132

CDL

HOSPITALITY TRUSTS

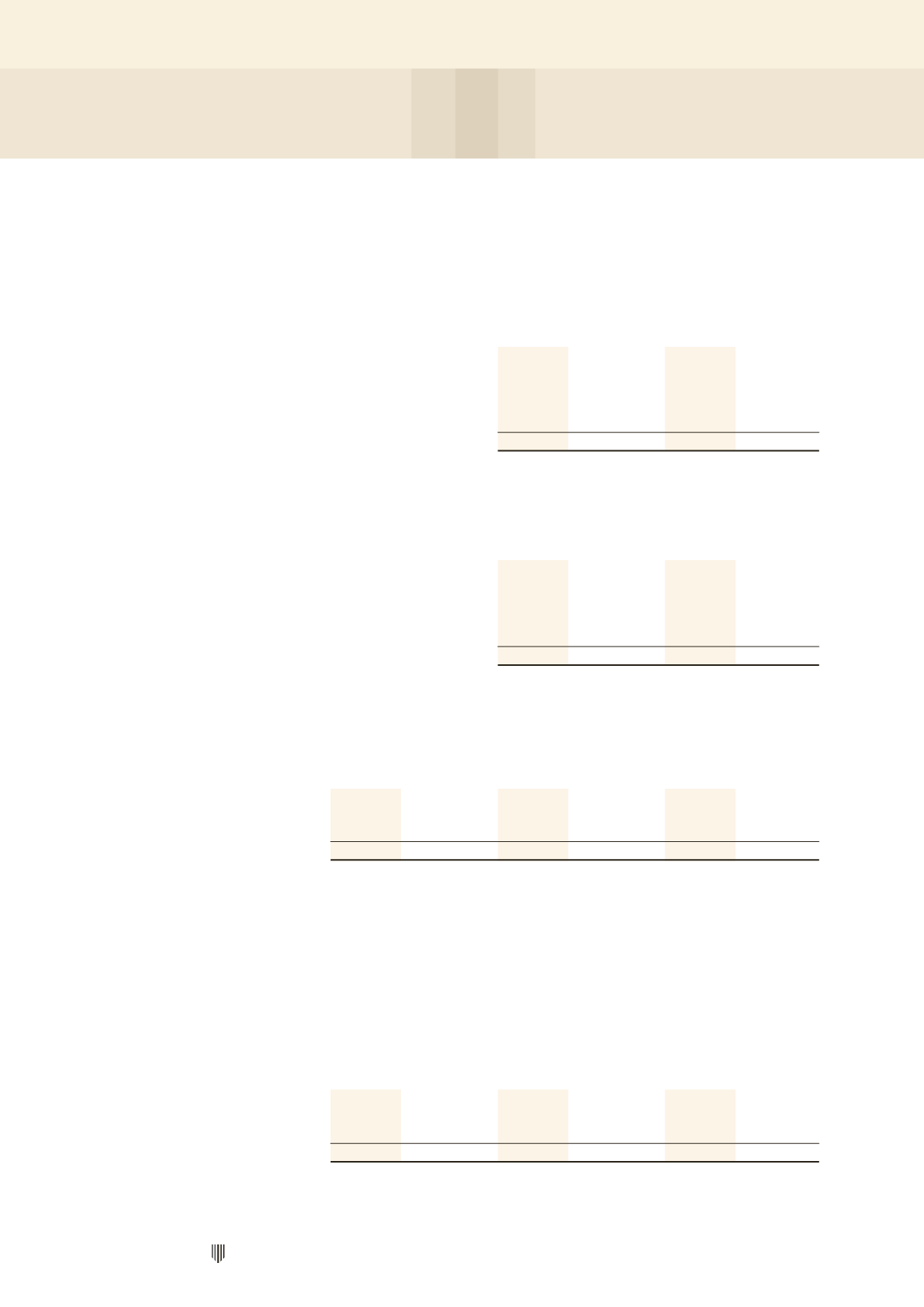

9 TRADE AND OTHER RECEIVABLES (CONT'D)

Impairment

Impairment

Gross

losses

Gross

losses

2014

2014

2013

2013

$’000

$’000

$’000

$’000

H-REIT Group

Not past due

19,445

–

11,947

–

Past due 31 – 60 days

87

–

2,417

–

Past due 61 – 90 days

–

–

13

–

More than 90 days

73

69

657

224

19,605

69

15,034

224

Impairment

Impairment

Gross

losses

Gross

losses

2014

2014

2013

2013

$’000

$’000

$’000

$’000

Stapled Group

Not past due

17,022

–

11,693

–

Past due 31 – 60 days

343

–

2,417

–

Past due 61 – 90 days

23

–

13

–

More than 90 days

306

182

657

224

17,694

182

14,780

224

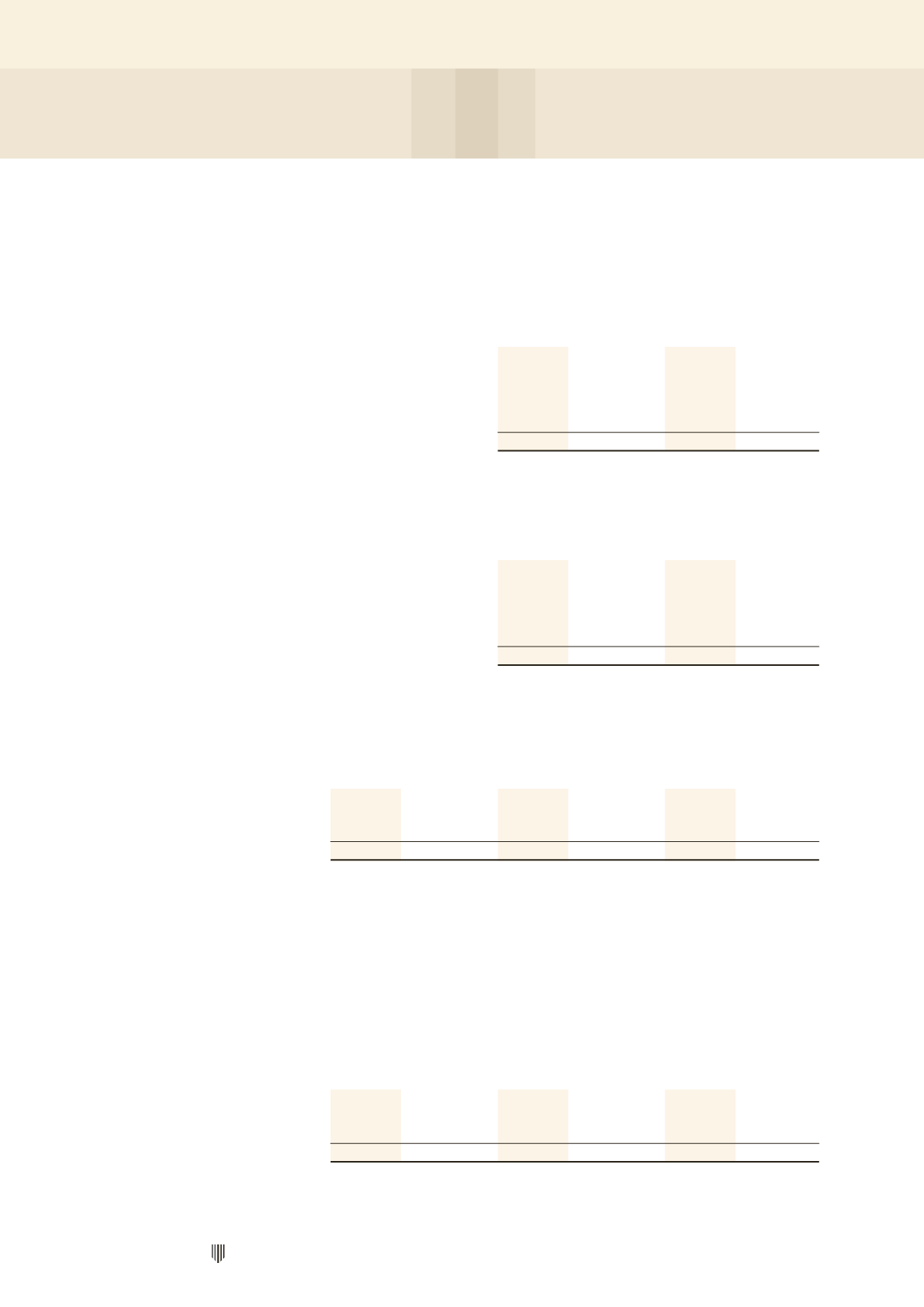

The change in impairment losses in respect of trade receivables during the year is as follows:

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

At 1 January

–

–

224

367

224

367

Impairment losses

addition/(reversal)

113

–

(155)

(143)

(42)

(143)

At 31 December

113

–

69

224

182

224

Based on historical default rates, the Stapled Group believes that, except for those recognised, no additional

impairment is necessary in respect of trade receivables not past due. These receivables related to tenants or

customers that have a good credit record with the HBT Group, H-REIT Group and the Stapled Group. H-REIT

Group also maintains sufficient security deposits as collateral.

10 CASH AND CASH EQUIVALENTS

HBT Group

H-REIT Group

Stapled Group

2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Cash at bank

4,066

266

13,947

22,854

18,013

23,120

Fixed deposits with

financial institutions

–

339

58,434

45,269

58,434

45,608

4,066

605

72,381

68,123

76,447

68,728

NOTES TO THE FINANCIAL STATEMENTS