131

ANNUAL REPORT 2014

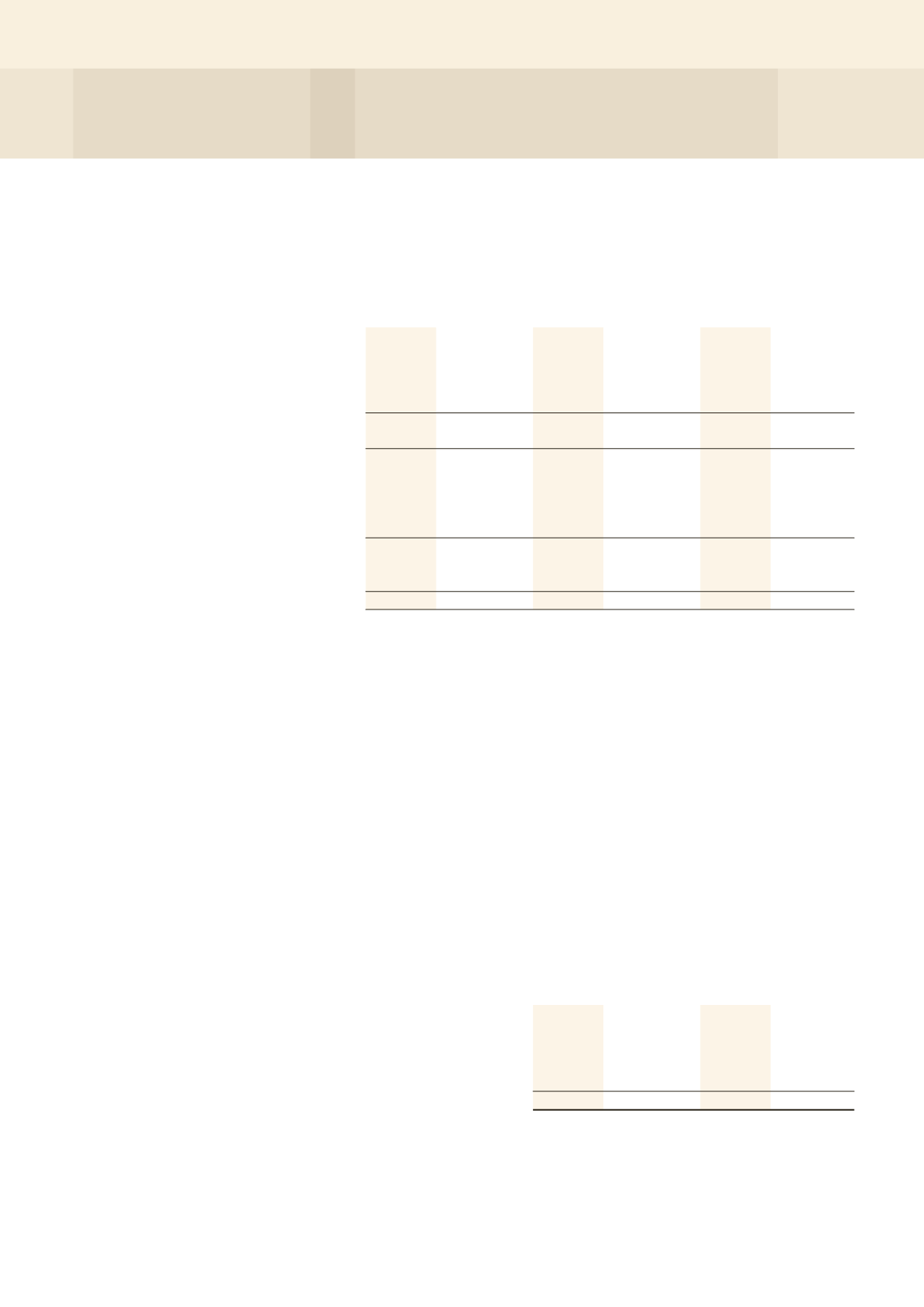

9 TRADE AND OTHER RECEIVABLES

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Trade receivables from:

- related corporations of

the H-REIT Manager

–

–

6,728

6,381

6,728

6,381

- related entities

991

–

4,091

–

–

–

- third parties

2,074

–

4,261

7,012

6,335

7,012

3,065

–

15,080

13,393

13,063

13,393

Impairment losses

(113)

–

(69)

(224)

(182)

(224)

Net trade receivables

2,952

–

15,011

13,169

12,881

13,169

Related corporations of

the H-REIT manager

–

–

11

–

11

–

Related entities

–

–

265

254

–

–

Other receivables

371

–

4,249

1,387

4,620

1,387

Loans and receivables

3,323

–

19,536

14,810

17,512

14,556

Prepayments

464

–

948

637

1,412

637

Deferred capital expenditure

–

–

1,115

301

1,115

301

3,787

–

21,599

15,748

20,039

15,494

H-REIT Group’s investment properties, except Claymore Connect, are leased to ten (2013: nine) master lessees.

