142

CDL

HOSPITALITY TRUSTS

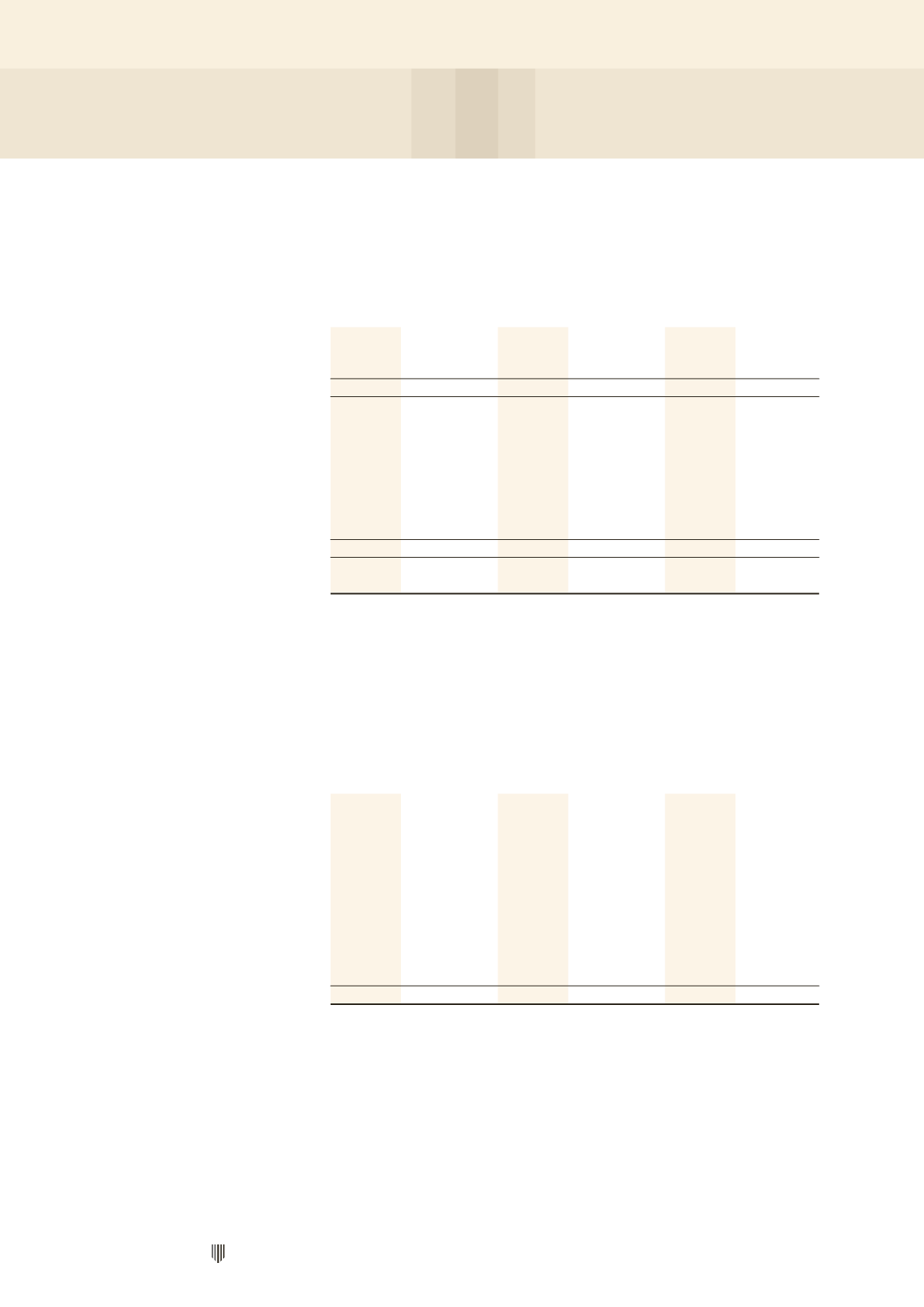

21 FINANCE INCOME AND FINANCE EXPENSE

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Interest income received/

receivable from banks

–

–

322

419

322

419

Exchange gain

–

–

798

–

798

–

Finance income

–

–

1,120

419

1,120

419

Exchange loss

–

–

–

(596)

–

(596)

Amortisation of transaction

costs capitalised

–

–

(940)

(741)

(940)

(741)

Financial expense arising from

remeasuring non-current

rental deposits at amortised cost

–

–

(187)

(181)

(187)

(181)

Interest paid/payable to banks

(1)

–

(16,432)

(15,539)

(16,433)

(15,539)

Finance costs

(1)

–

(17,559)

(17,057)

(17,560)

(17,057)

Net finance costs

(1)

–

(16,439)

(16,638)

(16,440)

(16,638)

The amortisation for 2014 and 2013 relate to the amortisation of transaction costs arising from the medium term

notes issuance, revolving credit facility and term loan facilities.

