177

Annual Report 2015

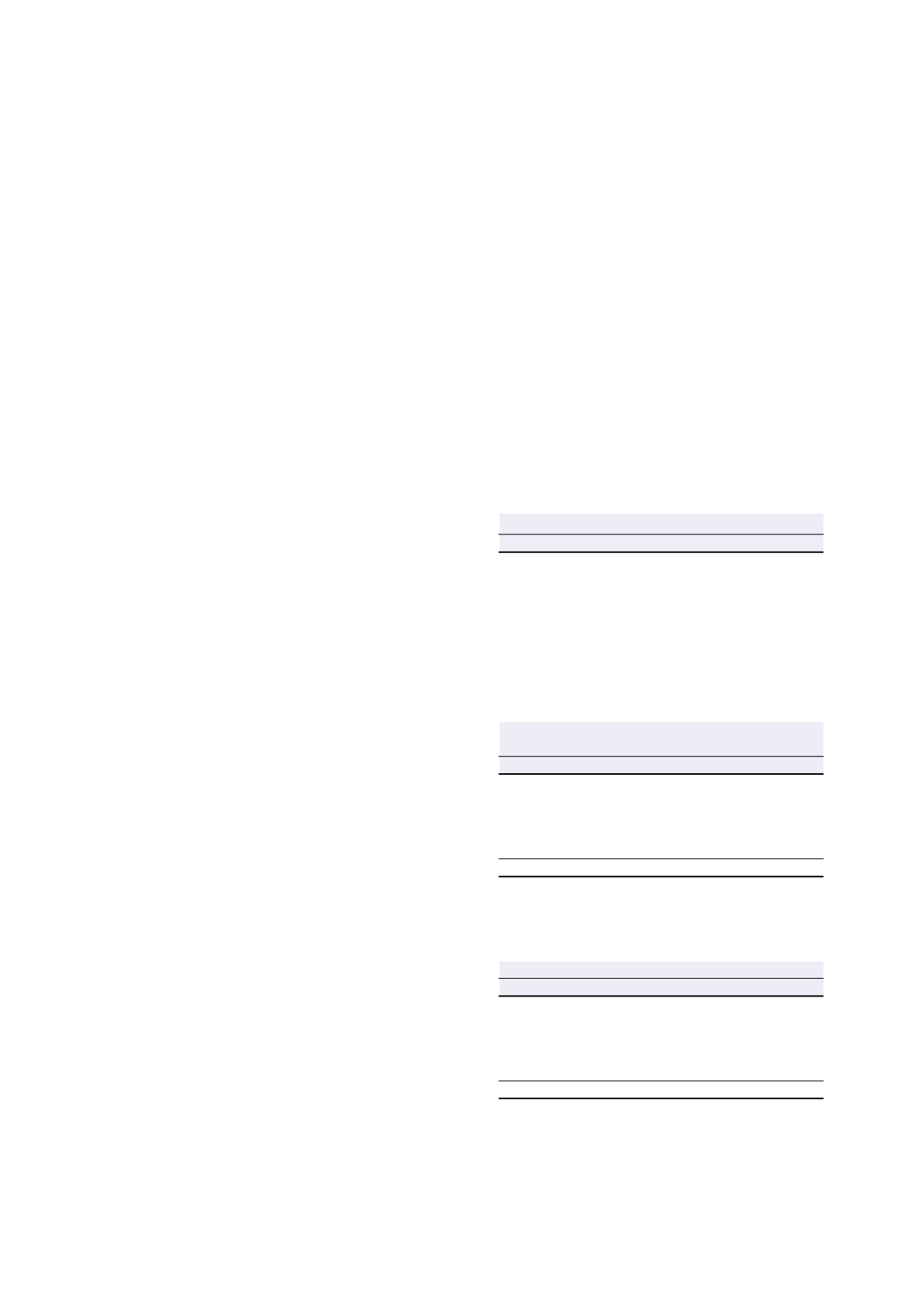

27 FINANCIAL INSTRUMENTS (CONT’D)

Interest rate risk (cont'd)

Cashflow sensitivity analysis for variable rate instruments (cont’d)

Total

comprehensive income Unitholders’ funds

100 bp 100 bp 100 bp 100 bp

increase decrease increase decrease

$’000

$’000

$’000

$’000

HBT Group

2015

Variable rate instrument

Loan from H-REIT

(1,356)

1,356

–

–

Cashflow sensitivity (net)

(1,356)

1,356

–

–

Total return

Unitholders’ funds

100 bp 100 bp 100 bp 100 bp

increase decrease increase decrease

$’000

$’000

$’000

$’000

H-REIT Group

2015

Variable rate instruments

Loan to HBT

1,356

(1,356)

