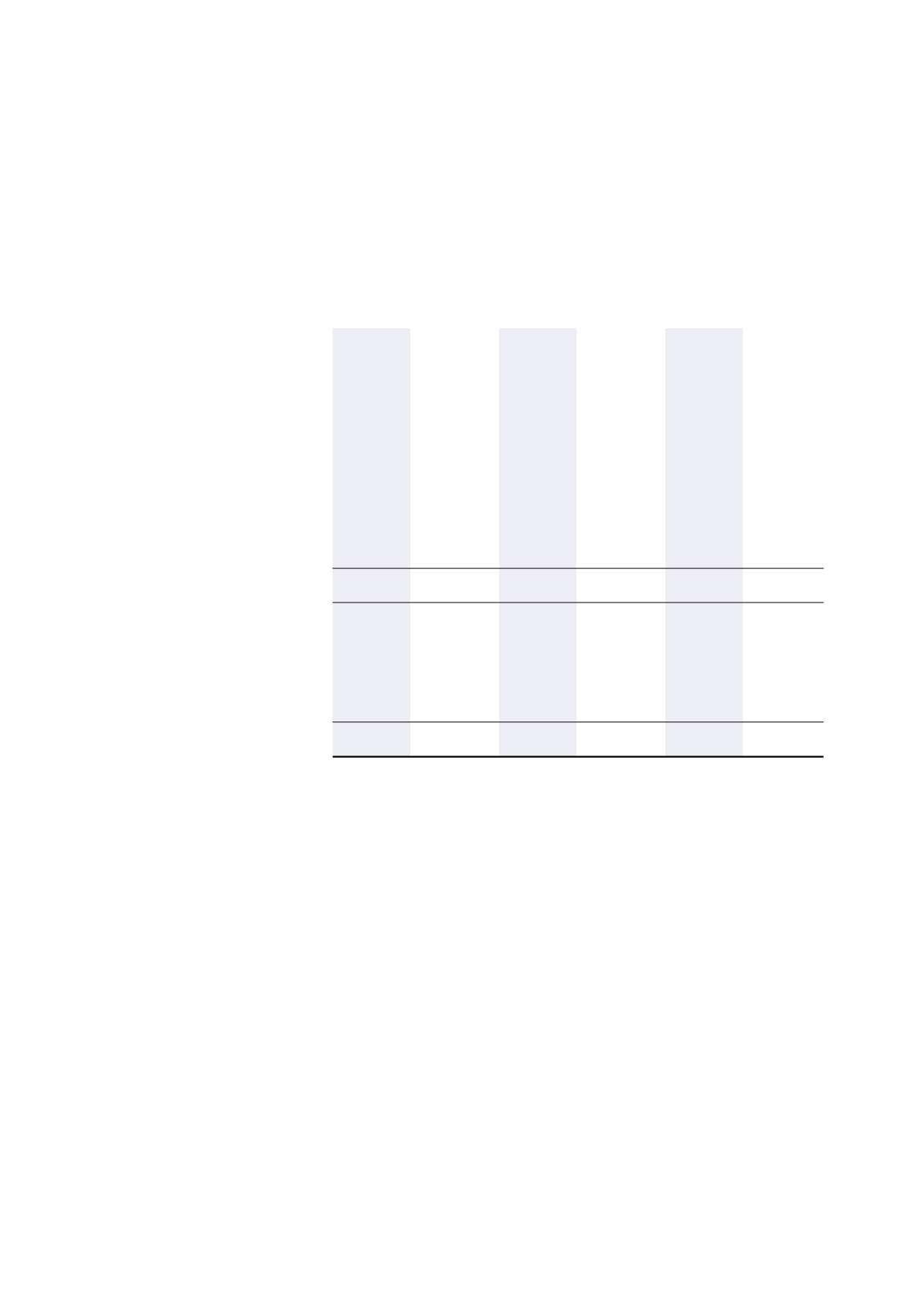

125

Annual Report 2015

HBT Group

H-REIT Group

Stapled Group

Note

2015

2014

2015

2014

2015

2014

$’000

$’000

$’000

$’000

$’000

$’000

Balance carried forward

(133,699)

3,461

113,882

43,370

(19,817)

46,831

Cash flows from financing activities

Other payables/(receivables)

139,144

–

(139,144)

–

–

–

Distribution to holders of

Stapled Securities

–

–

(102,587)

(105,639)

(102,587)

(105,639)

Finance costs paid

–

–

(20,142)

(16,644)

(20,142)

(16,644)

Payment of transaction costs

related to borrowings

–

–

(2,835)

(892)

(2,835)

(892)

Proceeds from bank loans

–

–

378,723

230,959

378,723

230,959

Proceeds from issuance of bond

–

–

35,030

–

35,030

–

Repayment of bank loans

–

–

(273,308)

(76,896)

(273,308)

(76,896)

Repayment of notes

–

–

–

(70,000)

–

(70,000)

Restricted cash

–

–

(1,371)

