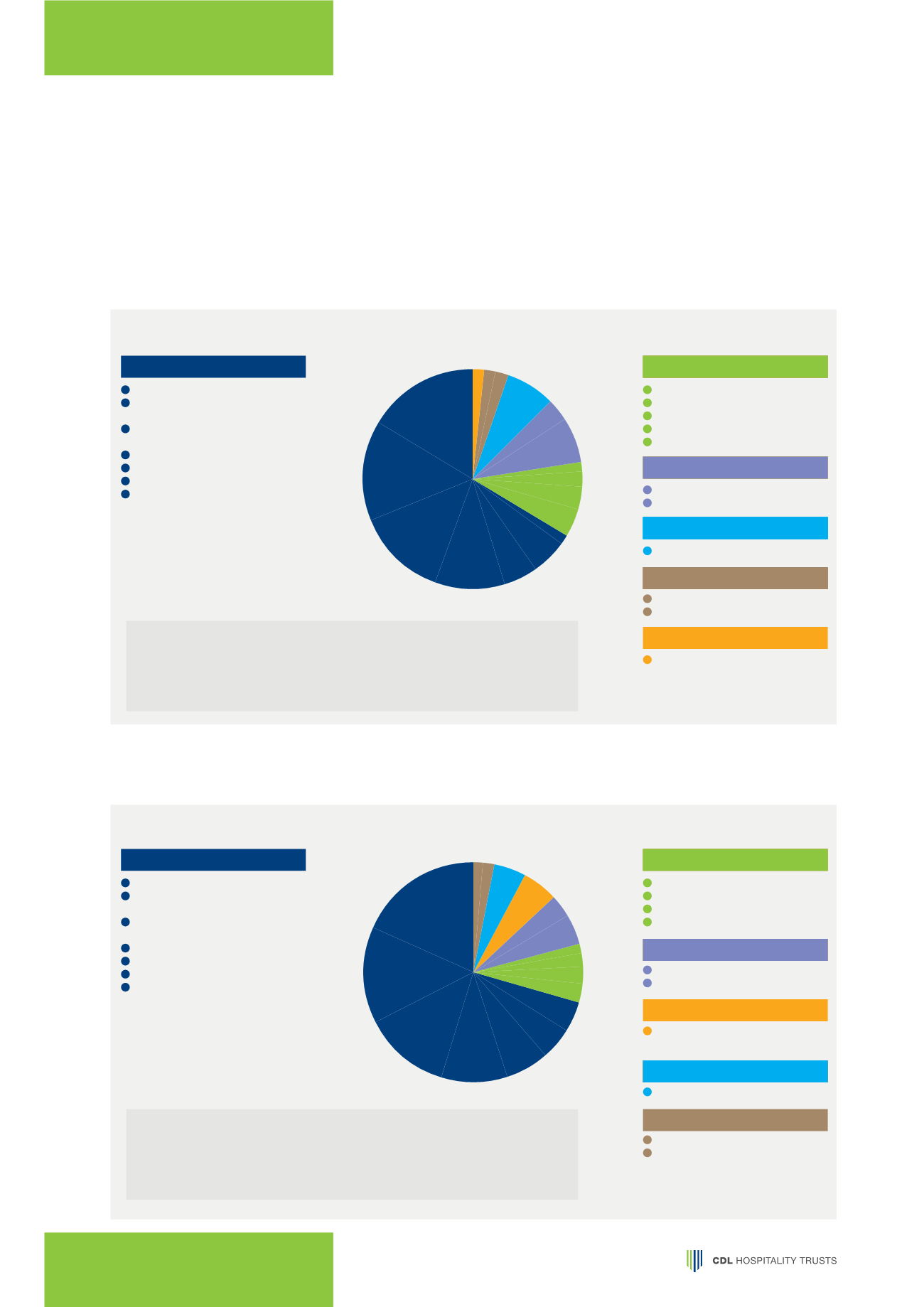

Singapore

66.4%

Orchard Hotel

16.1%

Novotel Singapore

14.8%

Clarke Quay

Grand Copthorne

13.4%

Waterfront Hotel

M Hotel

10.1%

Studio M Hotel

5.2%

Copthorne King’s Hotel

5.1%

Claymore Connect

1.6%

SINGAPORE PORTFOLIO

66.4%

OVERSEAS PORTFOLIO

33.6%

Australia

11.1%

Novotel Brisbane

4.0%

Mercure Brisbane

2.0%

Ibis Brisbane

1.3%

Mercure Perth

2.3%

Ibis Perth

1.5%

Maldives

10.0%

Angsana Velavaru

6.6%

Jumeirah Dhevanafushi

3.3%

New Zealand

7.1%

Rendezvous Hotel Auckland 7.1%

Japan

(1)

3.8%

MyStays Asakusabashi

2.1%

MyStays Kamata

1.7%

United Kingdom

(2)

1.7%

Hilton Cambridge

1.7%

City Centre

(1) Acquisition of the Japan Hotels was completed on 19 December 2014. Contribution

from the Japan Hotels for FY 2015 includes the last 13 days of FY 2014.

(2) Acquisition of the UK Hotel was completed on 1 October 2015, hence NPI of UK

Hotel only includes 3 months of contribution.

Note: Percentages may not add up due to rounding.

