157

Annual Report 2015

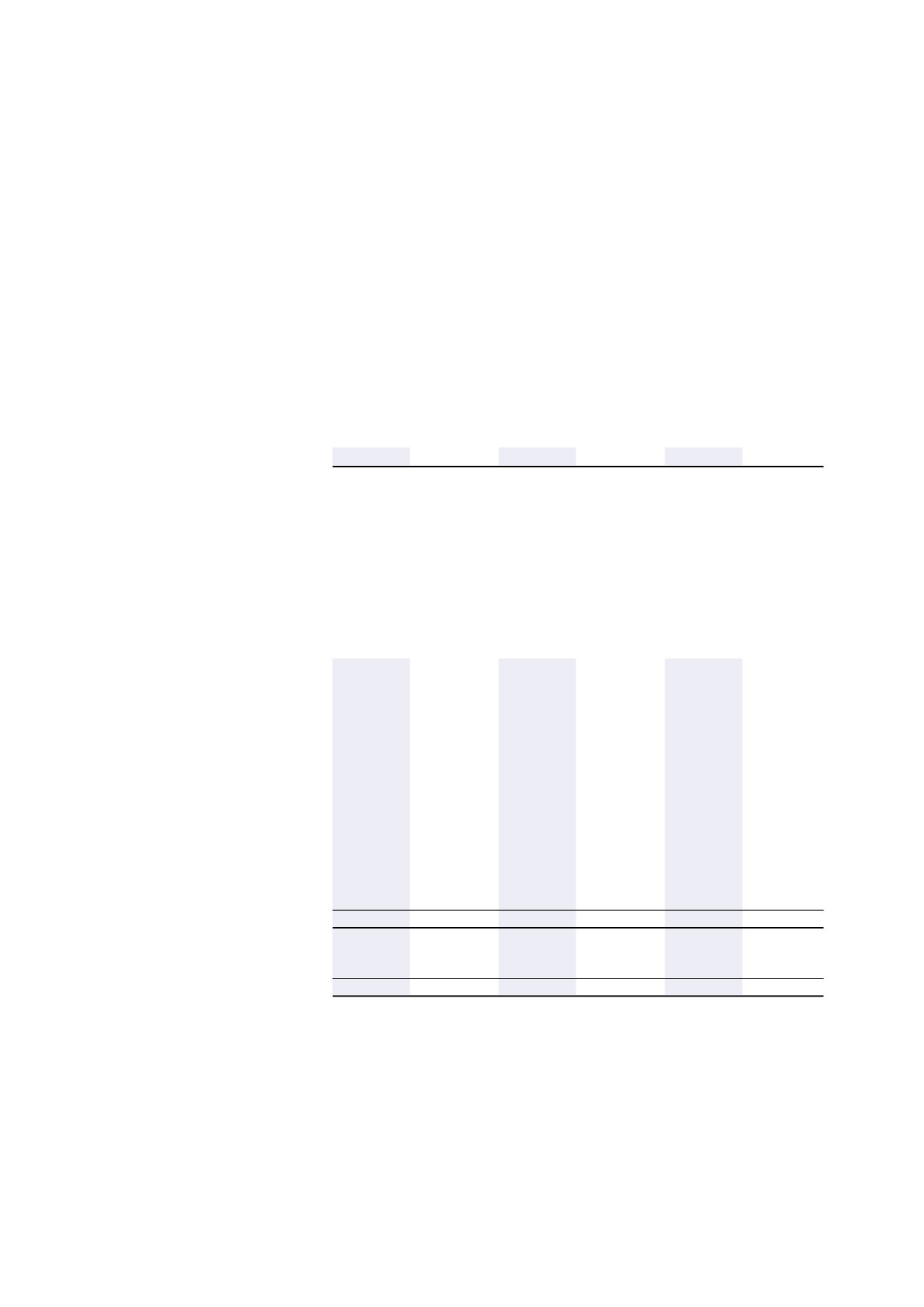

14 DEFERRED TAX (CONT’D)

Unrecognised deferred tax assets

Deferred tax assets have not been recognised in respect of these items because it is not probable that future taxable

profit will be available against which the H-REIT Group and the Stapled Group can utilise the benefits therefrom.

HBT Group

H-REIT Group

Stapled Group

2015

2014

2015

2014

2015

2014

$’000

$’000

$’000

$’000

$’000

$’000

Tax losses

16

–

1,189

–

1,205

–

Tax losses are subject to agreement by the tax authorities and compliance with tax regulations in the respective countries

in which the subsidiaries operate.

