138

CDL

HOSPITALITY TRUSTS

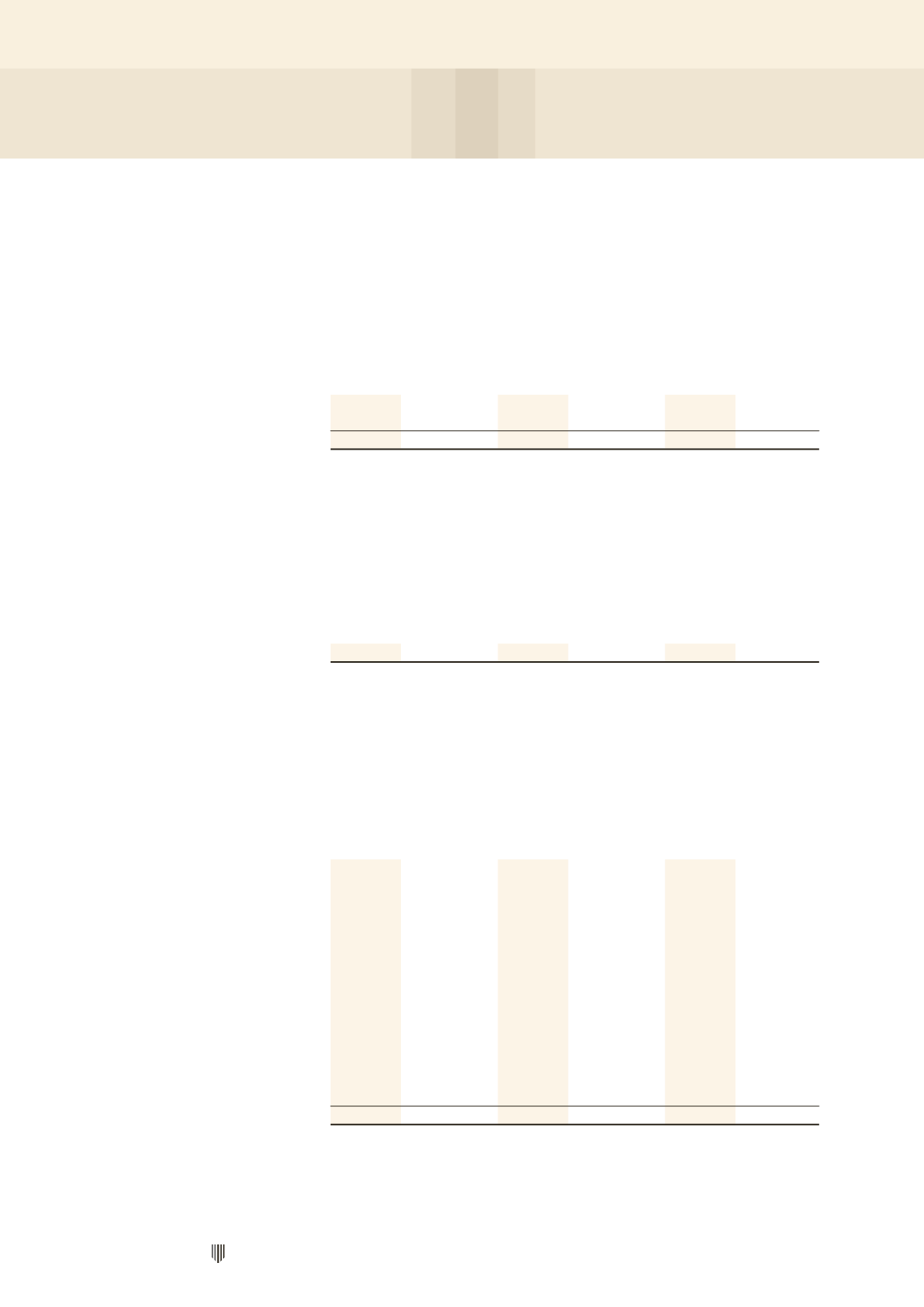

14 DEFERRED TAX (CONT'D)

Deferred tax liabilities and assets are offset when there is a legally enforceable right to set off current tax liabilities

and when the deferred taxes relate to the same tax authority. The amounts determined after appropriate offsetting

are included in statement of financial position as follows:

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Deferred tax assets

–

–

(1,018)

–

(1,018)

–

Deferred tax liabilities

–

–

11,574

–

11,521

–

–

–

10,556

–

10,503

–

Unrecognised deferred tax assets

Deferred tax assets have not been recognised in respect of these items because it is not probable that future

taxable profit will be available against which the H-REIT Group and the Stapled Group can utilise the benefits

therefrom.

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Tax losses

–

–

–

14,189

–

14,189

Tax losses are subject to agreement by the tax authorities and compliance with tax regulations in the respective

countries in which the subsidiaries operate.

