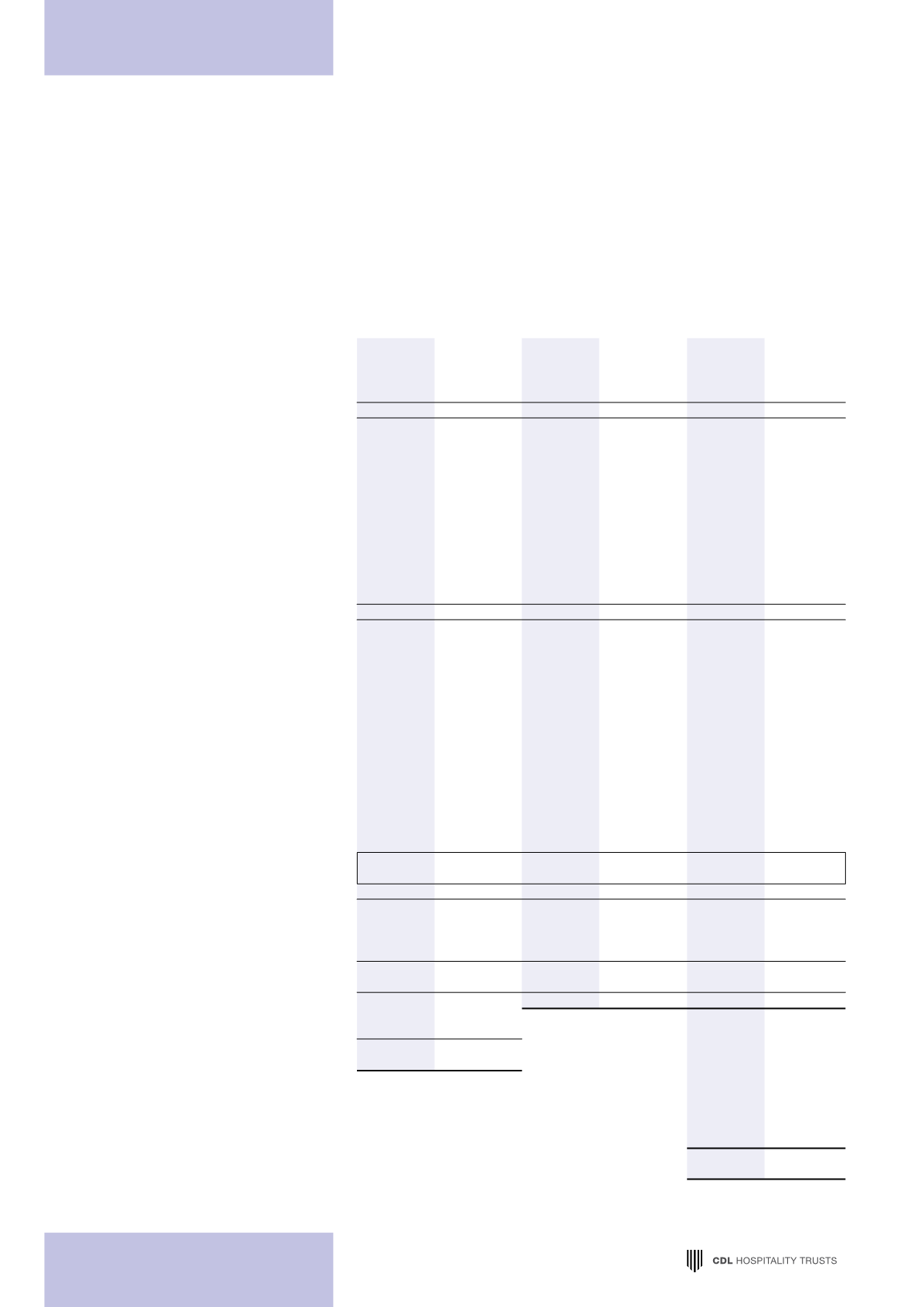

110

Year ended 31 December 2015

The accompanying notes form an integral part of these financial statements.

HBT Group

H-REIT Group

Stapled Group

Note

2015

2014

2015

2014

2015

2014

$’000

$’000

$’000

$’000

$’000

$’000

Gross revenue

Gross rental revenue

–

–

147,209 151,630 136,400 145,259

Room revenue

26,621

13,532

–

–

26,621

13,532

Food & beverage revenue

5,594

4,762

–

–

5,594

4,762

Other income

3,795

3,259

–

–

3,795

3,259

17

36,010

21,553 147,209 151,630 172,410 166,812

Property expenses

Operations and

maintenance expenses

18(a)

(11,635)

(8,480)

–

–

(11,635)

(8,480)

Hotel management fee

(2,022)

(1,207)

–

–

(2,022)

(1,207)

Property tax

(267)

–

(8,609)

(8,553)

(8,876)

(8,553)

Insurance

(27)

–

(1,608)

(1,525)

(1,635)

(1,525)

Administrative and

general expenses

18(b)

(4,609)

(2,163)

–

–

(4,609)

(2,163)

Sales and marketing expenses

18(c)

(1,674)

(1,192)

–

–

(1,674)

(1,192)

Energy and utility expenses

(2,021)

(1,754)

–

–

(2,021)

(1,754)

Rental expenses

(10,931)

(6,371)

–

–

(122)

–

Other property expenses

(42)

–

(2,771)

(1,412)

(2,813)

(1,412)

(33,228)

(21,167)

(12,988)

(11,490)

(35,407)

(26,286)

Net property income

2,782

386 134,221 140,140 137,003 140,526

H-REIT Manager’s base fees

19

–

–

(6,052)

(5,840)

(6,052)

(5,840)

H-REIT Manager’s

performance fees

19

–

–

(6,711)

(7,007)

(6,711)

(7,007)

H-REIT Trustee’s fees

–

–

(273)

(266)

(273)

(266)

HBT Trustee-Manager’s trustee

and management fees

(37)

(24)

–

–

(37)

(24)

HBT Trustee-Manager’s

acquisition fee

(132)

–

–

–

(132)

–

Valuation fees

–

–

(198)

(170)

(198)

(170)

Depreciation, amortisation

and impairment losses

(1,049)

–

(1,511)

–

(7,455)

(2,825)

Other trust expenses

20

(2,631)

(148)

(1,659)

(1,564)

(4,290)

(1,712)

Finance income

16

–

908

1,120

332

1,120

Finance costs

(582)

(1)

(22,636)

(17,559)

(22,626)

(17,560)

Net finance costs

21

(566)

(1)

(21,728)

(16,439)

(22,294)

(16,440)

Net (loss)/income before

fair value adjustment

(1,633)

213

96,089 108,854

89,561 106,242

Net fair value (loss)/gain

on investment properties

–

–

(38,534)

17,978

(30,221)

17,639

Net (loss)/income

22

(1,633)

213

57,555 126,832

59,340 123,881

Income tax expense

23

(222)

(42)

(629)

(1,434)

(906)

(1,425)

Total return for the year

(1,855)

171

56,926 125,398

58,434 122,456

Other comprehensive

income for the year, net of tax

–

–

Total comprehensive

income for the year

(1,855)

171

Earnings per Stapled

Security (cents)

24

Basic

5.93

12.52

Diluted

5.93

12.52

STATEMENT OF COMPREHENSIVE INCOME OF THE HBT GROUP

STATEMENTS OF TOTAL RETURNOF THE H-REIT

GROUP AND THE STAPLED GROUP