180

27 FINANCIAL INSTRUMENTS (CONT’D)

Fair values

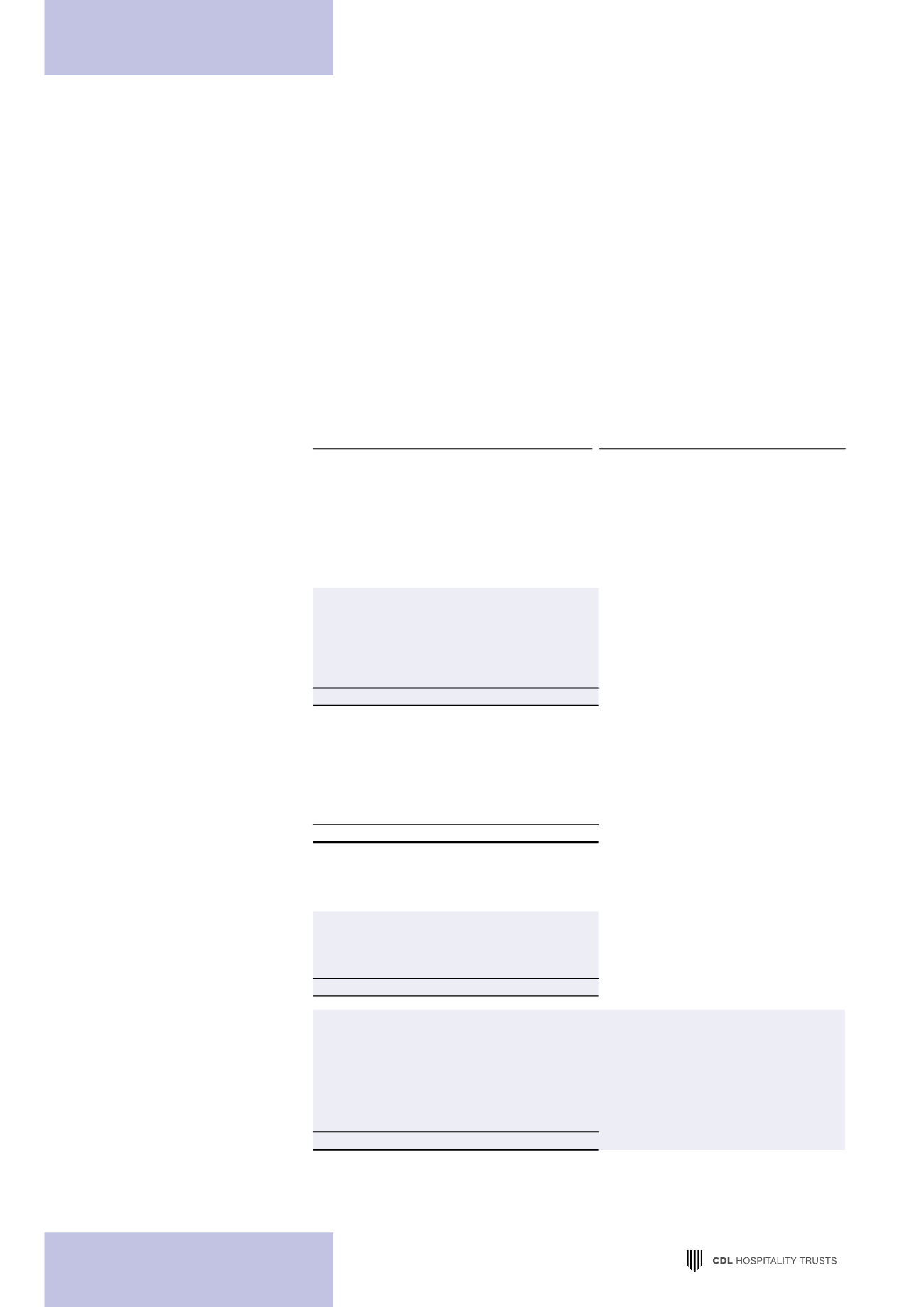

Accounting classifications and fair values

The carrying amounts fair values of financial assets and financial liabilities, including their levels in the fair value hierarchy,

are detailed below. It does not include fair value information for financial assets and financial liabilities not measured at

fair value if the carrying amount is a reasonable approximation of fair value.

