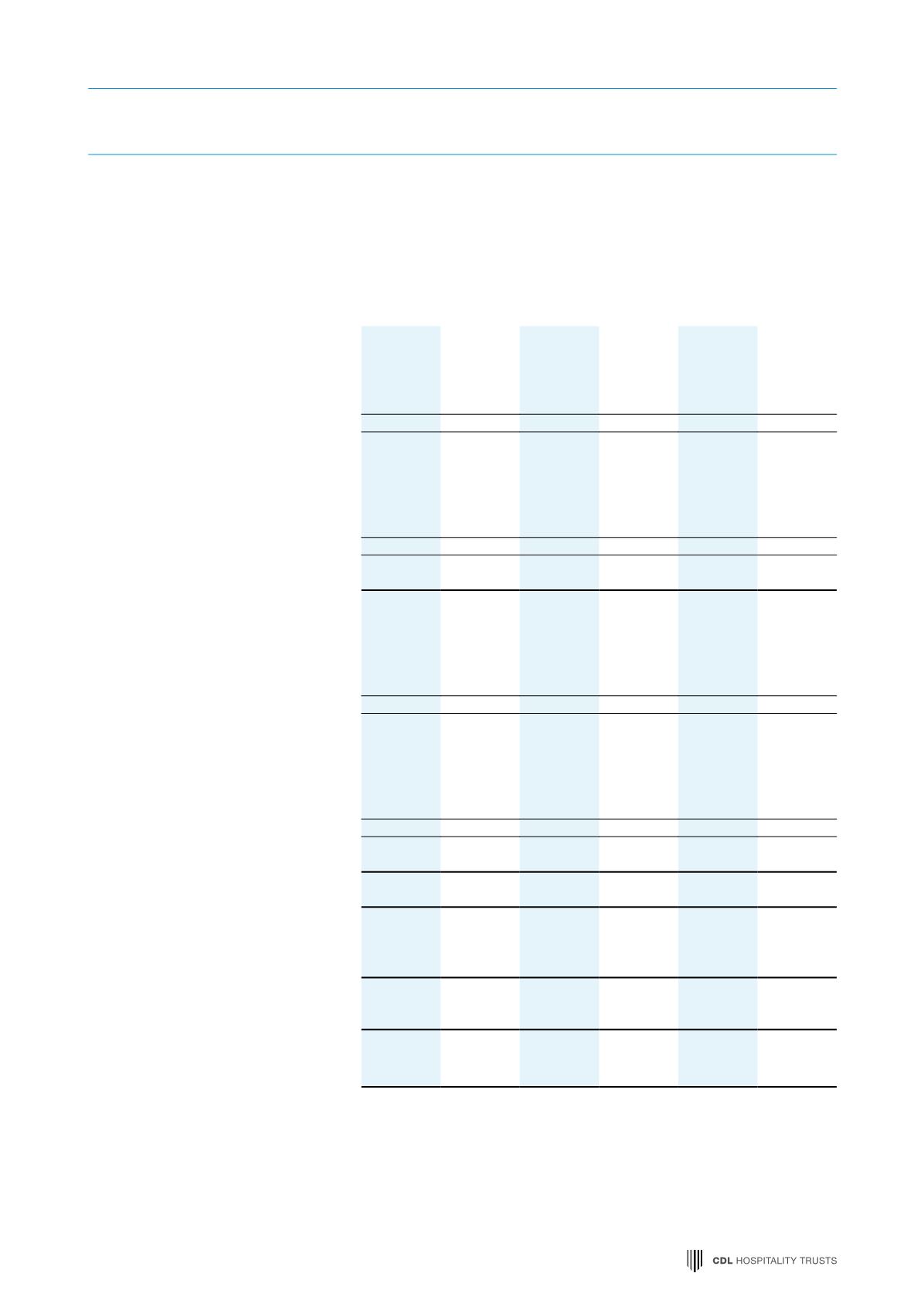

STATEMENTS OF FINANCIAL POSITION

REPORTS

As at 31 December 2016

HBT Group

H-REIT Group

Stapled Group

Note 2016

2015

2016

2015

2016

2015

$’000

$’000

$’000

$’000

$’000

$’000

Restated

Restated

Non-current assets

Investment properties

5

–

– 2,246,808 2,257,091 2,175,008 2,176,664

Property, plant and equipment

6

107,432 128,636 71,947 69,198 244,361 270,855

Prepaid land lease

7

–

–

–

–

6,817

7,406

Deferred tax assets

14

–

–

–

216

–

216

Other receivables

9

–

– 117,831 135,742

–

–

107,432 128,636 2,436,586 2,462,247 2,426,186 2,455,141

Current assets

Inventories

8

1,053

1,280

–

–

1,053

1,280

Trade and other receivables

9

5,820

6,322 26,530 18,741 25,704 19,094

Financial derivative assets

12

66

–

105

–

171

–

Cash and cash equivalents

10

14,301

9,701 67,927 62,267 82,228 71,968

21,240 17,303 94,562 81,008 109,156 92,342

Total assets

128,672 145,939 2,531,148 2,543,255 2,535,342 2,547,483

Non-current liabilities

Loans and borrowings

11

–

– 928,849 703,208 928,849 703,208

Rental deposits

–

–

8,981

8,749

8,981

8,749

Other payables

13

117,831 135,742

–

–

–

–

Deferred tax liabilities

14

6,213

7,545

8,902 10,514 15,115 18,059

124,044 143,287 946,732 722,471 952,945 730,016

Current liabilities

Loans and borrowings

11

–

–

– 219,136

– 219,136

Trade and other payables

13

11,964 11,389 28,116 26,819 33,433 32,239

Financial derivative liabilities

12

52

–

284

–

336

–

Provision for taxation

656

117

1,551

156

2,207

273

12,672 11,506 29,951 246,111 35,976 251,648

Total liabilities

136,716 154,793 976,683 968,582 988,921 981,664

Net assets/(liabilities)

16

(8,044)

(8,854) 1,554,465 1,574,673 1,546,421 1,565,819

Represented by:

Unitholders’ funds

(8,044)

(8,854) 1,554,465 1,574,673 1,546,421 1,565,819

Units/Stapled Securities in issue

(’000)

15

991,771 987,137 991,771 987,137 991,771 987,137

Net asset value per Unit/

Stapled Security ($)

16

(0.0081)

(0.0090)

1.56

1.59

1.55

1.58

The accompanying notes form an integral part of these financial statements.

114