162

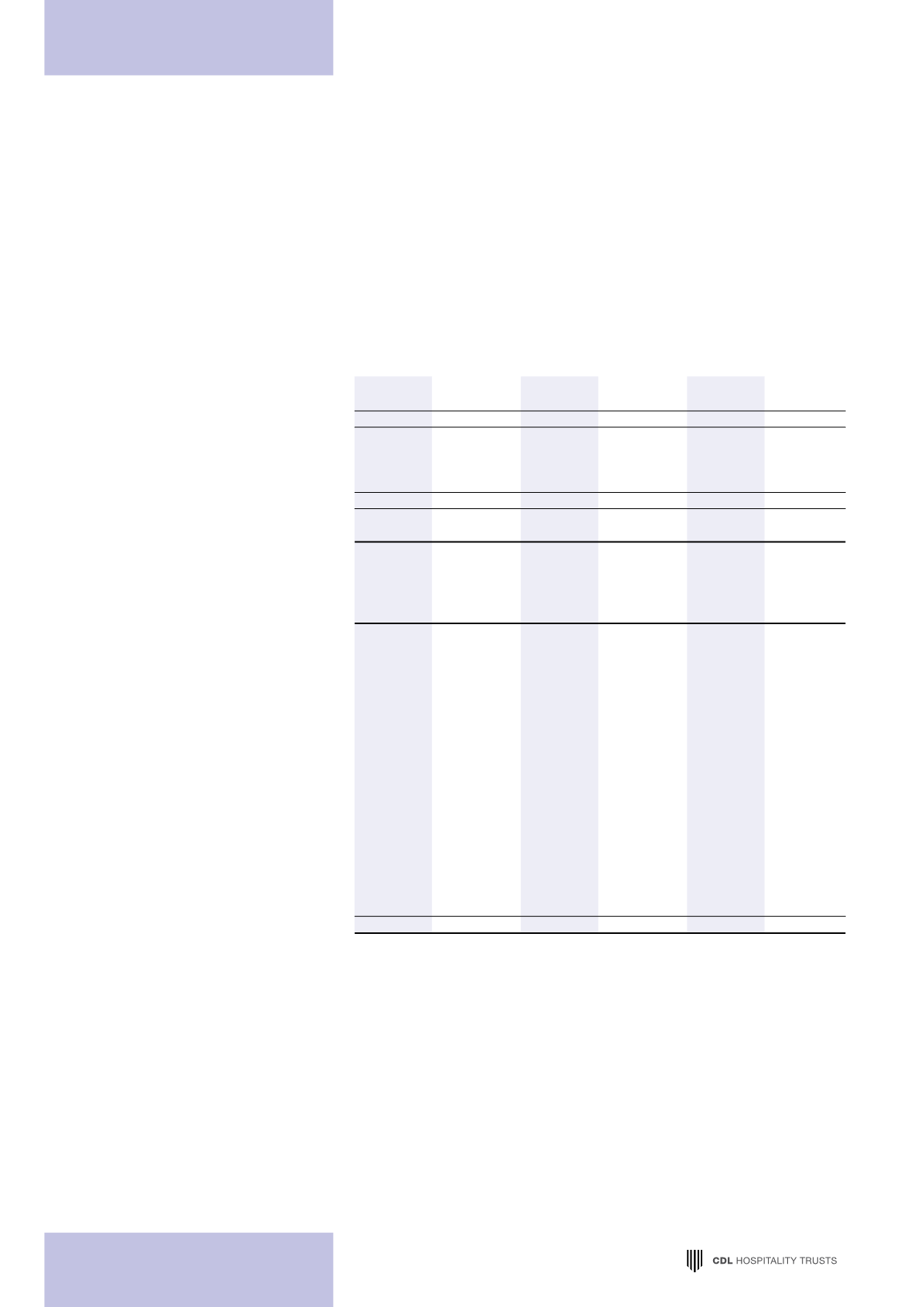

23 TAX EXPENSE

HBT Group

H-REIT Group

Stapled Group

2015

2014

2015

2014

2015

2014

$’000

$’000

$’000

$’000

$’000

$’000

Income tax expense

Current tax

209

42

550

332

759

373

Under provision in prior years

13

–

178

100

191

100

222

42

728

432

950

473

Deferred tax expense

Origination and reversal of

temporary differences

–

–

(99)

1,002

(44)

952

–

–

(99)

1,002

(44)

952

Tax expense

222

42

629

1,434

906

1,425

Reconciliation of

effective tax rate

Net (loss)/income

(1,633)

213

57,555 126,832

59,340 123,881

Tax calculated using

Singapore tax rate of 17%

(277)

36

9,784

21,561

10,087

21,060

Effect of tax in a foreign jurisdiction

(50)

(4)

1,475

1,980

1,425

1,987

Non-tax deductible items

1,050

12

5,996

6,460

6,521

6,894

Non-taxable item

–

–

1,255

(3,599)

1,255

(3,548)

Tax exempt income

(229)

(2)

(4,862)

(8,684)

(5,091)

(8,684)

Tax transparency

–

–

(13,468)

(14,839)

(13,468)

(14,839)

Tax incentives

(234)

–

(13)

–

(247)

–

Current year tax losses for

which no deferred tax

asset was recognised

16

–

–

–

16

–

Change in unrecognised

temporary differences

(104)

–

–

–

(104)

–

Recognition of deferred tax assets

–

–

–

(1,037)

–

(1,037)

Utilisation of tax losses

–

–

–

(508)

–

(508)

Under provision in prior years

13

–

178

100

191

100

Others

37

–

284

–

321

–

222

42

629

1,434

906

1,425

NOTES TO THE FINANCIAL STATEMENTS