119

Annual Report 2015

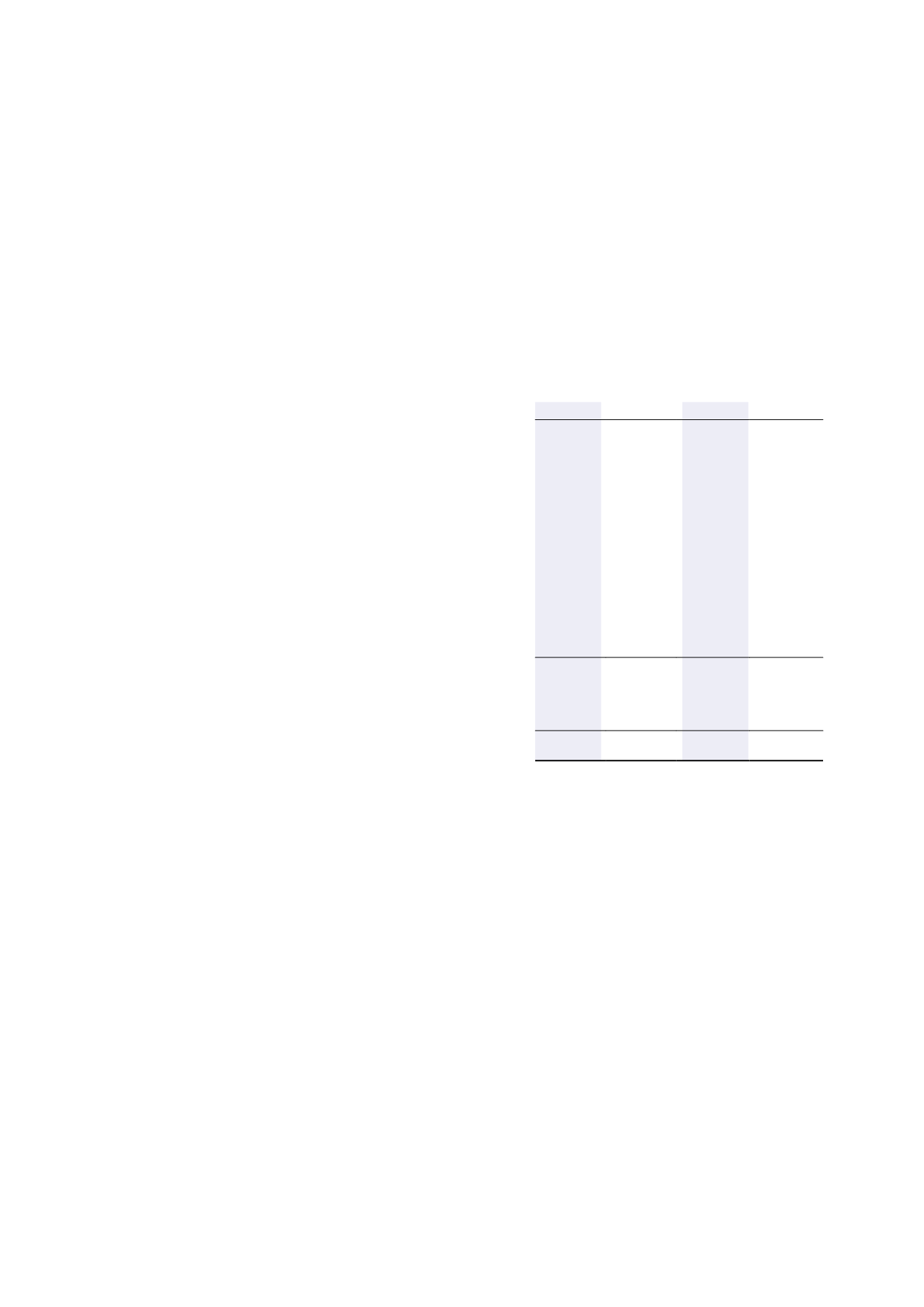

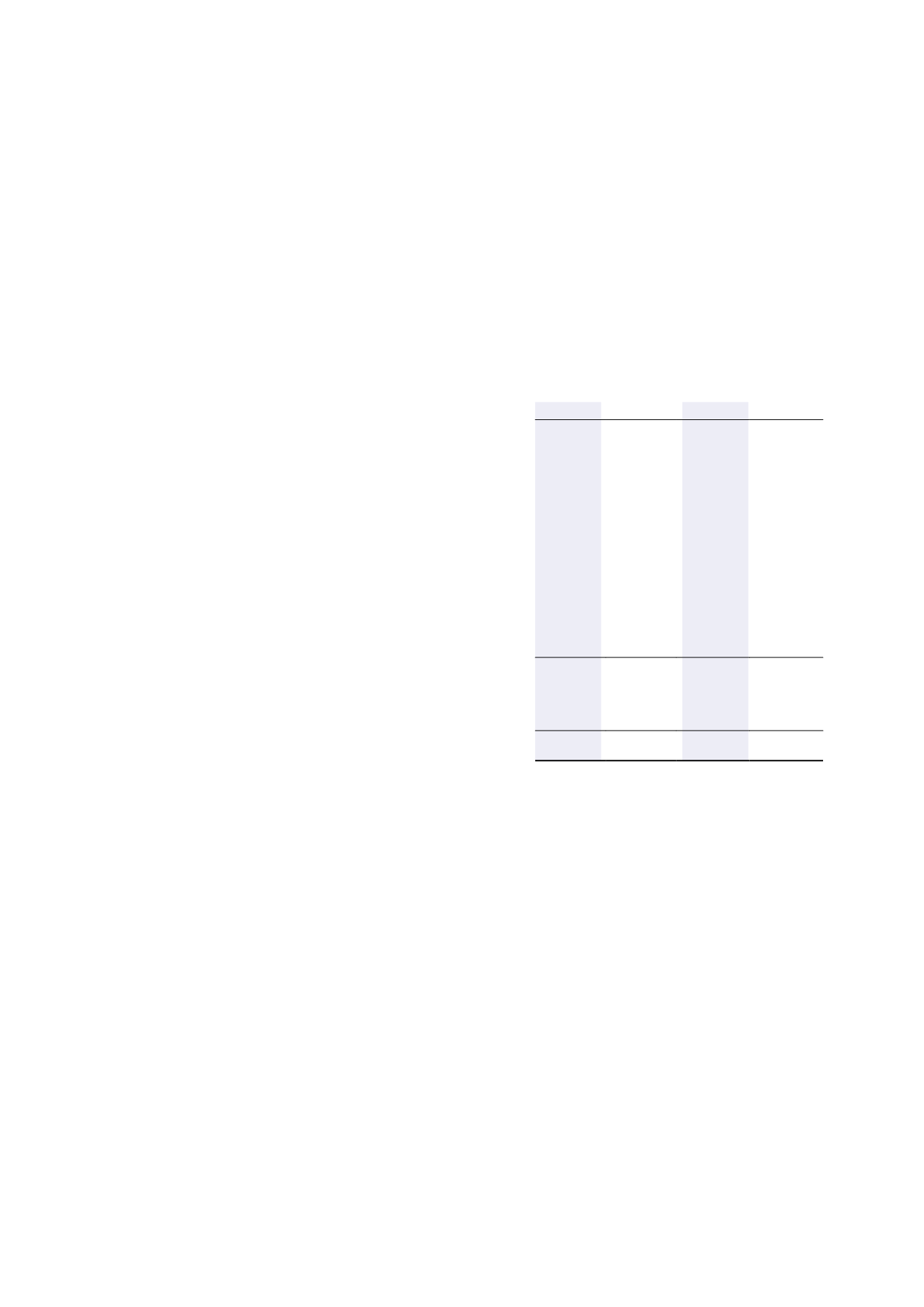

H-REIT GROUP

Description of

Property

Tenure of

Land

Term of

Lease

Remaining

Term of

Lease

Location

Existing

use

Carrying

value at

31/12/2015

Carrying

value at

31/12/2014

Percentage

of Total Net

Assets at

31/12/2015

Percentage

of Total Net

Assets at

31/12/2014

$’000

$’000

%

%

Balance brought forward

2,257,091 2,288,455

143.3

141.4

Investment properties, at valuation

2,257,091 2,288,455

143.3

141.4

Property, plant and equipment

Japan

Hotel MyStays

Asakusabashi

Freehold

–

–

1-5-5

Asakusabashi,

Taito-ku, Tokyo,

Japan

Hotel

37,763

36,251

2.4

2.2

Hotel MyStays

Kamata

Freehold

–

–

5-46-5 Kamata,

Ota-ku, Tokyo,

Japan

Hotel

30,905

29,437

2.0

1.8

Others

–

–

–

–

–

530

346

0.0

0.0

Property, plant and equipment, at net book value

69,198

66,034

4.4

4.0

Other assets and liabilities (net)

(751,616)

(735,644)

(47.7)

(45.4)

Net assets of the H-REIT Group

1,574,673 1,618,845

100.00

100.00

PORTFOLIO STATEMENTS

The accompanying notes form an integral part of these financial statements.

As at 31 December 2015