137

ANNUAL REPORT 2014

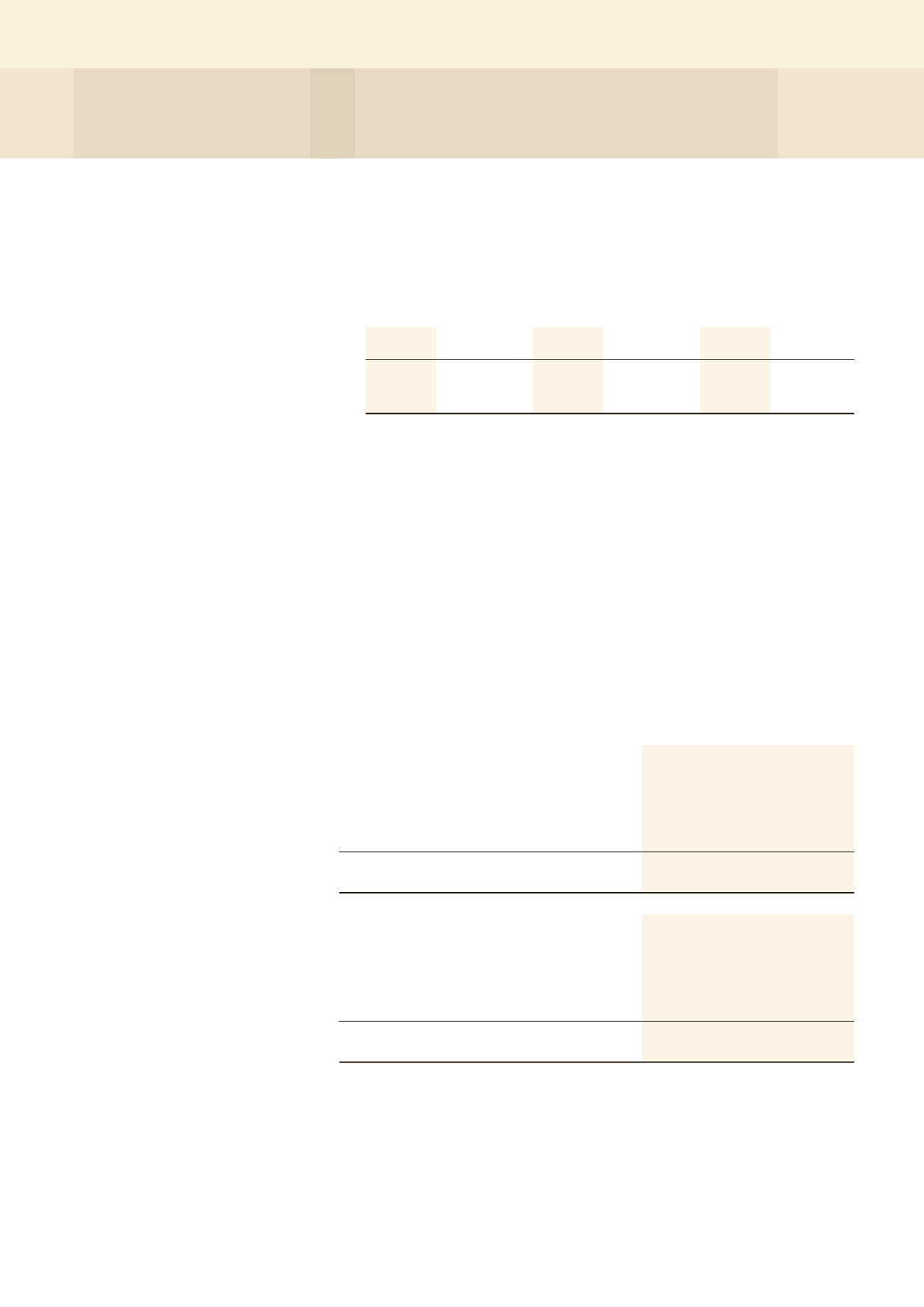

13 FINANCIAL DERIVATIVE LIABILITIES

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Non-current liabilities

Interest rate swap used for hedging

–

–

–

421

–

421

Current liabilities

Interest rate swap used for hedging

–

–

581

–

581

–

The H-REIT Group has an interest rate swap contract with a notional amount of $100,311,000 (2013: $105,353,000).

The H-REIT Group and Stapled Group use interest rate swaps to manage their exposures to interest rate movements

on the floating rate interest-bearing bank loans by swapping the interest expense of a bank loan from floating rate to

fixed rate (Note 12).