The contribution to trade and other receivables from these master lessees as at 31 December 2014 is $14,748,000

(2013: $12,494,000), of which $4,192,000 (2013: $6,166,000) is from third parties and $6,728,000 (2013: $6,328,000)

is from related corporations of the H-REIT Manager and $4,091,000 (2013: Nil) is from HBT Group.

Outstanding balances with related entities are unsecured. There is no impairment loss arising from these

outstanding balances.

Concentration of credit risk relating to trade receivables of H-REIT's Group's retail mall is limited due to the many

varied tenants. The H-REIT Group’s and HBT Group's historical experience in the collection of accounts receivables

falls within the recorded impairment losses. Due to these factors, the H-REIT Manager and HBT Trustee-Manager

believes that no additional credit risk beyond amounts provided for collection losses is inherent in the trade

receivables of the HBT Group, H-REIT Group and the Stapled Group.

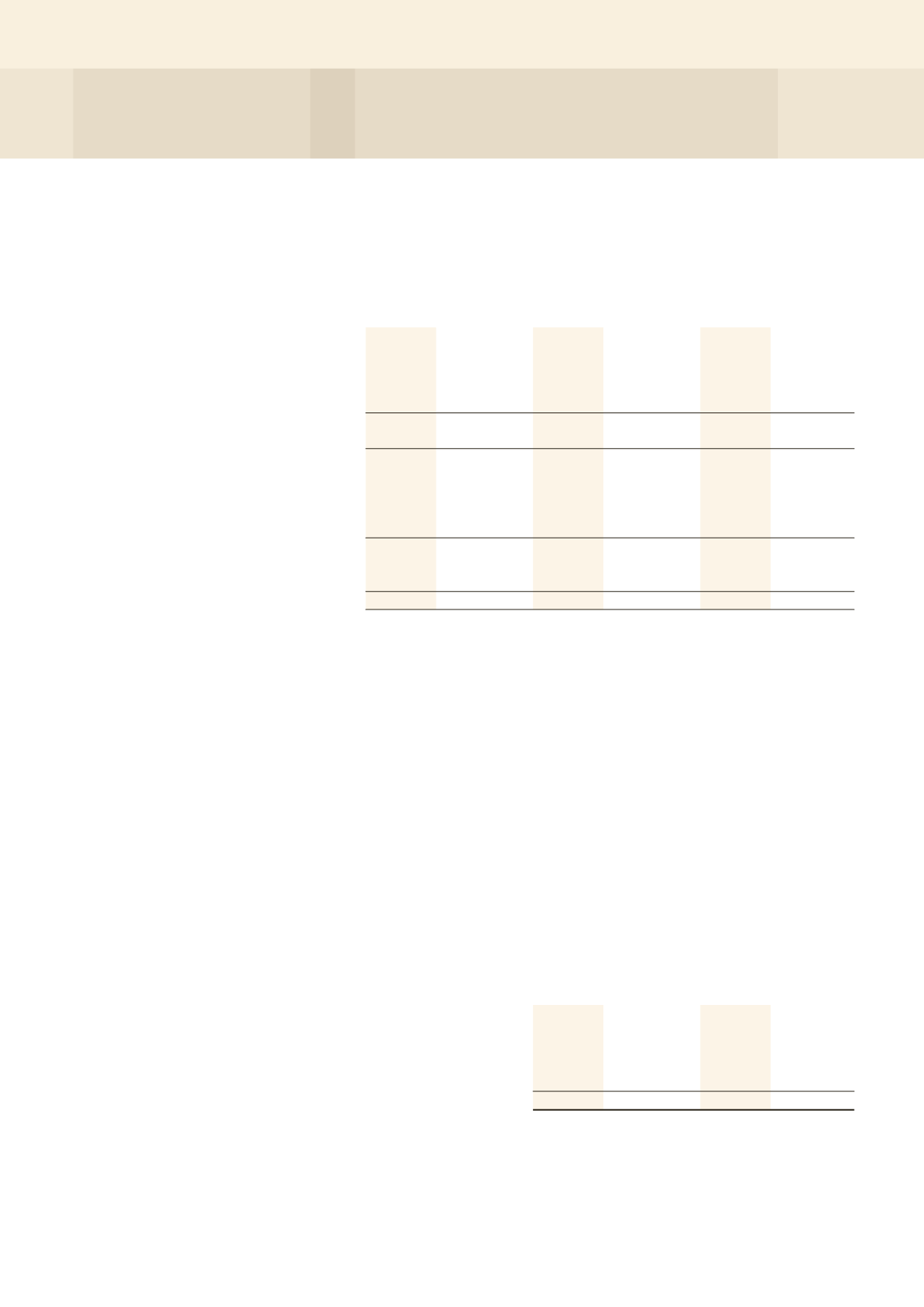

The ageing of loans and receivables at the reporting date is:

Impairment

Impairment

Gross

losses

Gross

losses

2014

2014

2013

2013

$’000

$’000

$’000

$’000

HBT Group

Not past due

2,933

–

–

–

Past due 31 – 60 days

247

–

–

–

Past due 61 – 90 days

23

–

–

–

More than 90 days

233

113

–

–

3,436

113

–

–

NOTES TO THE FINANCIAL STATEMENTS