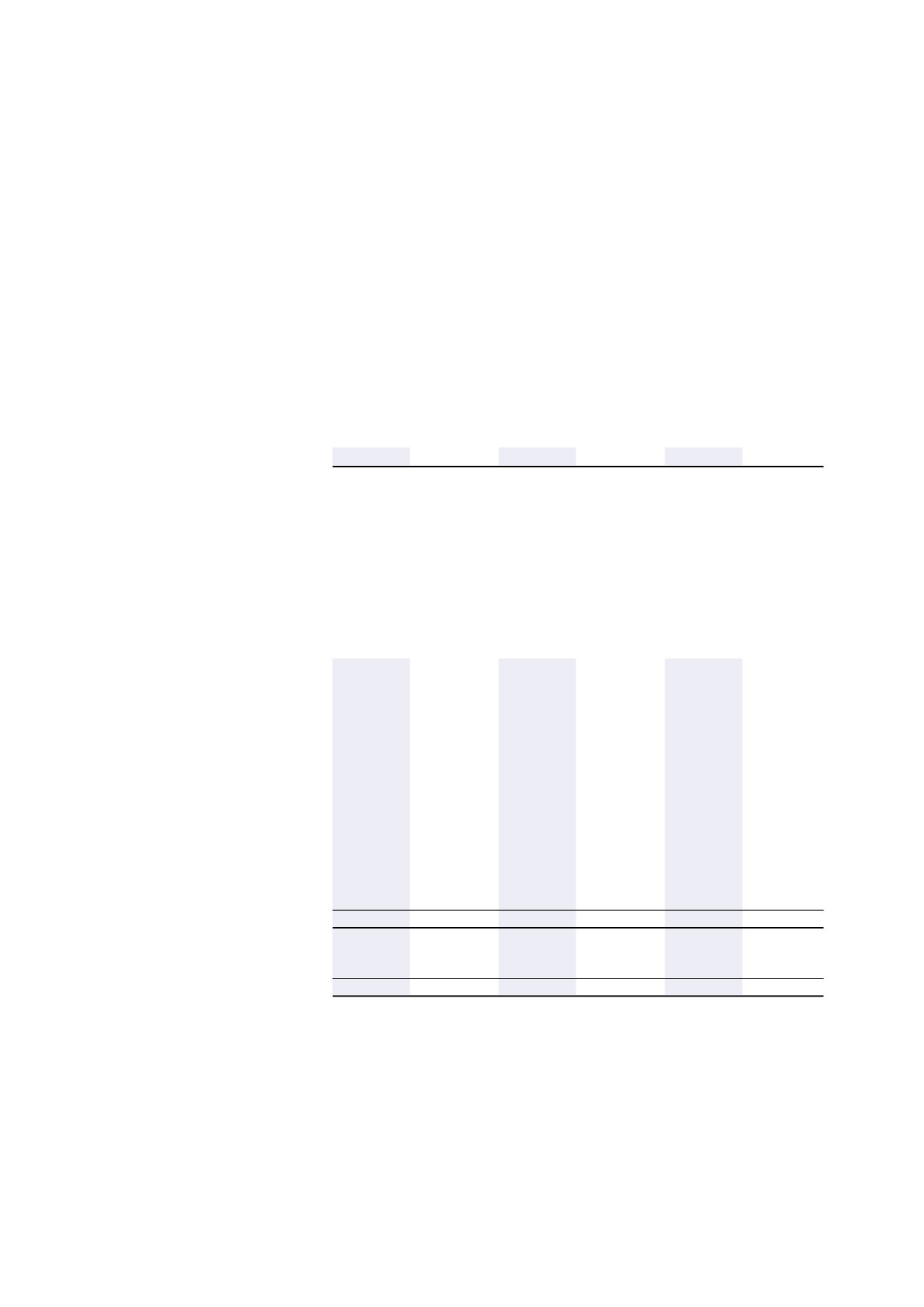

15 TRADE AND OTHER PAYABLES

HBT Group

H-REIT Group

Stapled Group

2015

2014

2015

2014

2015

2014

$’000

$’000

$’000

$’000

$’000

$’000

Trade payables to:

- related corporations of the

H-REIT Manager

–

–

110

121

110

121

- the H-REIT Manager

–

–

–

1,762

–

1,762

- related entities

2,816

4,091

–

991

–

–

- the HBT Trustee-Manager

–

24

–

–

–

24

- third parties

1,353

1,925

4,661

6,296

6,014

8,221

Other payables to:

- the H-REIT Manager

5

–

37

244

42

244

- related entities

506

265

2,869

–

222

–

- loan from H-REIT (Note 9)

135,742

–

–

–

–

–

- third parties

229

952

7,611

9,561

7,840

10,513

Accrued operating expenses

6,269

1,390

9,214

14,585

15,483

15,975

Rental deposits

211

–

132

1,026

343

1,026

Interest payable

–

–

2,185

1,765

2,185

1,765

147,131

8,647

26,819

36,351

32,239

39,651

Non-current

135,742

–

–

–

–

–

Current

11,389

8,647

26,819

36,351

32,239

39,651

147,131

8,647

26,819

36,351

32,239

39,651

Outstanding balances with the related corporations of H-REIT Manager and related entities are unsecured, interest-free

and repayable on demand. Loan from H-REIT is unsecured and bears interest ranging from 1.52% to 1.67% per annum

for a tenure of 6 years (Note 9).

Other payables in the H-REIT Group mainly relate to the remaining purchase consideration payable for the acquisition of

a subsidiary in prior years of $7,374,000 (2014: $7,374,000).

Included in accrued operating expenses of the H-REIT Group are the following:

-

amounts due to the H-REIT Trustee and H-REITManager of $46,000 (2014: $45,000) and $217,000 (2014: $2,006,000)

respectively; and

-

amounts due to related corporations of the H-REIT Manager of $4,665,000 (2014: $2,024,000).

NOTES TO THE FINANCIAL STATEMENTS