–

–

Loans and borrowings

(3,682)

3,682

–

–

Cashflow sensitivity (net)

(2,326)

2,326

–

–

2014

Variable rate instruments

Loans and borrowings

(5,575)

5,575

–

–

Interest rate swap

1,003

(1,003)

6

(374)

Cashflow sensitivity (net)

(4,572)

4,572

6

(374)

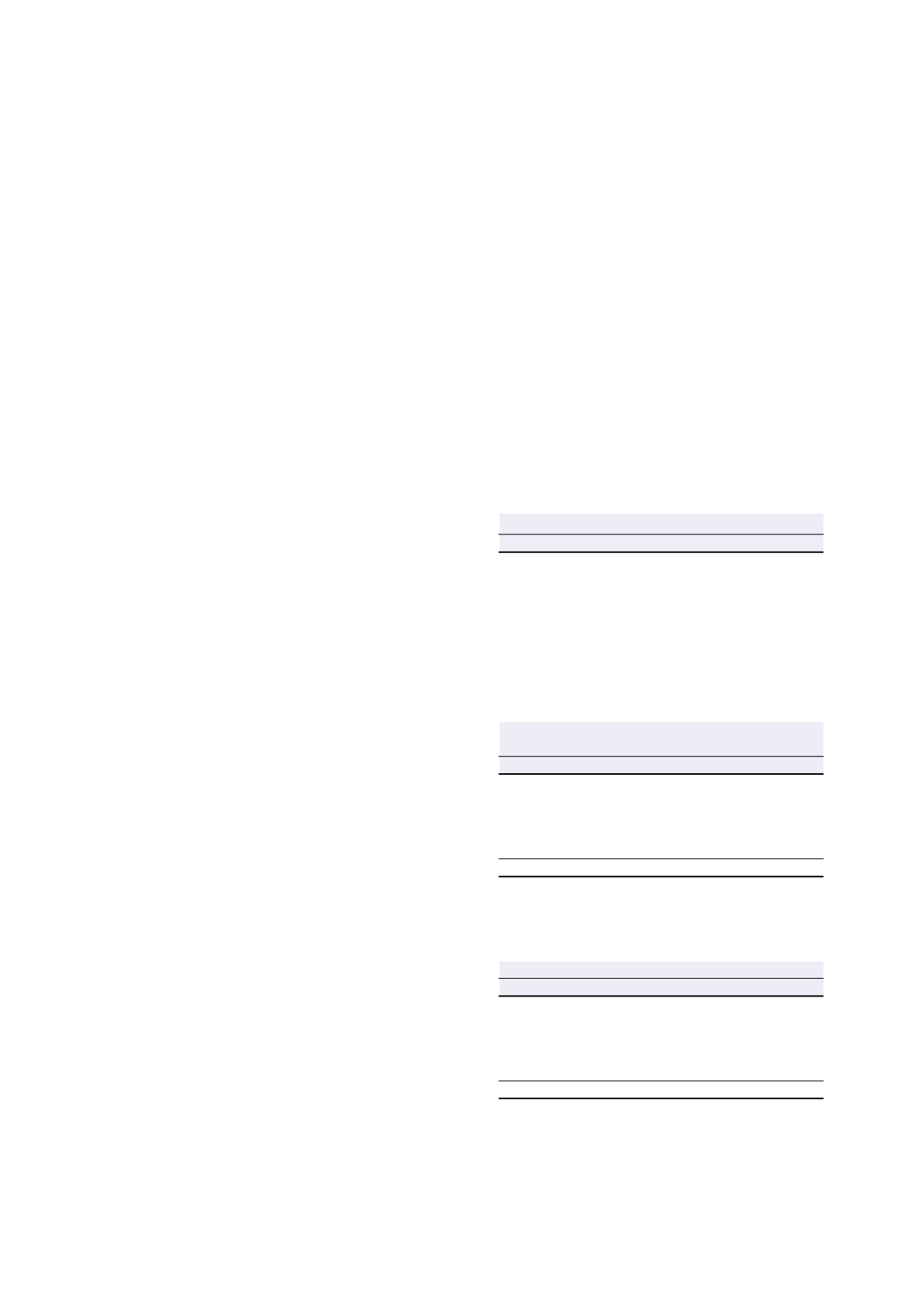

Stapled Group

2015

Variable rate instruments

Loans and borrowings

(3,682)

3,682

–

–

Cashflow sensitivity (net)

(3,682)

3,682

–

–

2014

Variable rate instruments

Loans and borrowings

(5,575)

5,575

–

–

Interest rate swap

1,003

(1,003)

6

(374)

Cashflow sensitivity (net)

(4,572)

4,572

6

(374)

NOTES TO THE FINANCIAL STATEMENTS