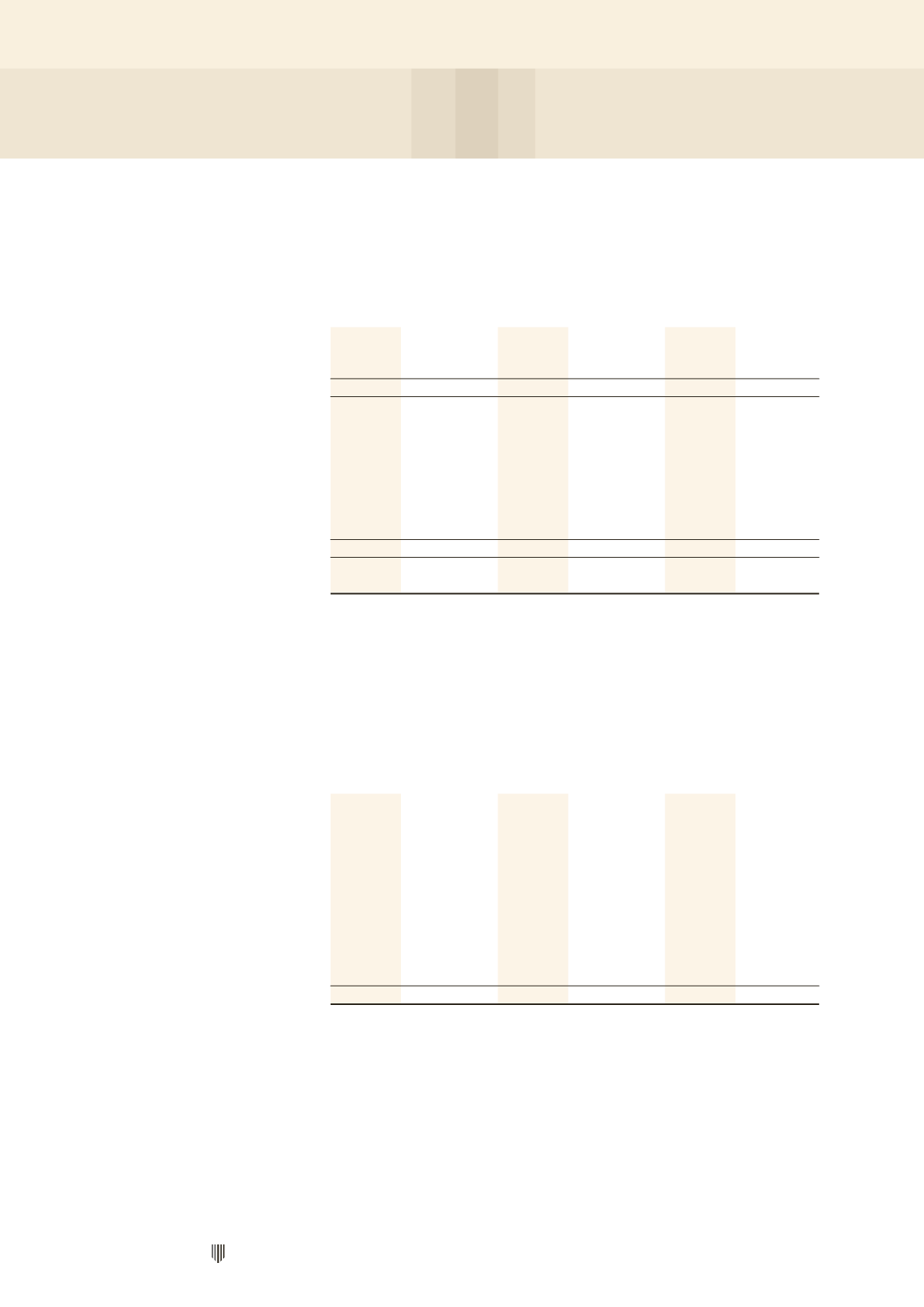

22 NET (LOSS)/INCOME

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Comprises net income of:

- H-REIT

–

–

108,149

119,977

108,149 119,977

- Other H-REIT Group entities

(including consolidation

adjustments)

–

–

18,683

23,011

18,683

23,011

- HBT Group

(58)

(31)

–

–

(58)

(31)

- Other HBT Group entities

(including consolidation

adjustments)

271

–

–

–

271

–

- Other Stapled Group’s

consolidation adjustments

–

–

–

–

(3,164)

–

213

(31)

126,832

142,988

123,881 142,957

NOTES TO THE FINANCIAL STATEMENTS