offset weakness in the Singapore and Maldives markets

as well as lower contribution from the Australia Hotels

due to negative currency translation and smaller

variable income.

Consequently, total distribution to Stapled Security

Holders for FY 2016 was largely unchanged at

S$99.1 million. We are pleased to deliver Total

Distribution per Stapled Security of 10.00 cents for

FY 2016, compared to 10.06 cents in FY 2015, reflecting

stability in our overall performance.

MARKET REVIEW AND OUTLOOK

In 2016, the Singapore hospitality industry faced

headwinds amidst lower corporate activities which

stemmed from global economic weakness, as well as

increased room supply. As a result, RevPAR for the

Singapore Hotels declined by 8.6% to S$160 in FY 2016.

Total visitor days to Singapore grew 2.2% year-on-year

("

yoy

") for 2016

(2)

. Our Singapore Hotels were able to

maintain a healthy average occupancy rate of 85.4% for

FY 2016.

In 2017, the trading environment in Singapore for hotels

is expected to remain competitive, especially given

the absence of biennial city-wide events such as the

Singapore Airshow in February and Food & Hotel Asia in

April. With a further 5.9% increase in new supply of hotel

rooms

(3)

and uncertainties arising from Brexit as well as

increased global political risks, the outlook remains one

of caution.

Despite uncertainties in the near term, we are optimistic

on the long term outlook for the Singapore tourism sector.

Singapore, being a key financial centre and gateway for

conducting business with the Asia Pacific region and

the rest of the world, continues to be an attractive hub

for conferences and events and was ranked as the top

international meeting city for the ninth consecutive

year

(4)

. Continued efforts by the Singapore government

are also in place to drive tourism flows such as active

marketing by the Singapore Tourism Board ("

STB

") and

infrastructure development. These include strategic

partnership deals between STB and Chinese online travel

services, as well as the ongoing construction of Changi

Airport’s Terminal 4, Terminal 5 and Jewel Changi Airport

– a retail and lifestyle mixed-use complex, which will

serve to anchor Singapore’s position as a leading aviation

hub in the region.

In Japan, demand drivers remained strong with

international visitor arrivals growing 21.8% to a record

24.0 million for 2016

(5)

. Consequently, the Japan Hotels

enjoyed strong occupancies of over 90% but faced rate

pressure partly from currency headwinds during the year

and rising competition from new hotel room supply.

As a result, RevPAR increased marginally by 0.6%. The

long-term outlook for the hospitality sector in Japan is

expected to be positive, with the Japanese government’s

(2)

International Visitor Arrivals Statistics – STB.

(3)

Based on STB, Horwath data (January 2017) and CDLHT research.

(4)

Travel Biz, "Singapore crowned Top International Meeting City by UIA", 30 September 2016.

(5)

Japan National Tourism Organization.

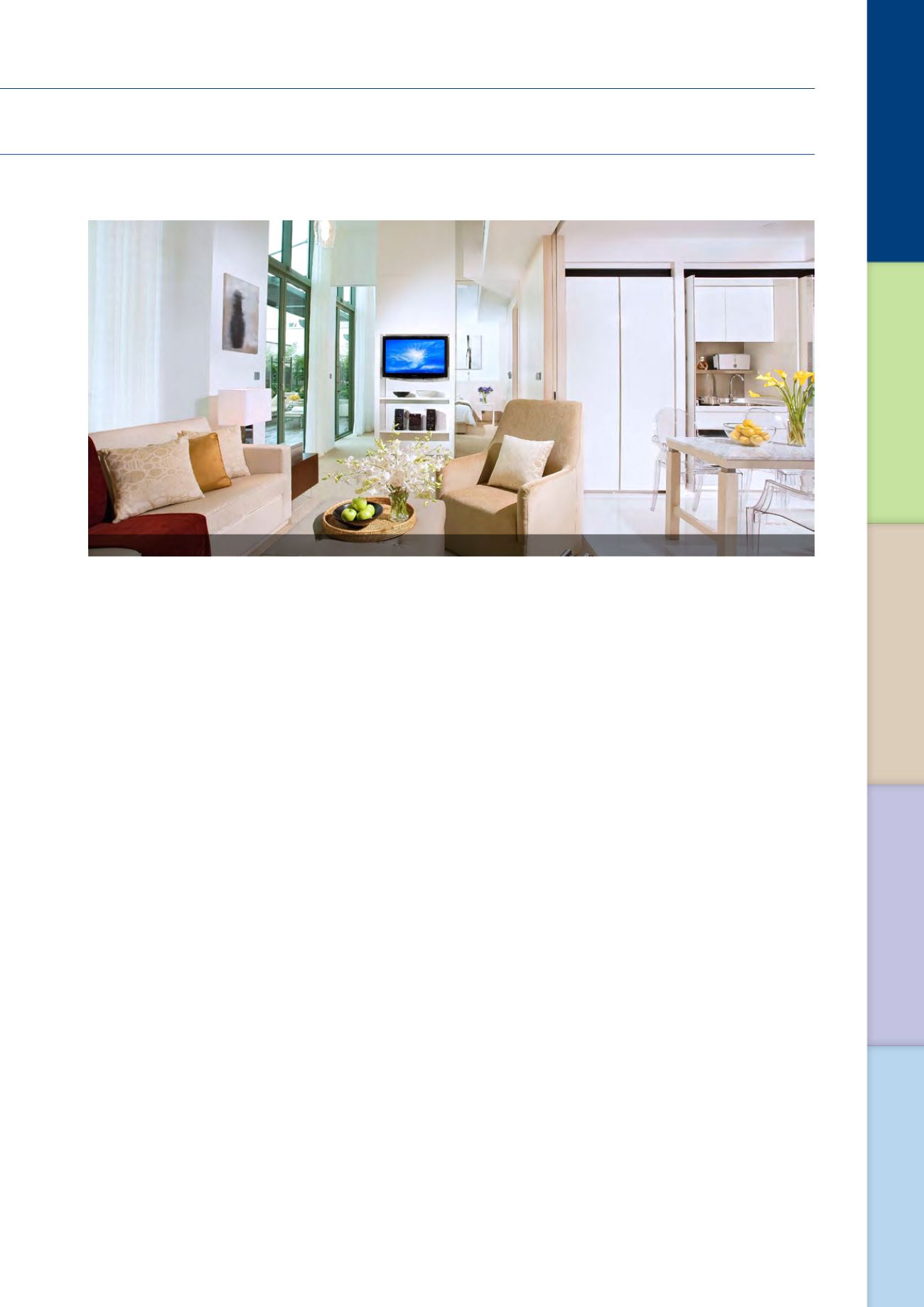

La Residenza Suite, Grand Copthorne Waterfront Hotel

7

Annual Report 2016

OVERVIEW AND

FINANCIAL REVIEW