CHAIRMAN’S

STATEMENT

OVERVIEW AND FINANCIAL REVIEW

With the successful completion of its first investment

in Europe, CDLHT’s portfolio valuation has grown to

S$2.5 billion as at 31 December 2015 and it now enjoys

greater income diversification though an enlarged

portfolio of 15 hotels and two resorts in six markets with

a total room count of 4,909.

PORTFOLIO ENHANCEMENT FOR OPTIMISED

VALUE

The Managers are constantly evaluating the portfolio for

asset enhancement opportunities that would improve

the assets’ value and competitiveness.

In 2015, asset enhancement initiatives that were

completed include the refurbishment of restaurant

and bar at Mercure Perth as well as the addition

of two new beach villas at Jumeirah Dhevanafushi.

Claymore Connect (formerly known as Orchard Hotel

Shopping Arcade) was officially opened in October

2015 following an asset enhancement exercise.

The mall’s net lettable area has increased by about

10,000 sq ft to approximately 54,000 sq ft

(3)

and is being

repositioned as a family-friendly mall.

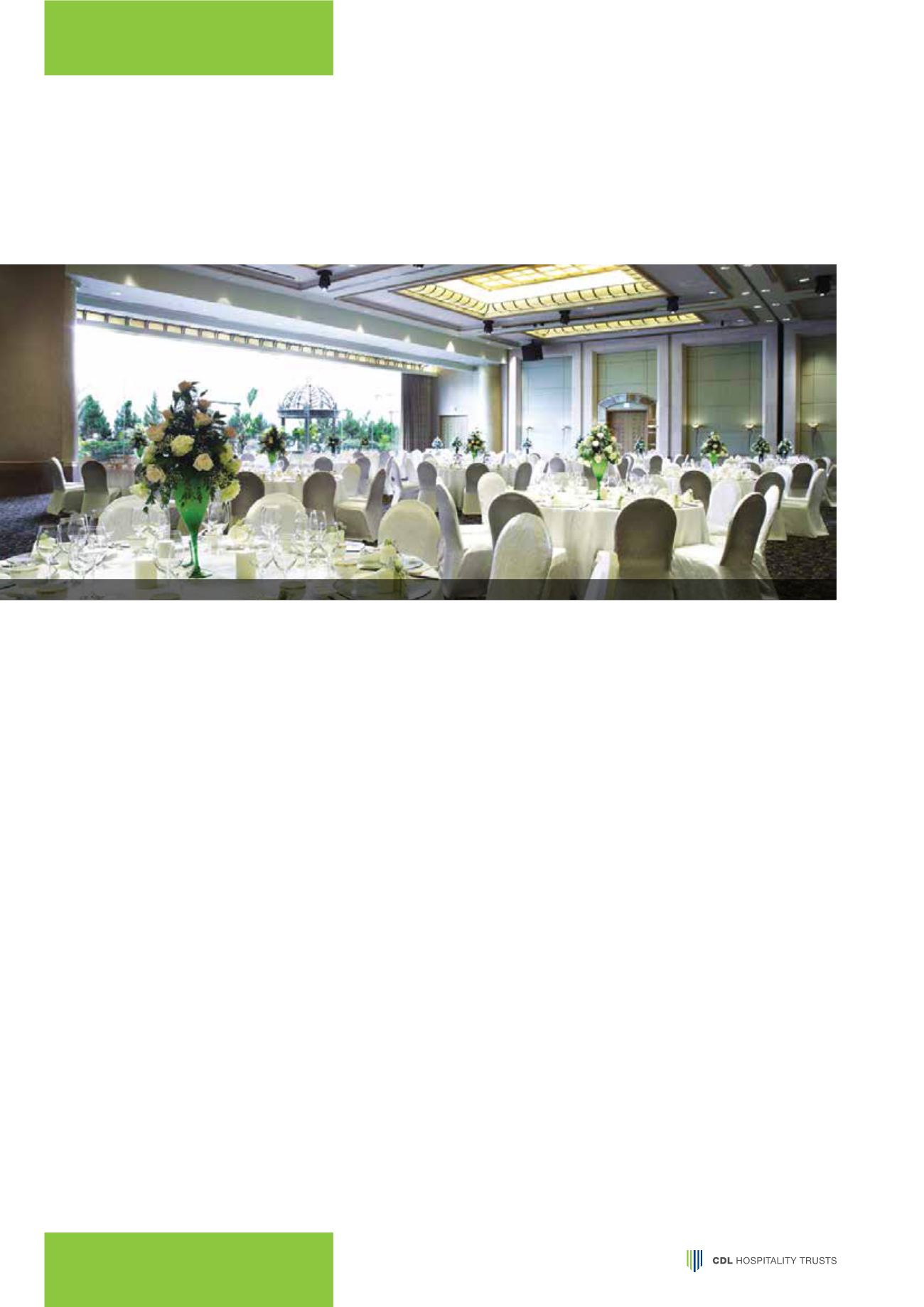

In 2016, Grand Copthorne Waterfront Hotel is expected

to complete its extensive renovation to refresh its lobby,

add meeting room capacity and significantly augment

its food and beverage offerings. At M Hotel, with the

exception of 10 suites, the refurbishment of all the

MAIDEN ENTRY INTO EUROPE VIA ACQUISITION

OF CAMBRIDGE CITY HOTEL

On 1 October 2015, CDLHT made its maiden entry into

Europe with the acquisition of a hotel in Cambridge,

UK for a property price of £61.5 million (approximately

S$132.7 million

(2)

). This acquisition was fully funded by

sterling-denominated debt. Hilton was appointed as the

manager of the hotel and the hotel was rebranded to

Hilton Cambridge City Centre on 15 December 2015.

This transaction represented a unique opportunity for

CDLHT to secure a prominent presence in Cambridge,

which is one of the most robust hospitality markets in

UK with a strong demand profile. It remains one of the

primary tourist destinations in UK due to its historical

and cultural appeal. As it is also an important location for

UK’s R&D sector, it is home to a large cluster of high-tech

businesses focusing on biomedical, pharmaceutical and

technology.

The hotel is a newly-refurbished upper upscale hotel

and comes with a comprehensive suite of facilities. It

also boasts a prime location in the heart of Cambridge

city centre, with easy access to transport amenities and

close proximity to tourist attractions. In addition, the

recent rebranding should also augment the trading

performance as the hotel benefits from the management

expertise and distribution strength of the international

operator.

(2)

Based on an exchange rate of £1.00 = S$2.1575. Price does not include net working capital adjustments and transaction costs.

(3)

Excludes net lettable area of the adjoining Galleria which is not part of the asset enhancement exercise.

Grand Ballroom, Grand Copthorne Waterfront Hotel

8