OVERVIEW AND

FINANCIAL REVIEW

growth in China has also contributed to a higher risk of

economic vulnerability worldwide. Any further slowdown

in economic activities will weigh on attendant demand

for hotel rooms in Singapore.

Notwithstanding the near-term challenges, the long-term

outlook for Singapore tourism sector remains positive,

augmented by initiatives of the Singapore government.

These include the continuing pipeline of tourist

attractions and ongoing construction of Changi Airport’s

Terminal 4 which will serve to entrench Singapore’s

position as a leading aviation hub in the region.

For CDLHT’s Australia and New Zealand Hotels, fixed

rent contributions were lower in FY 2015 due to local

currency weakness against the Singapore dollar. The

lack of new investments in the mining sector in Perth

and Brisbane as a result of the weak commodity prices,

coupled with the addition of new hotel supply, may

weigh on the trading performance of the hospitality

sector. However, any weakness in the performance of

the Australia Hotels is mitigated by the defensive lease

structure which provides CDLHT with largely fixed rent.

In New Zealand, the tourism sector is seeing good

growth momentum and the near-term outlook for the

hospitality sector looks promising.

In Maldives, the operating environment was affected

largely by the continued strength of the US dollar against

most currencies which rendered the travel destination

more expensive. In addition to the currency weakness

of key source markets against the US dollar, the slowing

growth in China and the recent devaluation of the

Chinese yuan are also expected to dampen demand for

luxury resort stays. Recognising the challenging trading

environment, the Managers have also been proactively

working with operators of the two resorts to work on

cost containment measures to protect the profit margins.

Strong performance and contributions from the newly

acquired Hilton Cambridge City Centre and the Japan

Hotels have helped to mitigate the weaker contributions

in other markets in 2015. For the period in which CDLHT

owns the UK Hotel (4Q 2015), it traded strongly post-

refurbishment, recording a yoy RevPAR growth of 20.8%.

The Japan Hotels, which was acquired in December

2014, saw RevPAR growth of 22.2%

(1)

in FY 2015 due

to a surge in visitor arrivals and active revenue

management strategies. Going forward, the Japanese

hospitality sector is expected to continue to benefit

from the various government initiatives to bring in more

tourists into Japan and from the potential growth leading

up to the Tokyo Olympics in 2020.

Overall, the Managers remain cautious over the health

of the global economy given lingering concerns on the

slowing growth in China, as well as the tepid economies

in the United States and Europe. The weak economic

sentiment may exert challenges for some of the

markets that CDLHT operates in. Nevertheless,

the geographically diversified portfolio is expected to

continue to provide CDLHT with the benefits of income

diversification when some markets are going through

unfavourable cycles.

OVERVIEW AND FINANCIAL REVIEW

(1)

The yoy RevPAR comparison assumes H-REIT, through the Japan Trust, owned the Japan Hotels for year ended 31 December 2014.

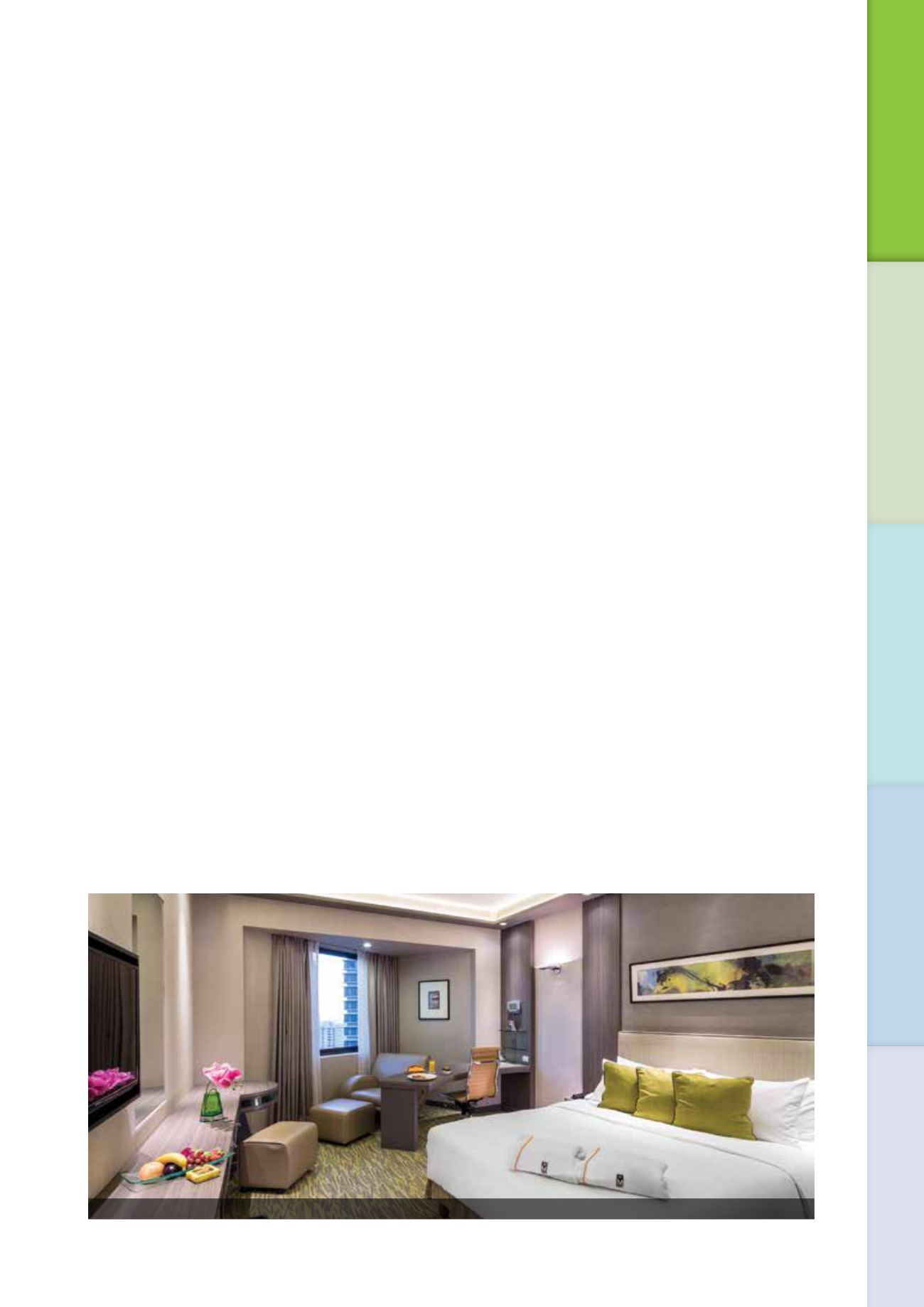

Club Room (post-refurbishment), M Hotel

7

Annual Report 2015