115

Annual Report 2015

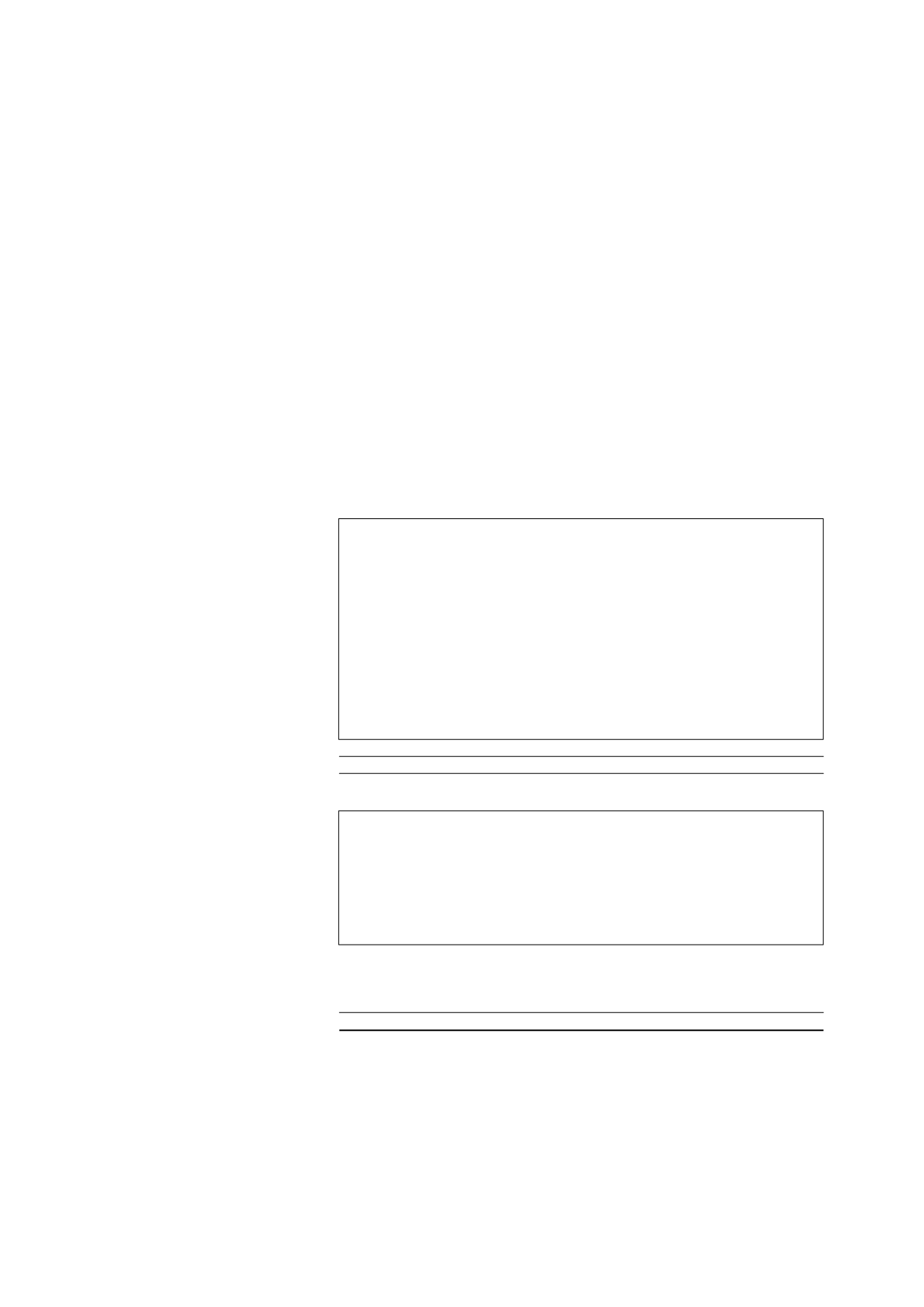

H-REIT Group

Foreign

currency

Units in

Issue

Hedging translation Accumulated

issue

expenses reserve

reserve

profits

Total

$’000

$’000

$’000

$’000

$’000

$’000

At 1 January 2014

1,137,803

(23,921)

(421)

(16,945)

498,518 1,595,034

Operations

Increase in net assets resulting

from operations

–

–

–

–

125,398 125,398

Hedging reserve

- Effective position of changes in

fair value of cash flows hedge

–

–

(160)

–

–

(160)

Foreign currency translation reserve

- Translation differences relating

to financial statements of

foreign subsidiaries

–

–

–

4,020

–

4,020

- Exchange differences on a monetary

item forming part of net investment

in foreign operation

–

–

–

(8,052)

–

(8,052)

- Exchange differences arising from

hedge of net investment in

foreign operation

–

–

–

(2,673)

–

(2,673)

