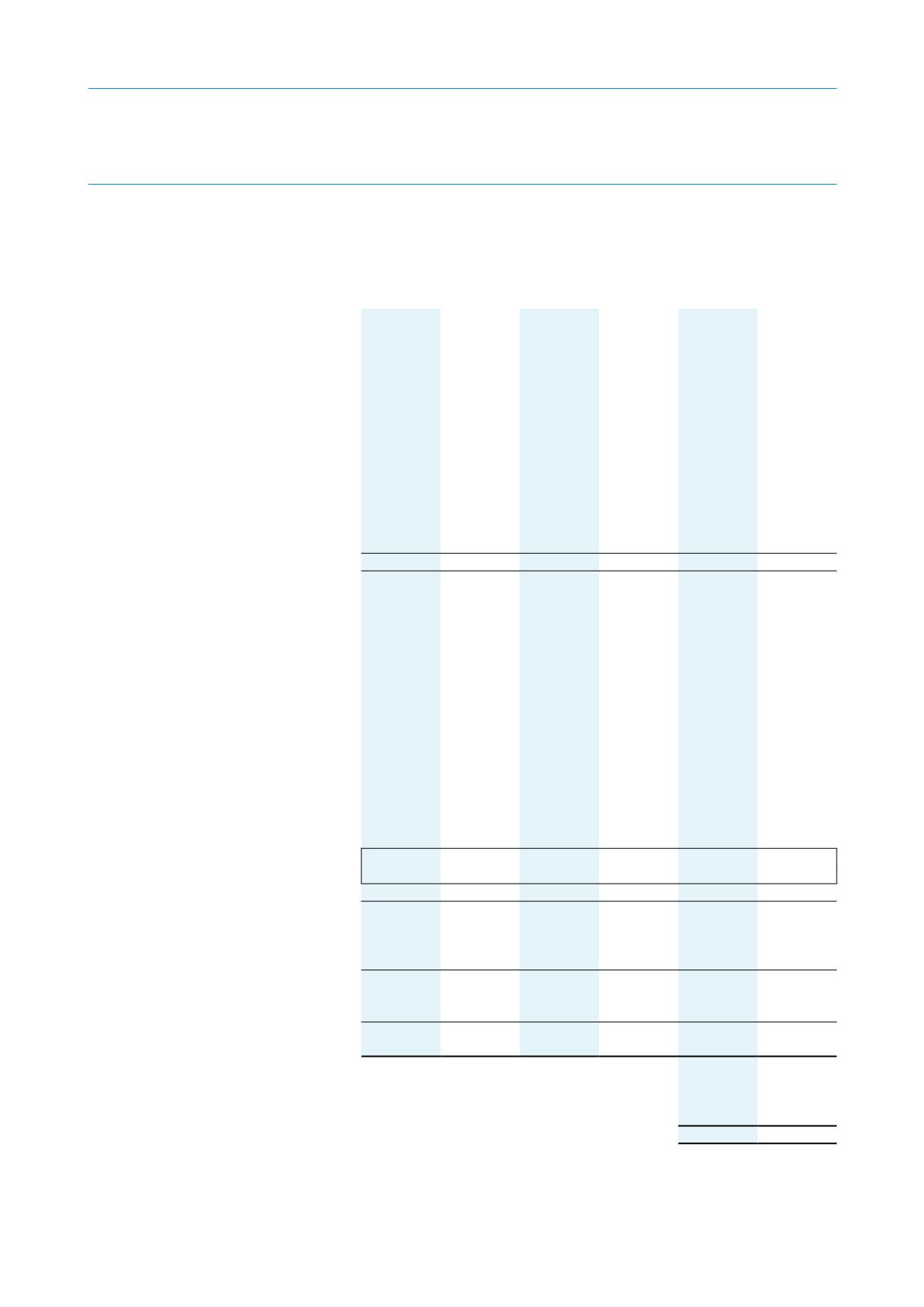

STATEMENT OF PROFIT OR LOSS OF THE HBT GROUP

STATEMENTS OF TOTAL RETURN OF THE H-REIT GROUP AND

THE STAPLED GROUP

REPORTS

Year ended 31 December 2016

HBT Group

H-REIT Group

Stapled Group

Note 2016

2015

2016

2015

2016

2015

$’000

$’000

$’000

$’000

$’000

$’000

Restated

Restated

Revenue

17

49,471 36,010 141,868 147,209 180,857 172,410

Property expenses

Operations and maintenance

expenses

18(a)

(15,025)

(11,635)

–

– (15,025)

(11,635)

Hotel management fee

(2,568)

(2,022)

–

–

(2,568)

(2,022)

Property tax

(977)

(267)

(8,938)

(8,609)

(9,915)

(8,876)

Insurance

(161)

(27)

(794)

(1,608)

(955)

(1,635)

Administrative and general

expenses

18(b)

(6,826)

(4,609)

–

–

(6,826)

(4,609)

Sales and marketing expenses

18(c)

(2,171)

(1,674)

–

–

(2,171)

(1,674)

Energy and utility expenses

(2,041)

(2,021)

–

–

(2,041)

(2,021)

Rental expenses

(10,917)

(10,931)

–

–

(435)

(122)

Other property expenses

–

(42)

(3,361)

(2,771)

(3,361)

(2,813)

(40,686)

(33,228)

(13,093)

(12,988)

(43,297)

(35,407)

Net property income

8,785

2,782 128,775 134,221 137,560 137,003

H-REIT Manager’s base fees

19

–

–

(5,975)

(6,052)

(5,975)

(6,052)

H-REIT Manager’s

performance fees

19

–

–

(6,439)

(6,711)

(6,439)

(6,711)

H-REIT Trustee’s fees

–

–

(272)

(273)

(272)

(273)

HBT Trustee-Manager’s

management fees

19

(438)

–

–

–

(438)

–

HBT Trustee-Manager’s

trustee fees

(134)

(37)

–

–

(134)

(37)

HBT Trustee-Manager’s

acquisition fee

–

(132)

–

–

–

(132)

Valuation fees

(28)

–

(157)

(198)

(185)

(198)

Depreciation, amortisation and

impairment losses

(3,769)

(8,824)

(1,774)

(1,511)

(16,938)

(15,230)

Other trust expenses

(187)

(2,631)

(2,107)

(1,659)

(2,294)

(4,290)

Finance income

13

16

2,367

908

141

332

Finance costs

(2,663)

(582)

(32,633)

(22,636)

(33,057)

(22,626)

Net finance costs

20

(2,650)

(566)

(30,266)

(21,728)

(32,916)

(22,294)

Net income/(loss) before fair

value adjustments

1,579 (9,408)

81,785 96,089 71,969 81,786

Net fair value losses on investment

properties

–

– (33,018)

(38,534)

(21,623)

(30,221)

Net income/(loss)

before tax

21

1,579

(9,408)

48,767 57,555 50,346 51,565

Tax expense

22

(634)

(190)

(380)

(629)

(1,014)

(874)

Net income/(loss)/Total return

for the year

23

945 (9,598)

48,387 56,926 49,332 50,691

Earnings per Stapled

Security (cents)

24

Basic

4.98

5.15

Diluted

4.95

5.15

The accompanying notes form an integral part of these financial statements.

115

Annual Report 2016