Carrying amount

Fair value

Fair value -

Other

Note Loans and hedging financial

receivables instruments liabilities Total

Level 1 Level 2 Level 3 Total

$’000

$’000

$’000 $’000 $’000 $’000 $’000 $’000

HBT Group

2015

Trade and other

receivables^

9

5,682

–

– 5,682

Cash and cash

equivalents

10

9,701

–

– 9,701

Trade and other

payables

15

–

– (147,131) (147,131)

15,383

– (147,131) (131,748)

2014

Trade and other

receivables^

9

3,323

–

– 3,323

Cash and cash

equivalents

10

4,066

–

– 4,066

Trade and other

payables

15

–

– (8,647)

(8,647)

7,389

– (8,647)

(1,258)

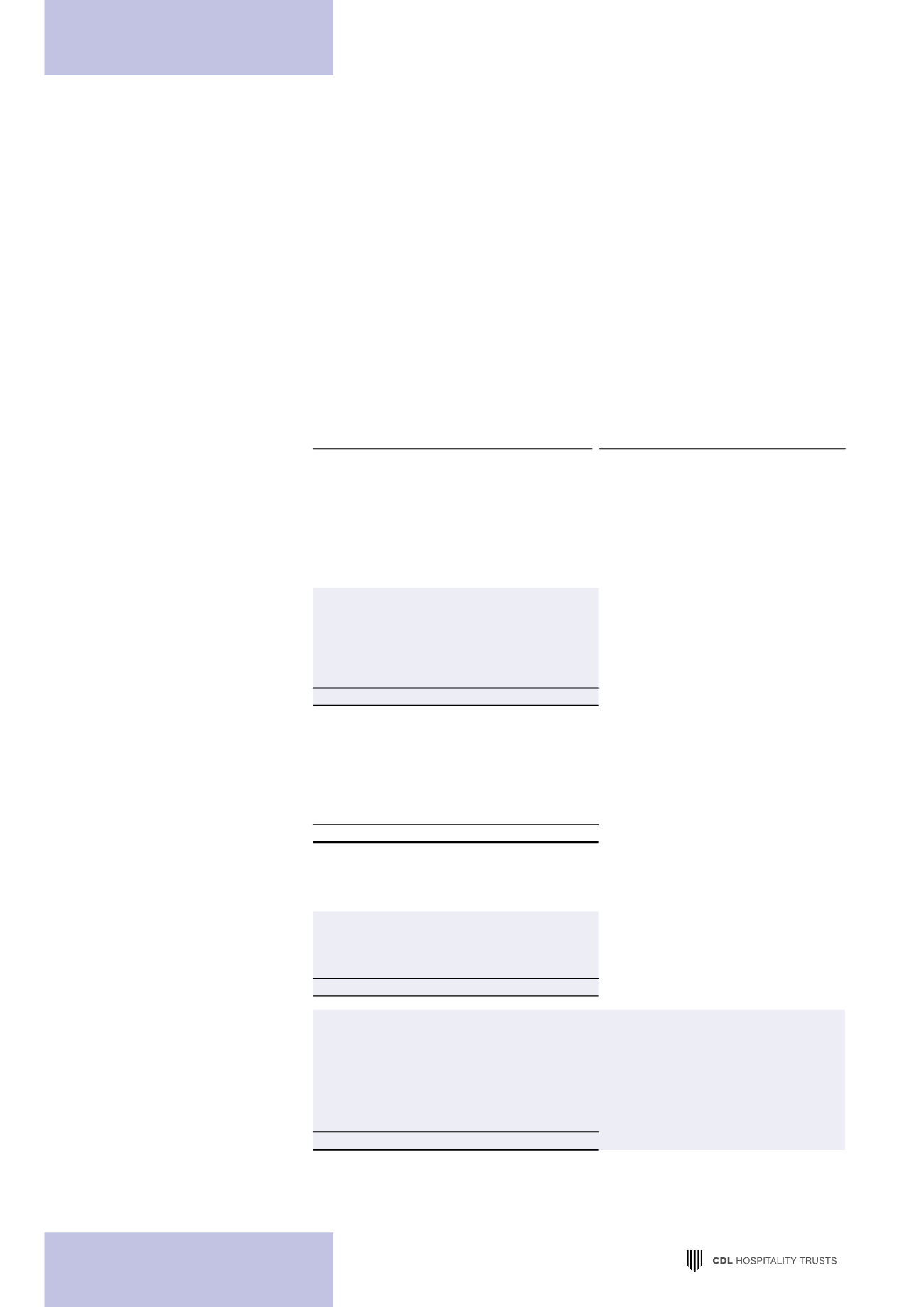

H-REIT Group

2015

Trade and other

receivables^

9 152,399

–

– 152,399

Cash and cash

equivalents

10

62,267

–

– 62,267

214,666

–

– 214,666

Secured TMK bond 12

–

– (35,694) (35,694)

– (35,697)

– (35,697)

Unsecured bank loans 12

–

– (683,143) (683,143)

– (681,828)

– (681,828)

Unsecured medium

term notes

12

–

– (203,507) (203,507)

– (203,887)

– (203,887)

Trade and other

payables

15

–

– (26,819) (26,819)

Rental deposits

–

– (8,749)

(8,749)

–

– (9,083)

(9,083)

–

– (957,912) (957,912)

^ Excluding prepayments and deferred capital expenditure

NOTES TO THE FINANCIAL STATEMENTS