CHAIRMAN’S STATEMENT

favourable initiatives and aim to welcome 40.0 million

foreign visitors in 2020

(6)

in conjunction with the Tokyo

Olympics. The government’s approval of the integrated

resorts will likely also provide support for long term

tourism growth.

In Maldives, the near term outlook continues to be

challenging. Given that the room rates are priced in US

dollar, the relative strength of the US dollar against some

of the top source markets has affected demand and caused

a downward adjustment in room rates as a compensating

effect. In addition, the cautious consumer sentiment

towards discretionary spending in the high-end leisure

market and slowing growth in China may continue to

affect the performance of our Maldives Resorts. As such,

the Managers have been working with operators of both

resorts to improve the market mix as well as taking cost

containment measures.

For the Australia Hotels, rent contribution for FY 2016

was lower mainly due to negative currency translation and

lower variable income. With the subdued natural resources

sector outlook and increase in new hotel room supply

in Perth and Brisbane, the trading performance of the

hospitality sector will likely remain challenging. However,

the defensive lease structure of the Australia Hotels which

provides CDLHT with largely fixed rent will mitigate any

downside risks in the hotels’ performance.

The acquisition of Hilton Cambridge City Centre in October

2015 has augmented CDLHT’s portfolio performance in FY

2016. The positive influence of the rebranding exercise in

2016 coupled with the product uplift after its refurbishment,

has supported a yoy RevPAR growth of 11.9%. Looking

ahead, the weaker pound is likely to improve tourism flows

in UK and international arrivals are expected to increase

in 2017

(7)

. However, there will be economic uncertainty

due to the impending commencement of the formal Brexit

negotiations in March 2017, which may affect corporate

demand.

In New Zealand, the tourism sector continued to enjoy

strong growth, reflected by the 11.8% yoy growth in visitor

arrivals in 2016 to a record high of 3.5 million

(8)

. The surge

in tourism arrivals was supported by additional commercial

flight capacity serving Auckland during 2016, with new

international airlines being launched and new routes

being established. This has benefited our NZ Hotel, Grand

Millennium Auckland, which saw a robust yoy RevPAR

growth of 10.8%.

The Managers are optimistic about the outlook of the New

Zealand hospitality sector and the growth momentum is

likely to be supported by the increase in new international

air services and a strong events calendar. In 2017, New

Zealand will host a number of global sporting events,

including the World Masters Games, Lions Tour and

Rugby League World Cup, which are expected to increase

international visitor flows to Auckland. Grand Millennium

Auckland’s new variable lease structure allows CDLHT

to be strongly positioned to maximise the benefit of the

growth trajectory going forward.

The importance of broadening our asset base remains a

paramount consideration. Our geographically diversified

portfolio of quality assets is expected to continue to

provide CDLHT with the benefits of income diversification

and generate sustainable returns for our Stapled

Security Holders.

OVERVIEW AND FINANCIAL REVIEW

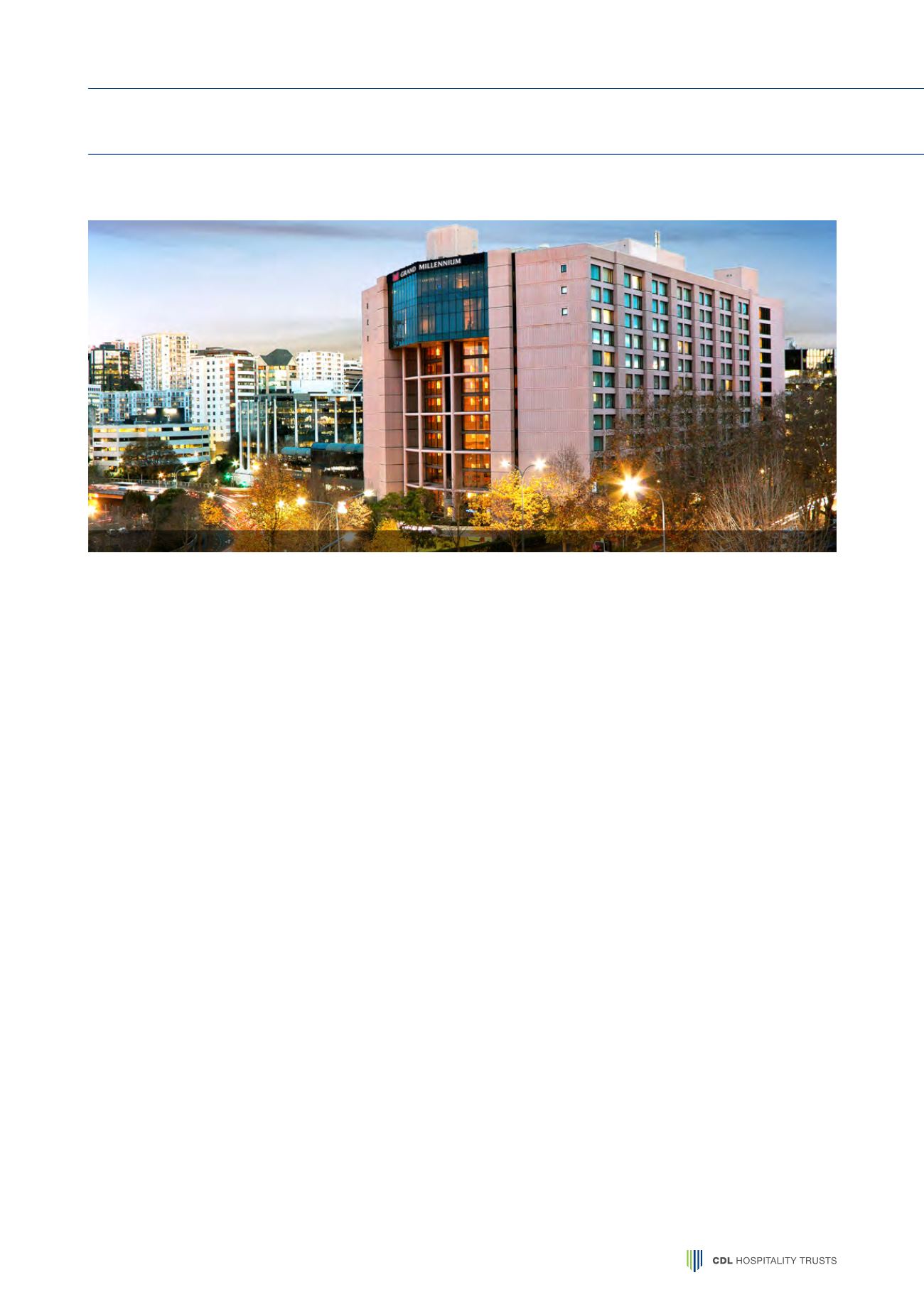

Grand Millennium Auckland

(6)

Nikkei Asian Review, "Japan prepares for mass influx of tourists", 11 January 2017.

(7)

TTG, "2017 could be ‘record year’ for inbound tourism", 30 December 2016.

(8)

Statistics New Zealand, "International Visitor Arrivals to New Zealand".

8