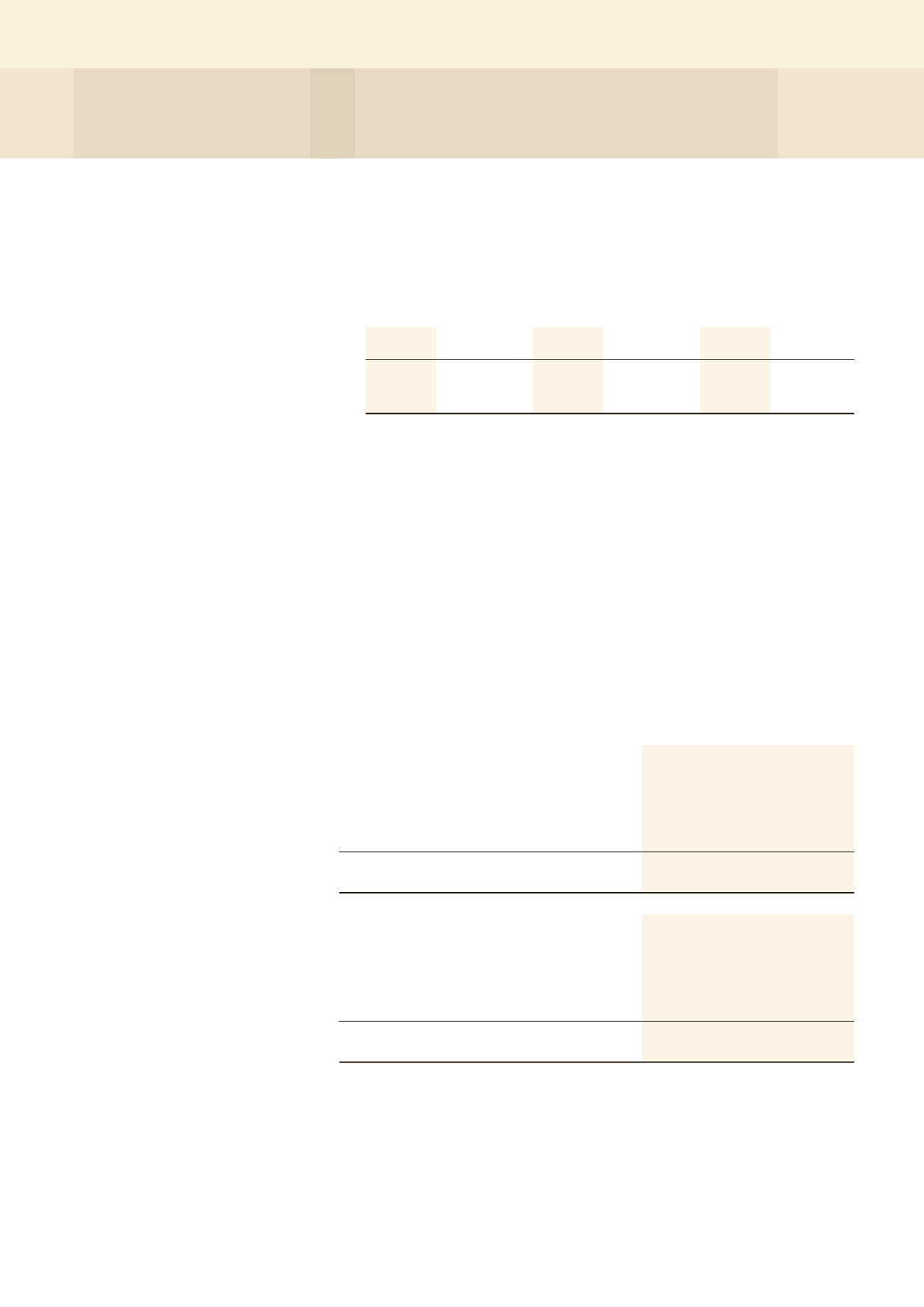

14 DEFERRED TAX

Movement in temporary differences during the year:

Recognised

Recognised

in

in

Statement

Balance Statement

Balance

Balance as of Total

Exchange as at

of Total

Exchange as at

at 1/1/2013 Return differences 31/12/2013 Return differences 31/12/2014

$’000

$’000

$’000

$’000

$’000

$’000

$’000

H-REIT Group

Deferred tax assets

Tax losses carried forward

(3,620)

(640)

434

(3,826)

(1,752)

243

(5,335)

Deferred tax liabilities

Investment properties

11,716

3,270

(1,309)

13,677

2,754

(540)

15,891

Net deferred tax liabilities/

(assets)

8,096

2,630

(875)

9,851

1,002

(297)

10,556

Stapled Group

Deferred tax assets

Tax losses carried forward

(3,620)

(640)

434

(3,826)

(1,752)

243

(5,335)

Deferred tax liabilities

Investment properties

11,716

3,270

(1,309)

13,677

2,704

(543)

15,838

Net deferred tax liabilities/

(assets)

8,096

2,630

(875)

9,851

952

(300)

10,503

NOTES TO THE FINANCIAL STATEMENTS