150

9 TRADE AND OTHER RECEIVABLES (CONT’D)

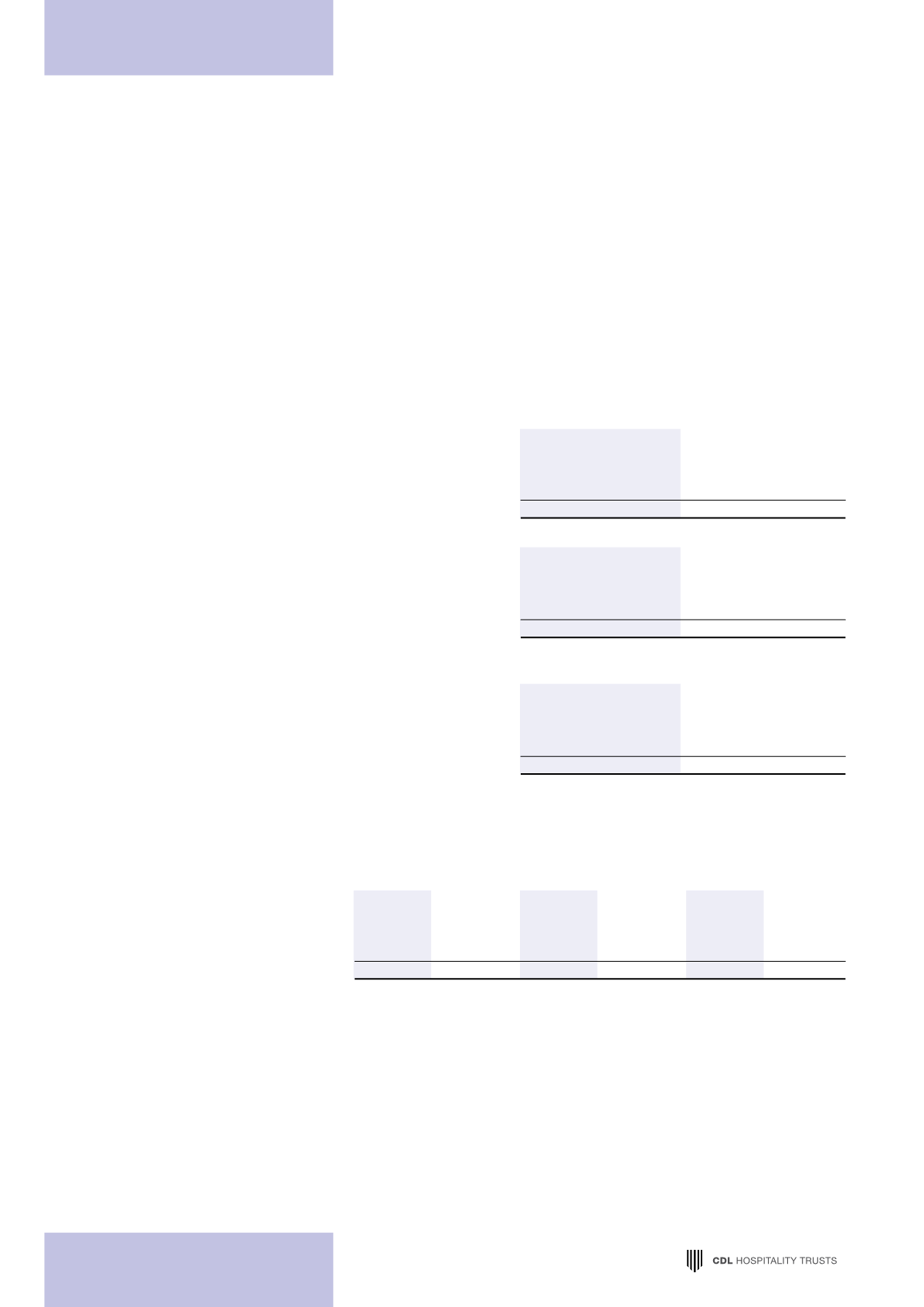

The ageing of loans and receivables at the end of the financial year is:

Impairment

Impairment

Gross

losses

Gross

losses

2015

2015

2014

2014

$’000

$’000

$’000

$’000

HBT Group

Not past due

4,701

–

2,933

–

Past due 31 – 60 days

437

–

247

–

Past due 61 – 90 days

220

–

23

–

More than 90 days

488

164

233

113

5,846

164

3,436

113

H-REIT Group

Not past due

152,337

74

19,445

–

Past due 31 – 60 days

131

99

87

–

Past due 61 – 90 days

173

99

–

–

More than 90 days

297

267

73

69

152,938

539

19,605

69

Stapled Group

Not past due

15,327

74

17,022

–

Past due 31 – 60 days

568

99

343

–

Past due 61 – 90 days

393

99

23

–

More than 90 days

785

431

306

182

17,073

703

17,694

182

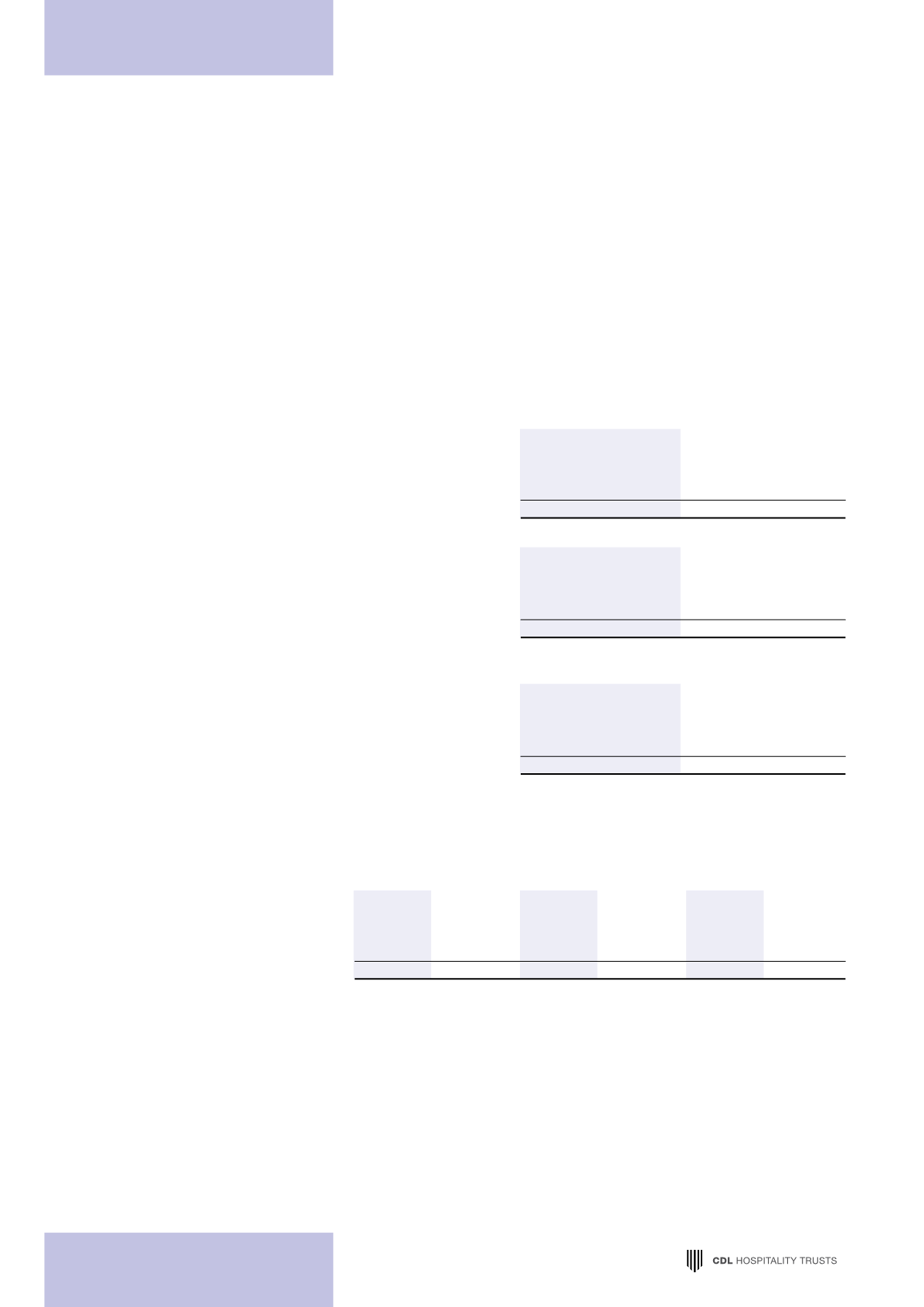

The change in impairment losses in respect of trade receivables during the year is as follows:

HBT Group

H-REIT Group

Stapled Group

2015

2014

2015

2014

2015

2014

$’000

$’000

$’000

$’000

$’000

$’000

At 1 January

113

–

69

224

182

224

Impairment losses

recognised/(reversed)

42

113

470

(155)

512

(42)

Translation differences

9

–

–

–

9

–

At 31 December

164

113

539

69

703

182

Based on historical default rates, the Stapled Group believes that, except for those recognised, no additional impairment

is necessary in respect of trade receivables not past due. These receivables related to tenants or customers that have

a good credit record with the HBT Group, the H-REIT Group and the Stapled Group. The H-REIT Group also maintains

sufficient security deposits as collateral.

NOTES TO THE FINANCIAL STATEMENTS