OVERVIEW OF CDL HOSPITALITY TRUSTS

OVERVIEW AND FINANCIAL REVIEW

• Opportunities arising from divestment of assets by

owners or developers.

• Opportunities to acquire under-performing assets

with turnaround potential by implementing value-

added strategies such as re-flagging, management

change and asset enhancements.

CAPITAL AND RISK MANAGEMENT STRATEGY

The H-REIT Manager intends to use a combination of

debt and equity to fund future acquisitions and property

enhancements such that it is within the Aggregate

Leverage limit set out in the Property Funds Appendix.

The objectives of the H-REIT Manager in relation to

capital and risk management are to:

• maintain a strong balance sheet and remain within

the Aggregate Leverage limit set out in the Property

Funds Appendix;

• minimise the cost of debt financing;

• secure diversified funding sources from both financial

institutions and capital markets as H-REIT grows in

size and scale; and

• manage the exposure arising from adverse market

movements in interest rates and foreign exchange

through appropriate hedging strategies.

ACTIVE ASSET MANAGEMENT

The H-REIT Manager actively engages its master lessees,

leveraging on H-REIT’s economies of scale and its

relationship with M&C, which has extensive experience

in the hospitality industry, to maximise the operating

performance and cash flow of the assets. In addition, it

seeks to implement various asset enhancement initiatives

to improve the assets’ value and competitiveness.

HBT’S STRATEGY

M&C Business Trust Management Limited, as

trustee-manager of HBT (the "

HBT Trustee-Manager

"),

first activated HBT at the end of 2013.

HBT may act as the master lessee(s) of H-REIT’s hotels if

any of the following occurs:

• It is appointed by H-REIT, in the absence of any other

master lessee(s) being appointed, as a master lessee

of one of the hotel assets in H-REIT’s portfolio at the

expiry of the lease term. The intention is for HBT

to appoint professional hotel managers to manage

these hotels.

• H-REIT acquires hotels in the future, and, if there are

no other suitable master lessees, H-REIT will lease

these acquired hotels to HBT. HBT will then become

a master lessee for these hotels and will appoint

professional hotel managers to manage these hotels.

The HBT Group currently acts as the master lessees

for three of the properties in H-REIT’s portfolio, namely

Jumeirah Dhevanafushi, Hotel MyStays Asakusabashi

and Hotel MyStays Kamata, and is the asset owner of

Hilton Cambridge City Centre, and appoints professional

hotel managers to manage these properties.

HBT may also undertake certain hospitality and

hospitality-related development projects, acquisitions

and investments, which may not be suitable for H-REIT.

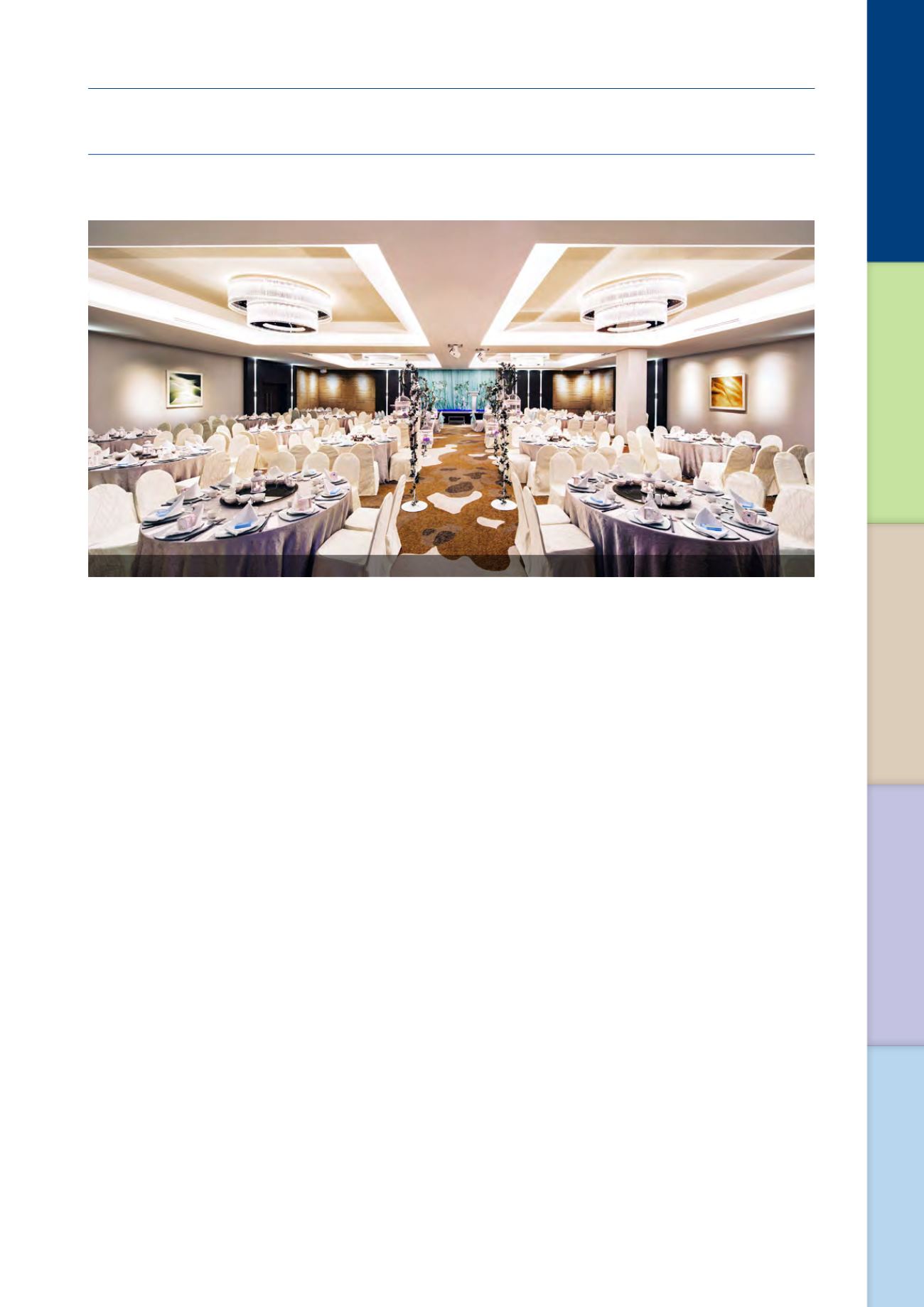

Junior Ballroom, Novotel Singapore Clarke Quay

3

Annual Report 2016

OVERVIEW AND

FINANCIAL REVIEW