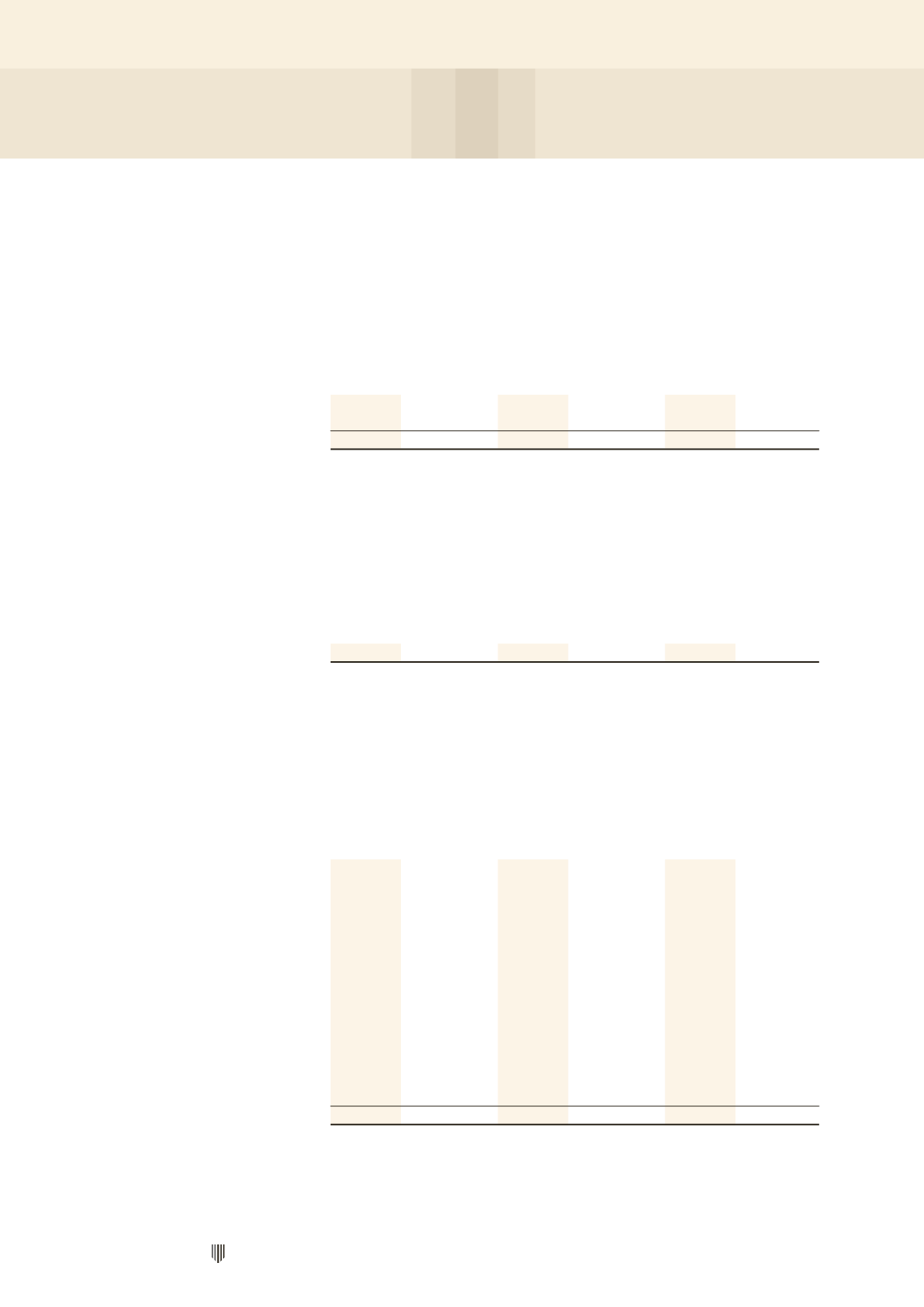

15 TRADE AND OTHER PAYABLES

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Trade payables to:

- related corporations of

the H-REIT Manager

–

–

121

159

121

159

- the H-REIT Manager

–

–

1,762

748

1,762

748

- related entities

4,091

–

991

–

–

–

- the HBT Trustee- Manager

24

–

–

–

24

–

- third parties

1,925

–

6,296

4,112

8,221

4,112

Other payables to:

- the H-REIT Manager

–

–

244

33

244

33

- related entities

265

–

–

–

–

–

- third parties

952

254

9,561

8,702

10,513

8,702

Accrued operating expenses

1,390

3

14,585

5,182

15,975

5,185

Rental deposits

–

–

1,026

1,412

1,026

1,412

Interest payable

–

–

1,765

1,981

1,765

1,981

8,647

257

36,351

22,329

39,651

22,332

NOTES TO THE FINANCIAL STATEMENTS