12

CDL

HOSPITALITY TRUSTS

PORTFOLIO SUMMARY

OF CDL HOSPITALITY TRUSTS

(1) All properties, excluding the Japan Hotels were valued as at 31 December 2014. The Japan Hotels which were acquired on 19 December

2014, were valued (average of two valuations done by DTZ Debenham Tie Leung Kodo Kaisha and International Appraisals Incorporated) as at

30 October 2014.

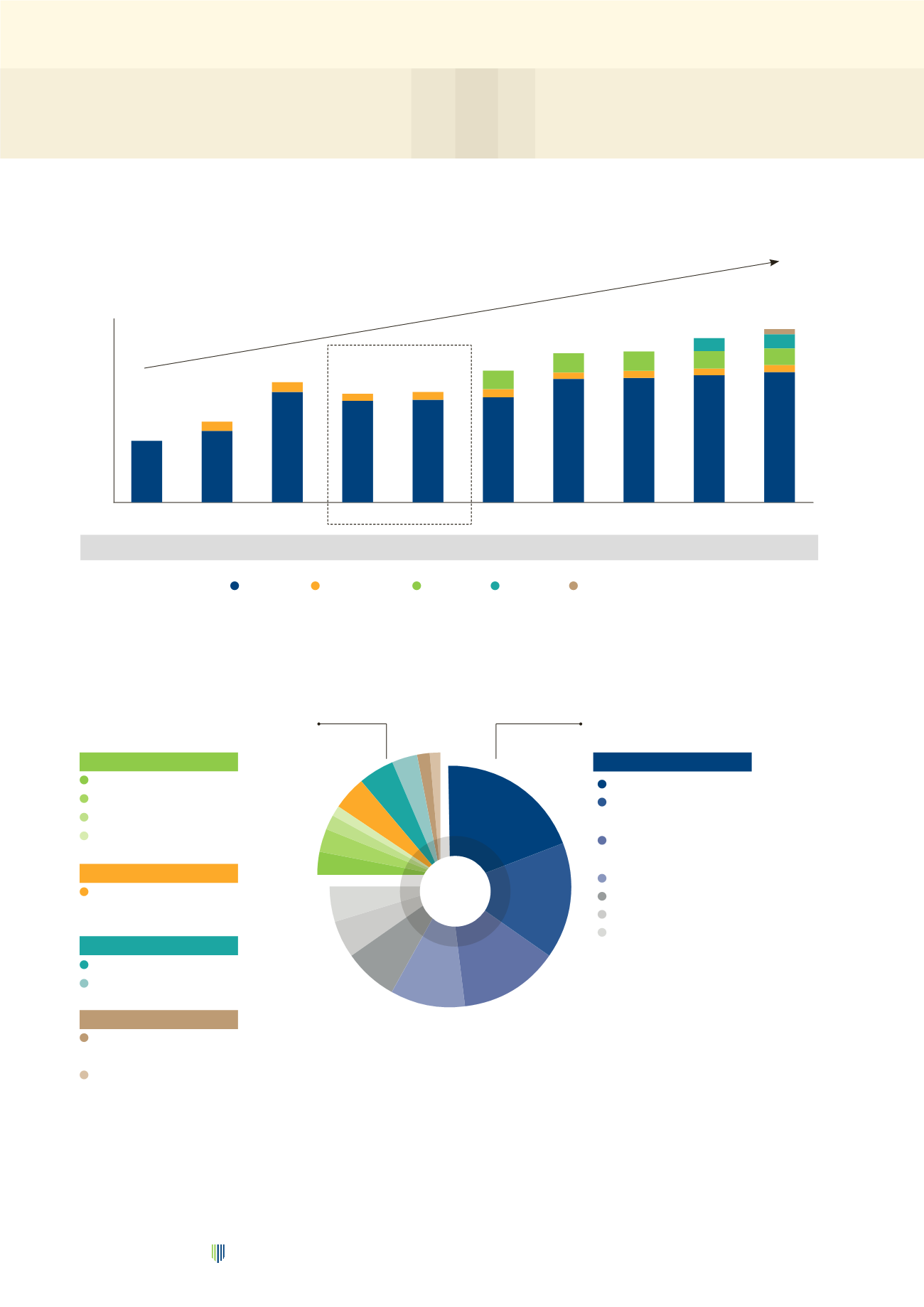

PORTFOLIO VALUATION

As at 31 December 2014, portfolio of CDLHT registered a yoy increase of 5.2%.