Other comprehensive income

–

–

(160)

(6,705)

–

(6,865)

Total comprehensive income

–

–

(160)

(6,705)

125,398 118,533

Unitholders’ transactions

Units/Stapled Securities to be issued

as payment of H-REIT Manager’s

management fees

10,278

–

–

–

–

10,278

Units/Stapled Securities to be issued

as payment of H-REIT Manager’s

acquisition fees

639

–

–

–

–

639

Distributions to holders of

Stapled Securities

–

–

–

– (105,639)

(105,639)

Net decrease in net

assets resulting from

unitholders’ transactions

10,917

–

–

– (105,639)

(94,722)

At 31 December 2014

1,148,720

(23,921)

(581)

(23,650)

518,277 1,618,845

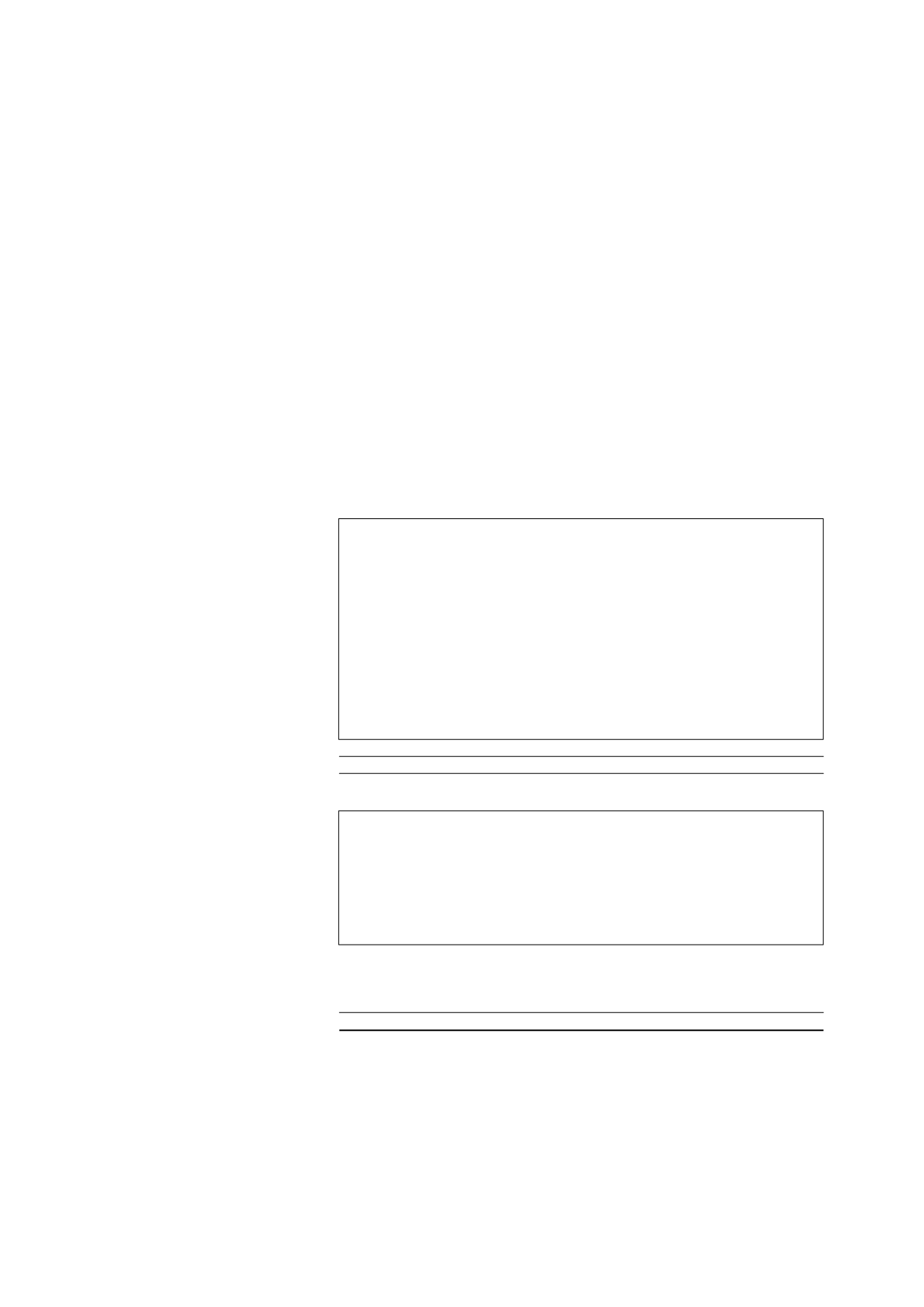

STATEMENTS OF MOVEMENTS IN UNITHOLDERS’ FUNDS

The accompanying notes form an integral part of these financial statements.

Year ended 31 December 2014