133

ANNUAL REPORT 2014

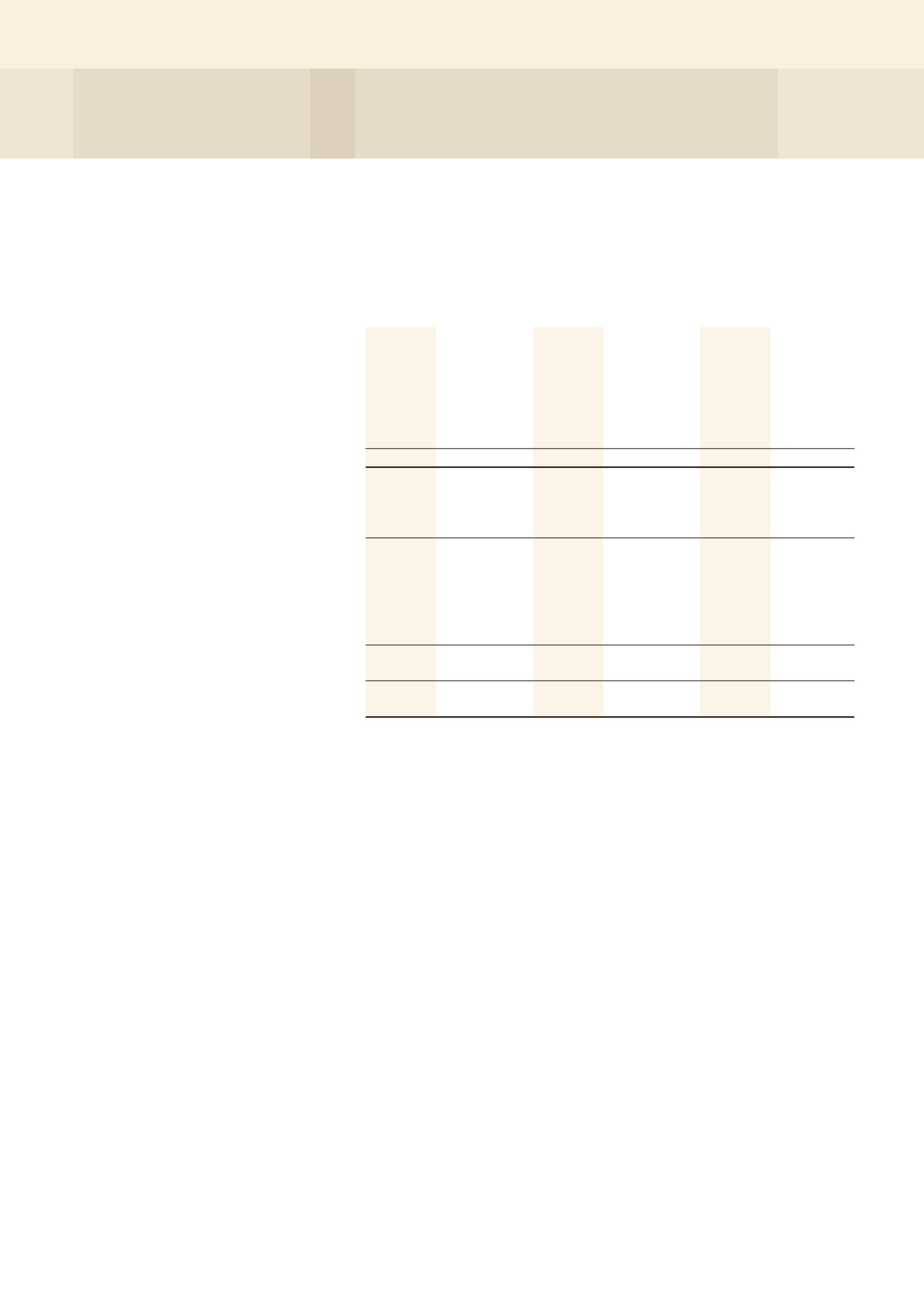

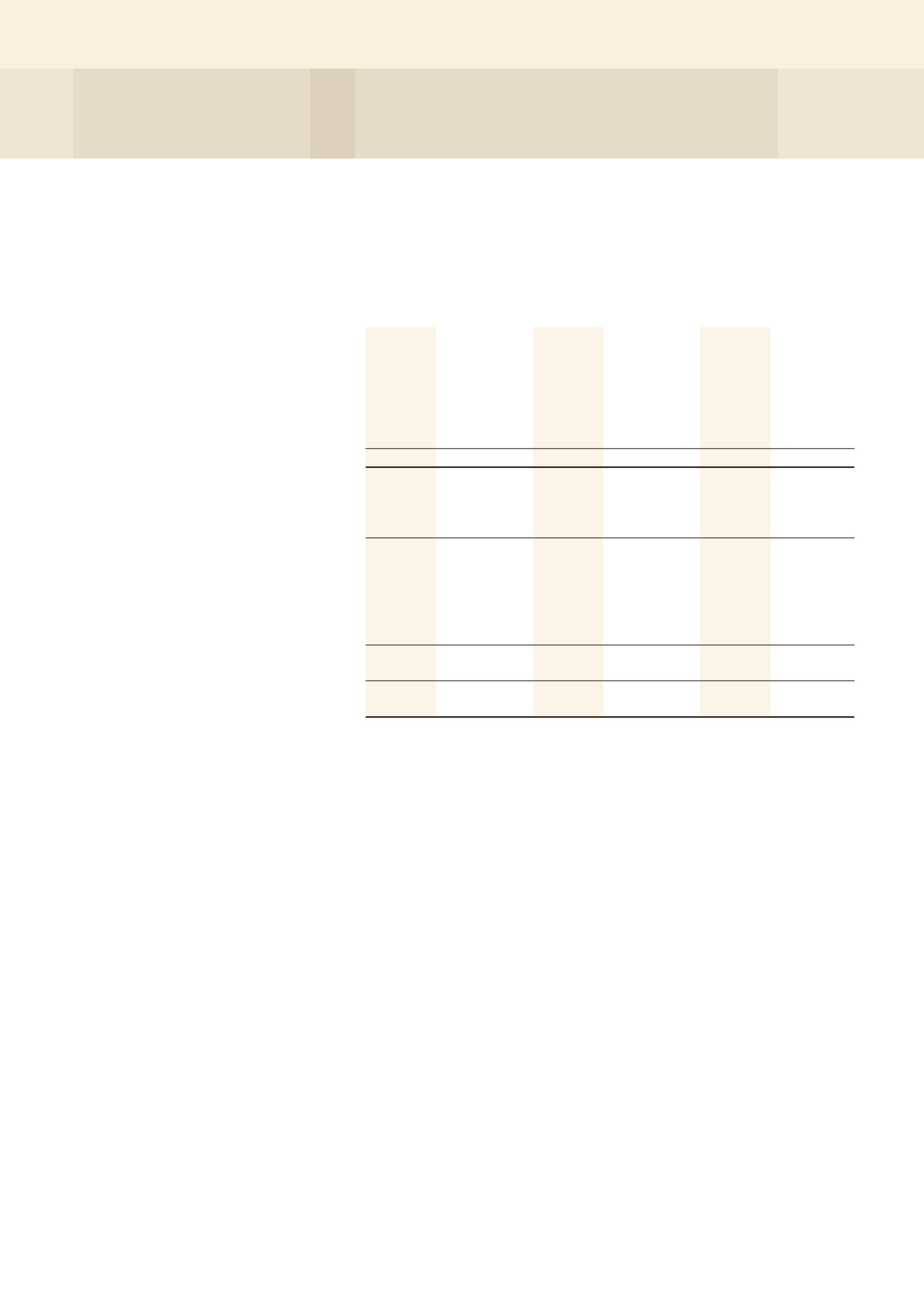

11 UNITS/STAPLED SECURITIES IN ISSUE

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

’000

’000

’000

’000

’000

’000

Units/Stapled Securities in issue:

At 1 January

974,141

968,739

974,141

968,739

974,141 968,739

Creation of Units/Stapled

Securities:

- H-REIT Manager’s

management fee

paid in Stapled Securities

6,144

5,402

6,144

5,402

6,144

5,402

At 31 December

980,285

974,141

980,285

974,141

980,285 974,141

Issued and issuable Units/

Stapled Securities:

Units/Stapled Securities in issue 980,285

974,141

980,285

974,141

980,285 974,141

H-REIT Manager’s

management fees payable

in Stapled Securities

1,579

1,628

1,579

1,628

1,579

1,628

H-REIT Manager’s acquisition fees

payable in Stapled Securities

368

–

368

–

368

–

Units/Stapled Securities to

be issued

1,947

1,628

1,947

1,628

1,947

1,628

982,232

975,769

982,232

975,769

982,232 975,769

During the year, the following Stapled Securities were issued:

• 6,143,718 (2013: 5,402,605) Stapled Securities were issued at unit prices ranging from $1.6248 to $1.7323

(2013: $1.6285 to $2.0561) per Stapled Security, amounting to $10,125,657 (2013: $9,821,211) as satisfaction of

management fees paid in Stapled Securities.

Each H-REIT unit is stapled together with a HBT unit under the terms of a stapling deed dated 12 June 2006

entered into between the H-REIT Manager, the H-REIT Trustee and the HBT Trustee-Manager and cannot be

traded separately. Each Stapled Security represents an undivided interest in H-REIT and HBT.

A holder of the Stapled Security has no equitable or proprietary interest in the underlying assets of the Stapled

Group and is not entitled to the transfer to it of any asset (or any part thereof) or of any real estate, any interest in

any asset and real estate-related assets (or any part thereof) of the Stapled Group.

The liability of a holder of the Stapled Securities is limited to the amount paid or payable for the Stapled Securities.

Each HBT unit and H-REIT unit carry the same voting rights.

NOTES TO THE FINANCIAL STATEMENTS