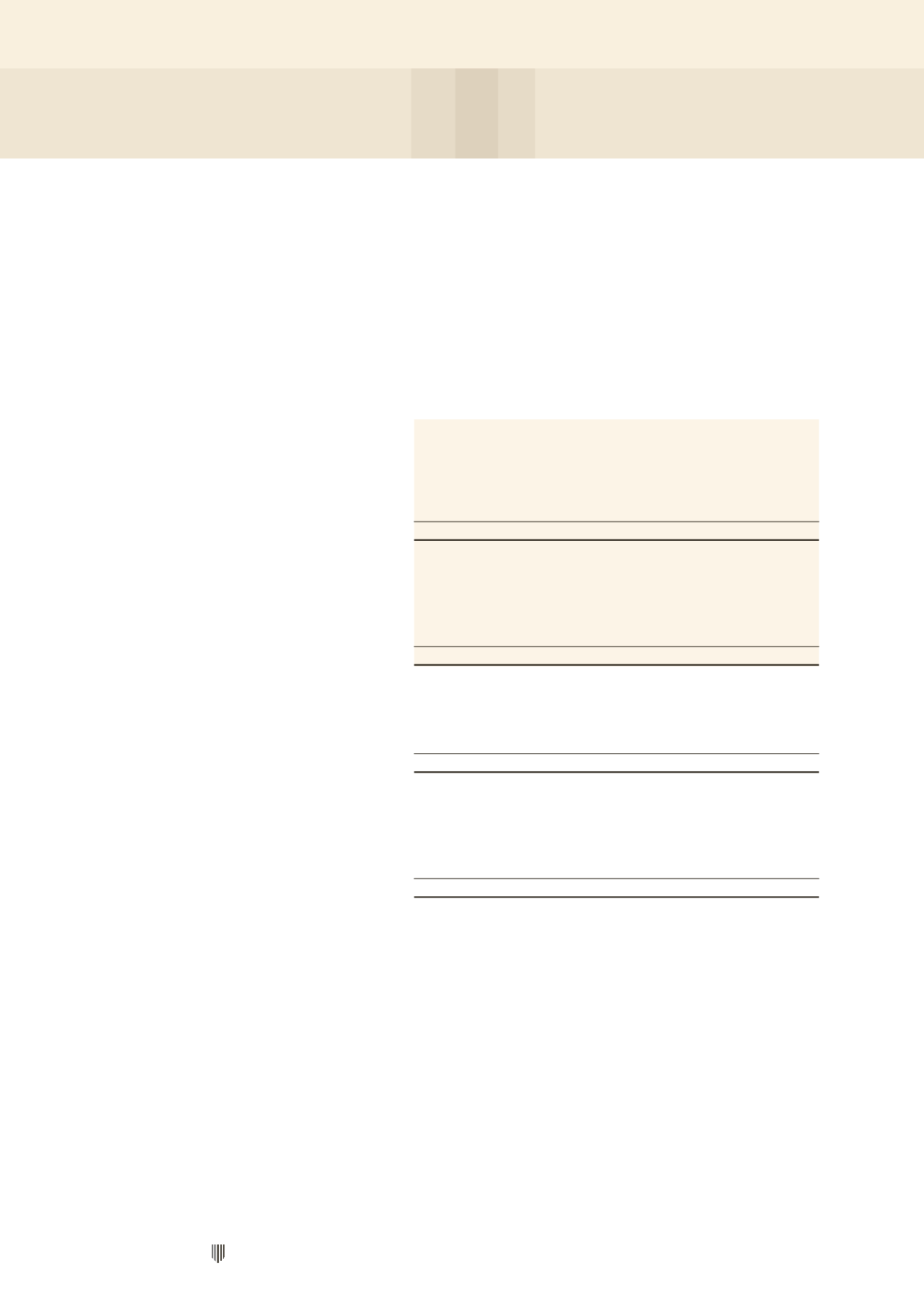

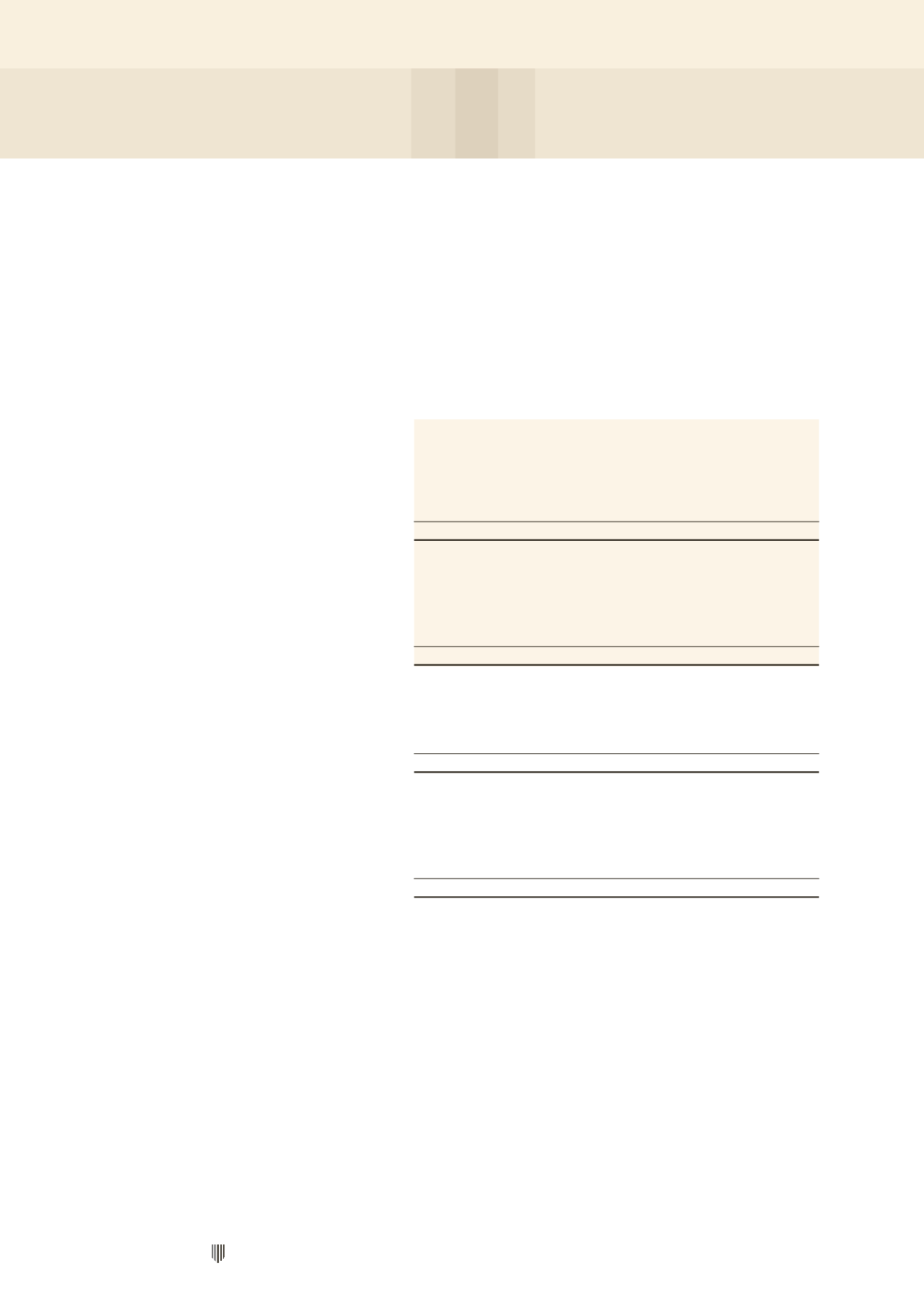

27 FINANCIAL RISK MANAGEMENT (CONT’D)

Fair values (cont'd)

Accounting classifications and fair values (cont'd)

Fair value – Other

Loans and hedging financial

Note receivables instruments liabilities

Total

Fair value

$’000

$’000

$’000 $’000

$’000

H-REIT Group

2014

Trade and other receivables^

9

19,536

–

–

19,536

19,536*

Cash and cash equivalents

10

72,381

–

–

72,381

72,381*

Rental deposits

126

–

–

126

123

92,043

–

–

92,043

92,040

Unsecured bank loans

12

–

– (571,488)

(571,488)

(570,061)

Unsecured medium term notes

12

–

– (203,444)

(203,444)

(203,121)

Financial derivatives liabilities

13

–

(581)

–

(581)

(581)

Trade and other payables

15

–

–

(36,351)

(36,351)

(36,351)*

Rental deposits

–

–

(7,065)

(7,065)

(7,984)

–

(581)

(818,348)

(818,929)

(818,098)

2013

Trade and other receivables^

9

14,810

–

–

14,810

14,810*

Cash and cash equivalents

10

68,123

–

–

68,123

68,123*

Rental deposits

76

–

–

76

72

83,009

–

–

83,009

83,005

Unsecured bank loans

12

–

– (415,064)

(415,064)

(413,748)

Unsecured medium term notes

12

–

– (273,164)

(273,164)

(273,668)

Financial derivatives liabilities

13

–

(421)

–

(421)

(421)

Trade and other payables

15

–

–

(22,329)

(22,329)

(22,329)*

Rental deposits

–

–

(6,826)

(6,826)

(7,728)

–

(421)

(717,383)

(717,804)

(717,894)

^ Excluding prepayments and deferred capital expenditure

* Carrying amount is a reasonable approximation of fair value

NOTES TO THE FINANCIAL STATEMENTS