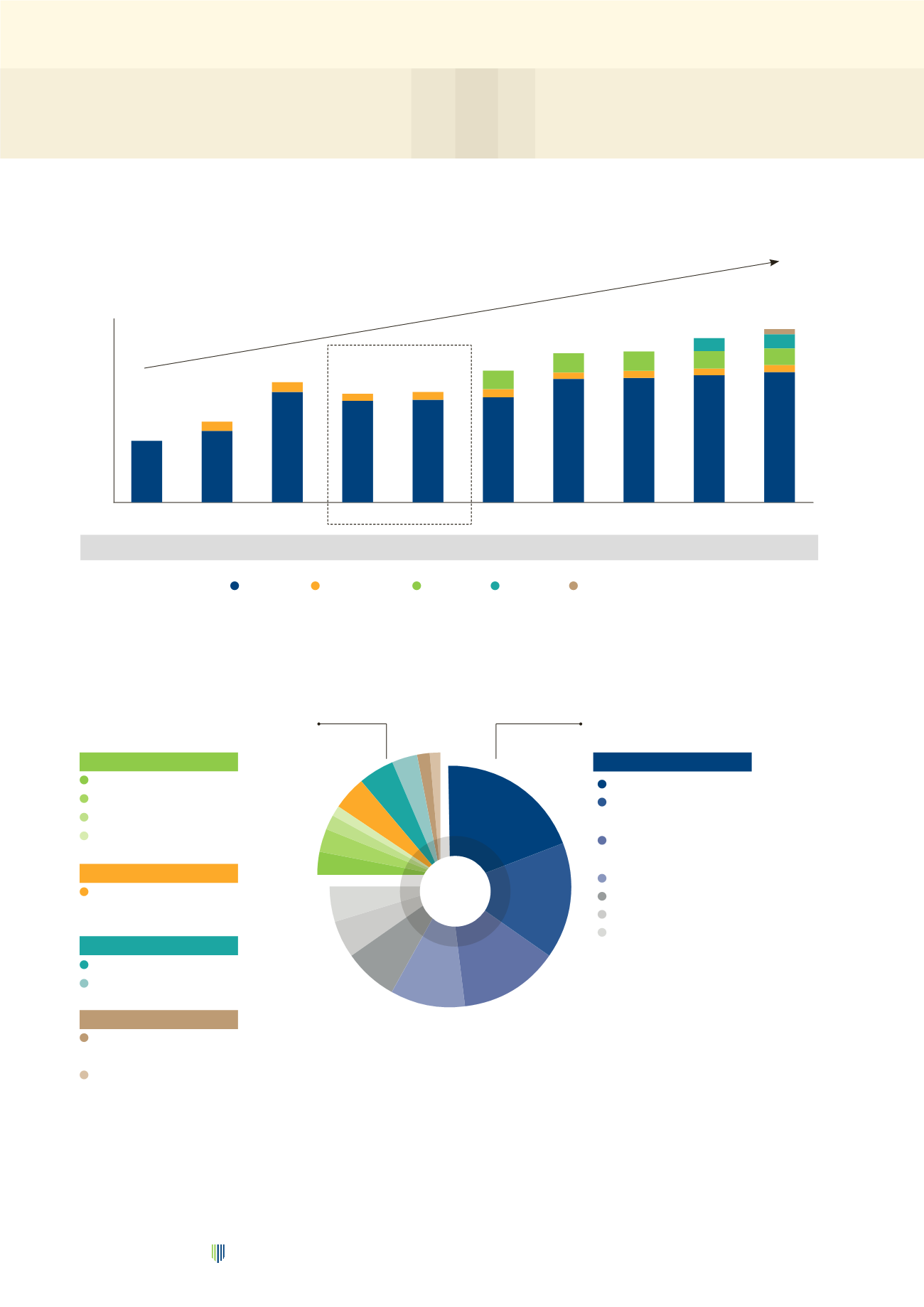

BREAKDOWN OF PORTFOLIO VALUATION BY GEOGRAPHY AND PROPERTIES

(1)

As at 31 December 2014

SINGAPORE PORTFOLIO 75.1%

Singapore

75.1%

Orchard Hotel

19.5%

Grand Copthorne

15.4%

Waterfront Hotel

Novotel Singapore

13.5%

Clarke Quay

M Hotel

10.0%

Studio M Hotel

7.0%

Copthorne King’s Hotel

5.2%

Claymore Connect

4.5%

OVERSEAS PORTFOLIO 24.9%

Australia

9.6%

Novotel Brisbane

3.3%

Mercure & Ibis Brisbane 2.8%

Mercure Perth

2.1%

Ibis Perth

1.4%

New Zealand

4.4%

Rendezvous Grand

4.4%

Hotel Auckland

Maldives

8.1%

Angsana Velavaru

4.6%

Jumeirah Dhevanafushi

3.5%

Japan

2.8%

Hotel MyStays

1.6%

Asakusabashi

Hotel MyStays

1.2%

Kamata

PORTFOLIO VALUATION

S$2.4 BILLION

2,500

2,000

1,500

1,000

500

0

S$M

846

979

123

128

1,501

1,388

1,392

1,435

1,675

1,695

1,725

1,769

93

110

99

253

90

265

89

261

101

234

179

103

225

191

67

846M

1,102M

1,629M

1,481M 1,502M

1,787M

2,030M 2,045M

2,239M

2,355M

Sub-Prime

IPO 31 Dec 06 31 Dec 07 31 Dec 08 31 Dec 09 31 Dec 10 31 Dec 11 31 Dec 12 31 Dec 13 31 Dec 14

(1)

Singapore New Zealand

Japan

Maldives

Australia

Change (%) +30.2% +47.8%

-9.1% +1.4% +19.0% +13.6% +0.7% +9.5% +5.2%

Compound Annual Growth Rate of 12.9%