158

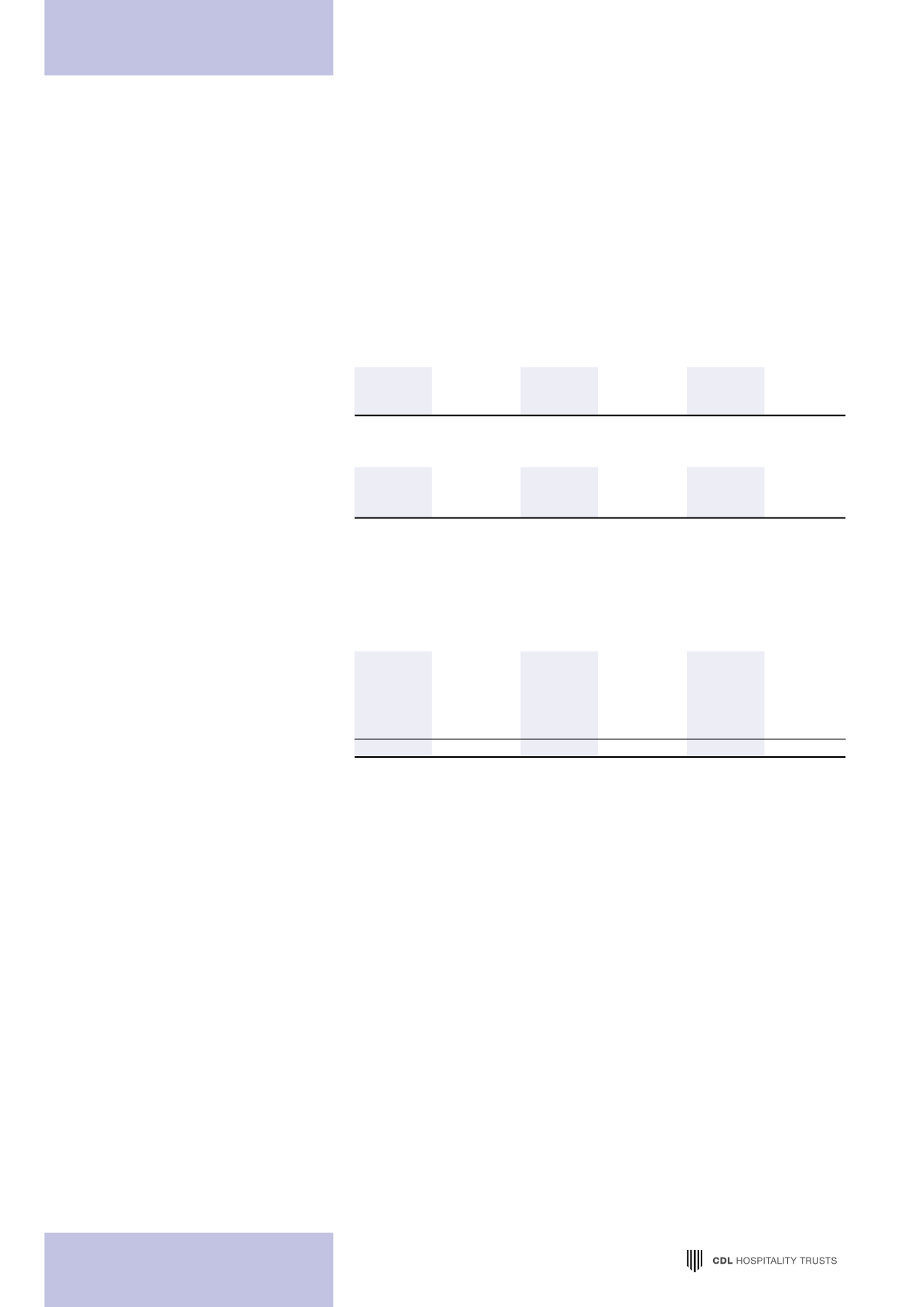

16 NET ASSET VALUE PER UNIT/STAPLED SECURITY

HBT Group

H-REIT Group

Stapled Group

2015

2014

2015

2014

2015

2014

$’000

$’000

$’000

$’000

$’000

$’000

Net asset value per

Unit/Stapled Security

is based on net assets

(1,309)

