179

Annual Report 2015

27 FINANCIAL INSTRUMENTS (CONT’D)

Foreign currency risk (cont'd)

Sensitivity analysis

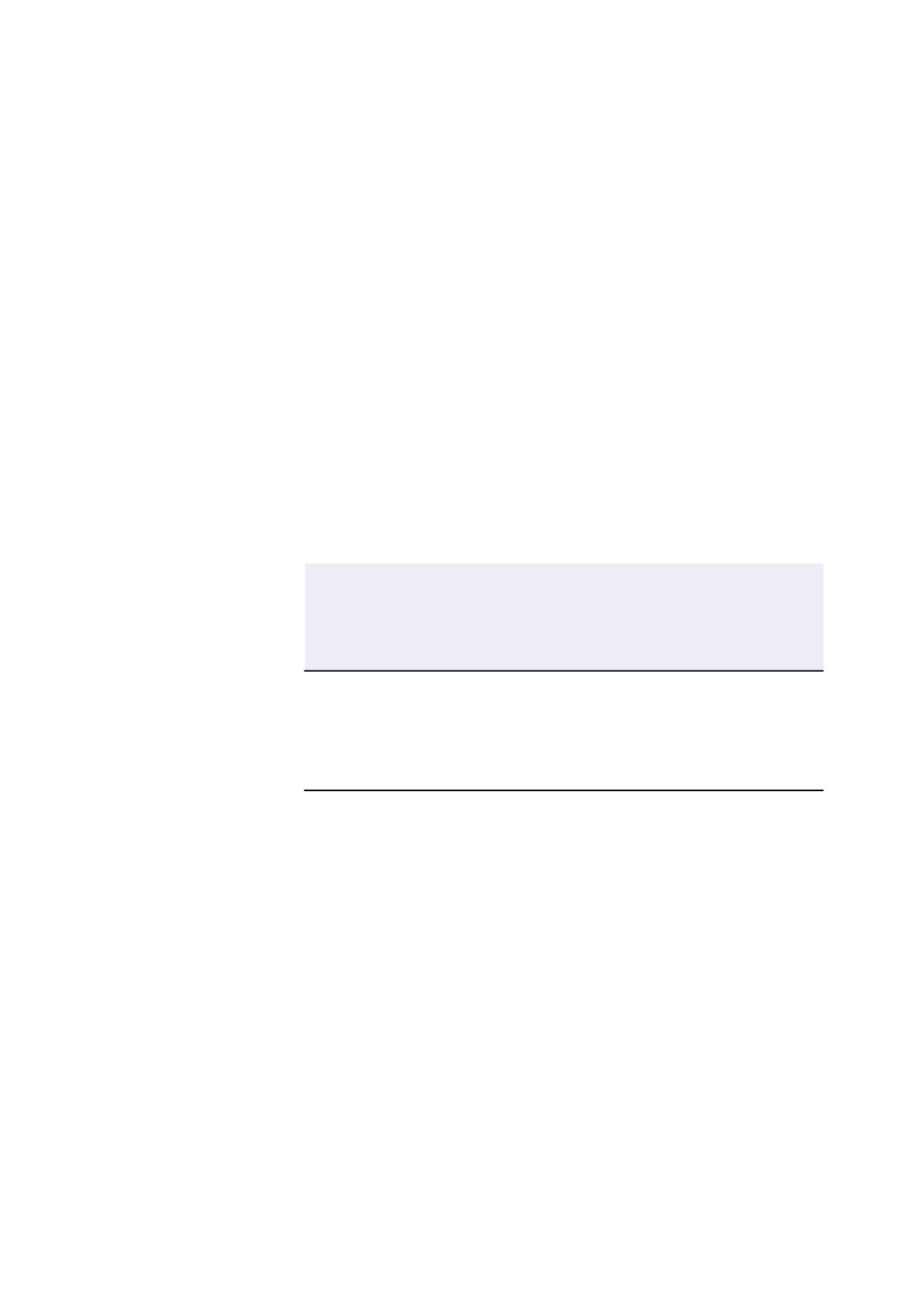

A 10% strengthening of the Singapore dollar against the following currencies at the end of the financial year would

increase/(decrease) total comprehensive income and unitholders’ funds of the HBT Group and total return (before

any tax effects) and unitholders’ funds of the H-REIT Group and the Stapled Group, by the amounts shown below.

This analysis assumes that all other variables, in particular interest rates, remain constant.

HBT Group

H-REIT Group

Stapled Group

Total

comprehensive Unitholders’

Total

Unitholders’

Total

Unitholders’

income

funds

return

funds

return

funds

$’000

$’000

$’000

$’000

$’000

$’000

2015

Australian dollar

–

–

(1,132)

9,566

(1,132)

9,566

New Zealand dollar

–

–

(1,019)

–

(1,019)

–

United States dollar

–

–

(693)

19,754

(693)

19,754

Japanese yen

–

–

(278)

3,832

(278)

3,832

Sterling pound

13,574

–

(13)

–

13,561

–

Singapore dollar

(4)

–

(1)

–

(5)

–

2014

Australian dollar

–

–

(978)

10,031

(978)

10,031

New Zealand dollar

–

–

(566)

–

(566)

–

United States dollar

–

–

(1,430)

18,523

(1,430)

18,523

Japanese yen

–

–

1

3,567

1

3,567

Singapore dollar

(2)

–

(6)

–

(8)

–

A 10%weakening of the Singapore dollar against the above currencies at the end of the financial year would have had the

equal but opposite effect on the above currencies to the amounts shown above, on the basis that all other variables

remain constant.

The H-REIT Group’s investments in its Australia, Maldives and Japan subsidiaries are hedged by Australian dollar,

United States dollar and Japanese yen denominated bank loans with the carrying amount of $329,947,000 (2014:

$351,090,000), which mitigates the currency risk arising from the subsidiaries’ net assets. The fair value of the borrowing

as at 31 December 2015 was $328,848,000 (2014: $349,663,000). The loans are designated as net investment hedge.

No ineffectiveness was recognised from the net investment hedge. The H-REIT Group’s investments in other subsidiaries

are not hedged.

NOTES TO THE FINANCIAL STATEMENTS