–

(1,371)

–

Net cash from/(used in)

financing activities

139,144

–

(125,634)

(39,112)

13,510

(39,112)

Net increase/(decrease) in

cash and cash equivalents

5,445

3,461

(11,752)

4,258

(6,307)

7,719

Cash and cash equivalents at

beginning of the year

4,066

605

72,381

68,123

76,447

68,728

Effect of exchange rate changes

on cash and cash equivalents

190

–

267

–

457

–

Cash and cash equivalents at

end of the year (Note 10)

9,701

4,066

60,896

72,381

70,597

76,447

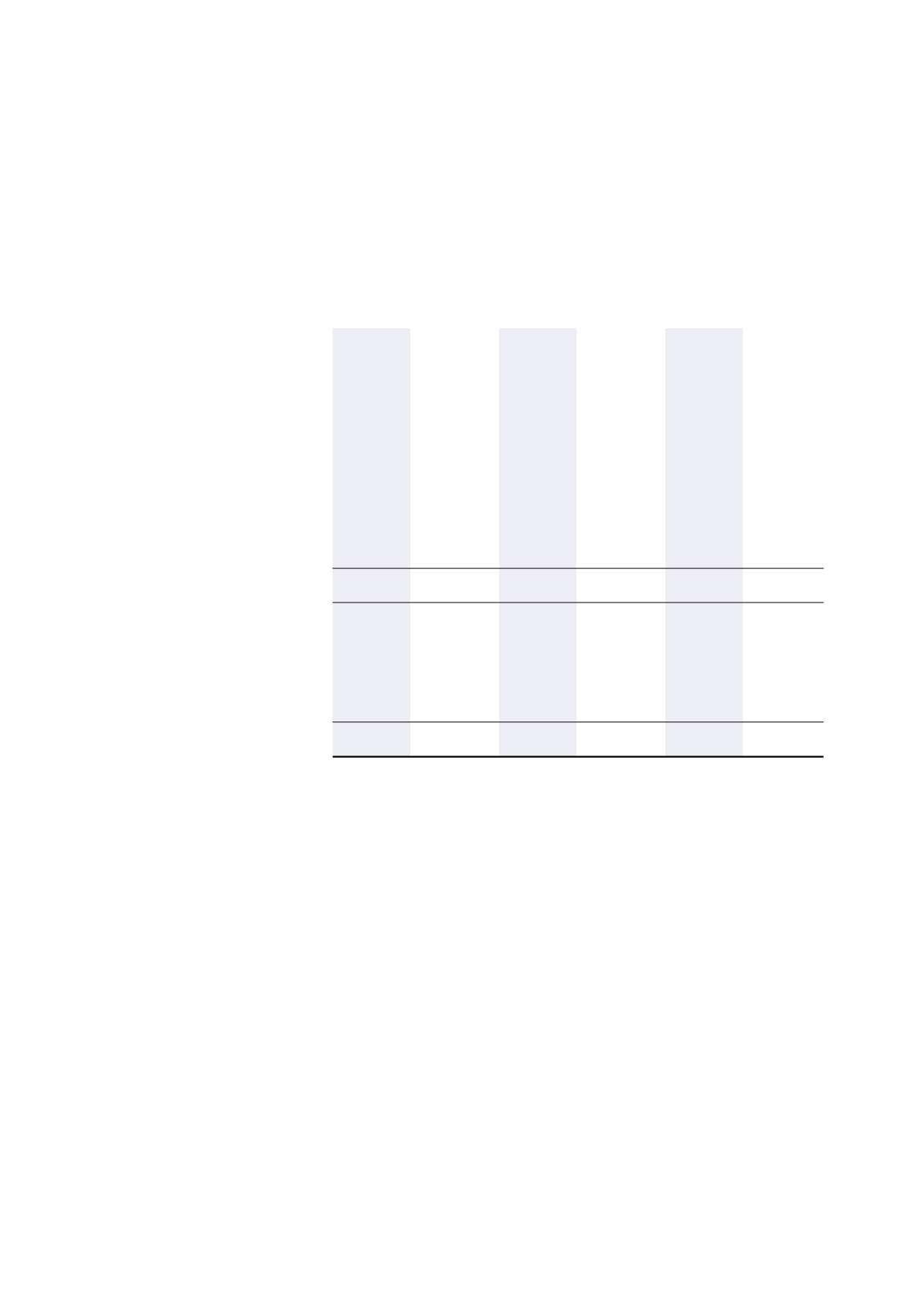

Significant Non-Cash Transactions

H-REIT Group and Stapled Group

For the financial year ended 31 December 2015, a total of 6,921,908 (2014: 6,462,785) Stapled Securities amounting to

$10,210,000 (2014: $10,917,000) were issued or will be issued to the H-REIT Manager at various unit prices as satisfaction of

asset management fees payable in units.

STATEMENTS OF CASH FLOWS

The accompanying notes form an integral part of these financial statements.

Year ended 31 December 2015