528 1,574,673 1,618,845 1,573,364 1,616,127

Note

’000

’000

’000

’000

’000

’000

Total issued and issuable

Units/Stapled Securities

at 31 December

11 989,154 982,232 989,154 982,232 989,154 982,232

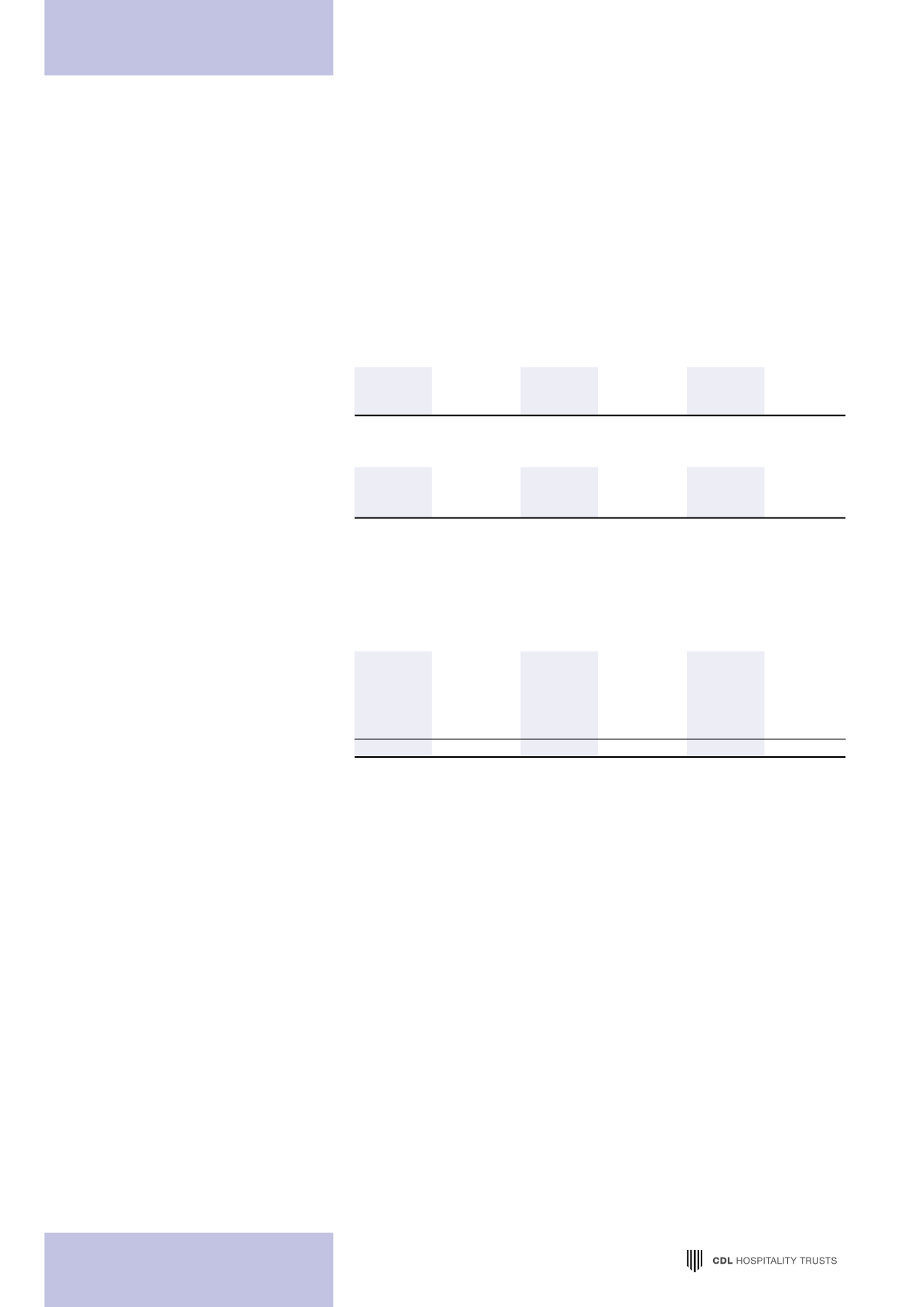

17 GROSS REVENUE

HBT Group

H-REIT Group

Stapled Group

2015

2014

2015

2014

2015

2014

$’000

$’000

$’000

$’000

$’000

$’000

Fixed rent

–

–

67,524

66,577

67,524

66,577

Variable rent

–

–

79,685

85,053

68,876

78,682

Room revenue

26,621

13,532

–

–

26,621

13,532

Food and beverage revenue

5,594

4,762

–

–

5,594

4,762

Other revenue

3,795

3,259

–

–

3,795

3,259

36,010

21,553 147,209 151,630 172,410 166,812

Variable rent for the H-REIT Group includes rental income from the HBT Group.

Revenue of the HBT Group comprises revenue from hotel and resort operations which represents revenue from letting

of rooms, food and beverages sales and revenue from other hotel and resort-related services.

Under the terms of the master lease agreements for the properties, the H-REIT Group is generally entitled to a fixed

rent component and/or a variable rent component computed based on a certain percentage of the revenue and/or

gross operating profit. The initial period of the leases ranges from 10 years to 20 years, with or without options for

renewal for a period ranging from 5 years to 50 years.

NOTES TO THE FINANCIAL STATEMENTS