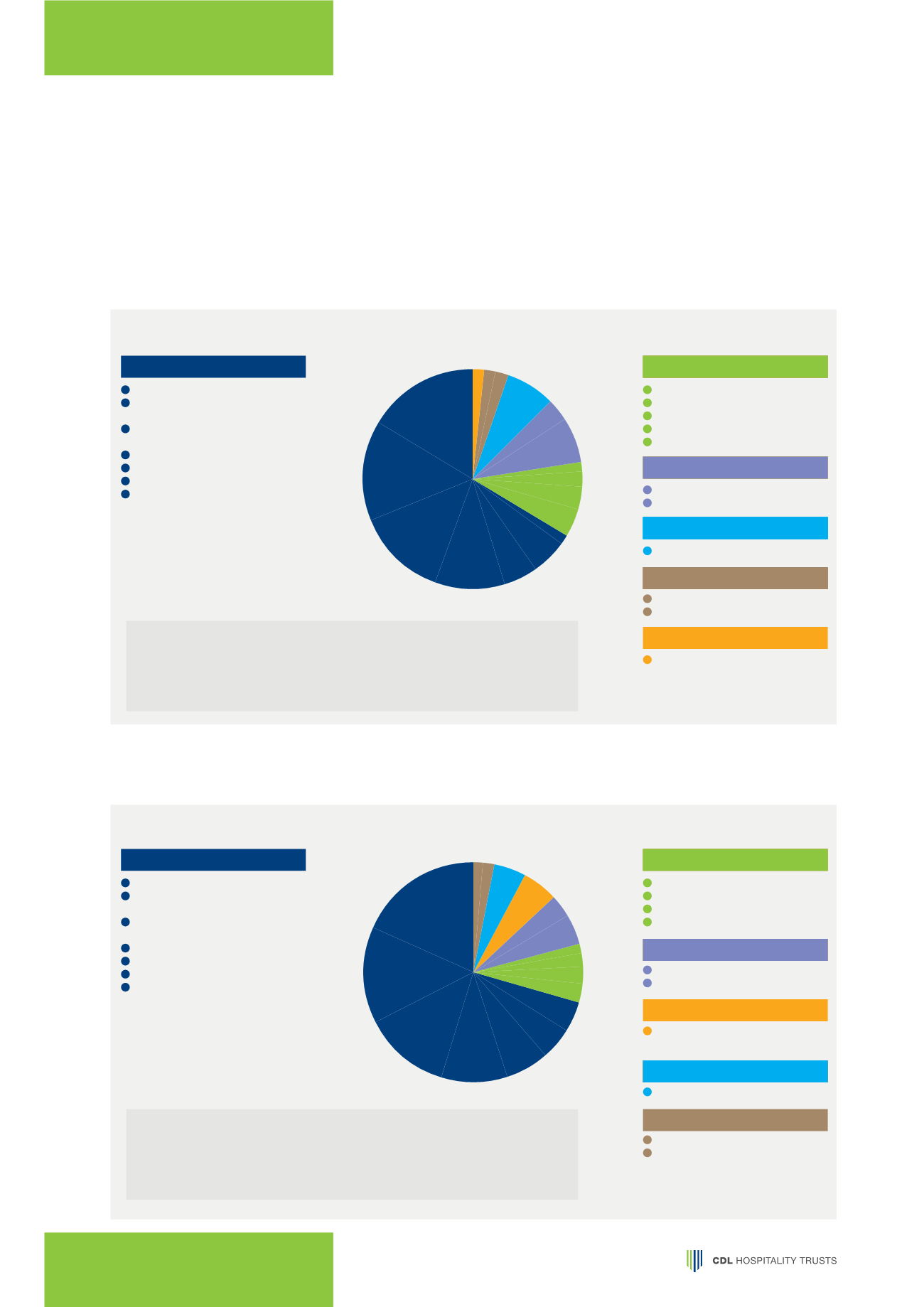

Singapore

70.5%

Orchard Hotel

18.2%

Grand Copthorne

14.2%

Waterfront Hotel

Novotel Singapore

12.9%

Clarke Quay

M Hotel

9.5%

Studio M Hotel

6.4%

Copthorne King’s Hotel

4.9%

Claymore Connect

4.3%

SINGAPORE PORTFOLIO

70.5%

OVERSEAS PORTFOLIO

29.5%

Australia

8.6%

Novotel Brisbane

2.8%

Mercure & Ibis Brisbane 2.6%

Mercure Perth

1.9%

Ibis Perth

1.3%

Maldives

7.7%

Angsana Velavaru

4.5%

Jumeirah Dhevanafushi

3.3%

United Kingdom

5.4%

Hilton Cambridge

5.4%

City Centre

New Zealand

4.6%

Rendezvous Hotel Auckland 4.6%

Japan

3.2%

MyStays Asakusabashi

1.8%

MyStays Kamata

1.5%

(1) All properties, excluding the UK Hotel, were valued as at 31 December 2015.

The UK Hotel, which was acquired on 1 October 2015, was valued by Knight Frank

LLP as at 25 August 2015.

Note: Percentages may not add up due to rounding.

NET PROPERTY INCOME

S$

137.0 MILLION

PORTFOLIO VALUATION

S$

2.5 BILLION

PORTFOLIO SUMMARY

OF CDL HOSPITALITY TRUSTS

OVERVIEW AND FINANCIAL REVIEW

NET PROPERTY INCOME BY GEOGRAPHY AND PROPERTIES

(1) (2)

For FY 2015

PORTFOLIO VALUATION BY GEOGRAPHY AND PROPERTIES

(1)

As at 31 December 2015

16