9

ANNUAL REPORT 2014

DEBT PROFILE OF CDLHT

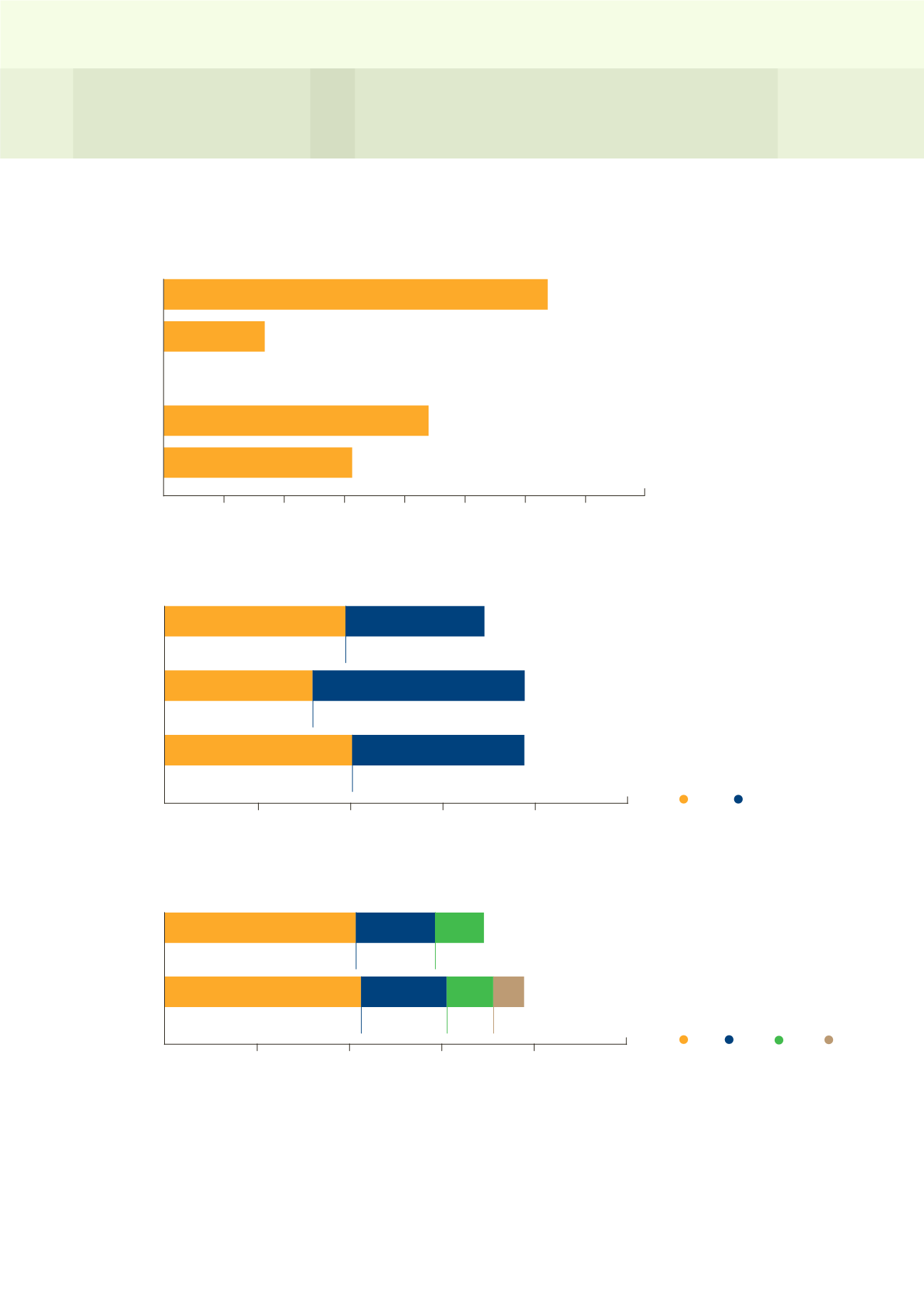

Debt Maturity Profile

(1) Subsequent to the financial year end, H-REIT exercised its option to convert a 5-year US$65.0 million (S$86.0 million) floating rate term loan into a 5-year

fixed rate term loan, as allowed under the terms of the loan term facility. The percentage of fixed borrowings, after this conversion, is about 52.2%.

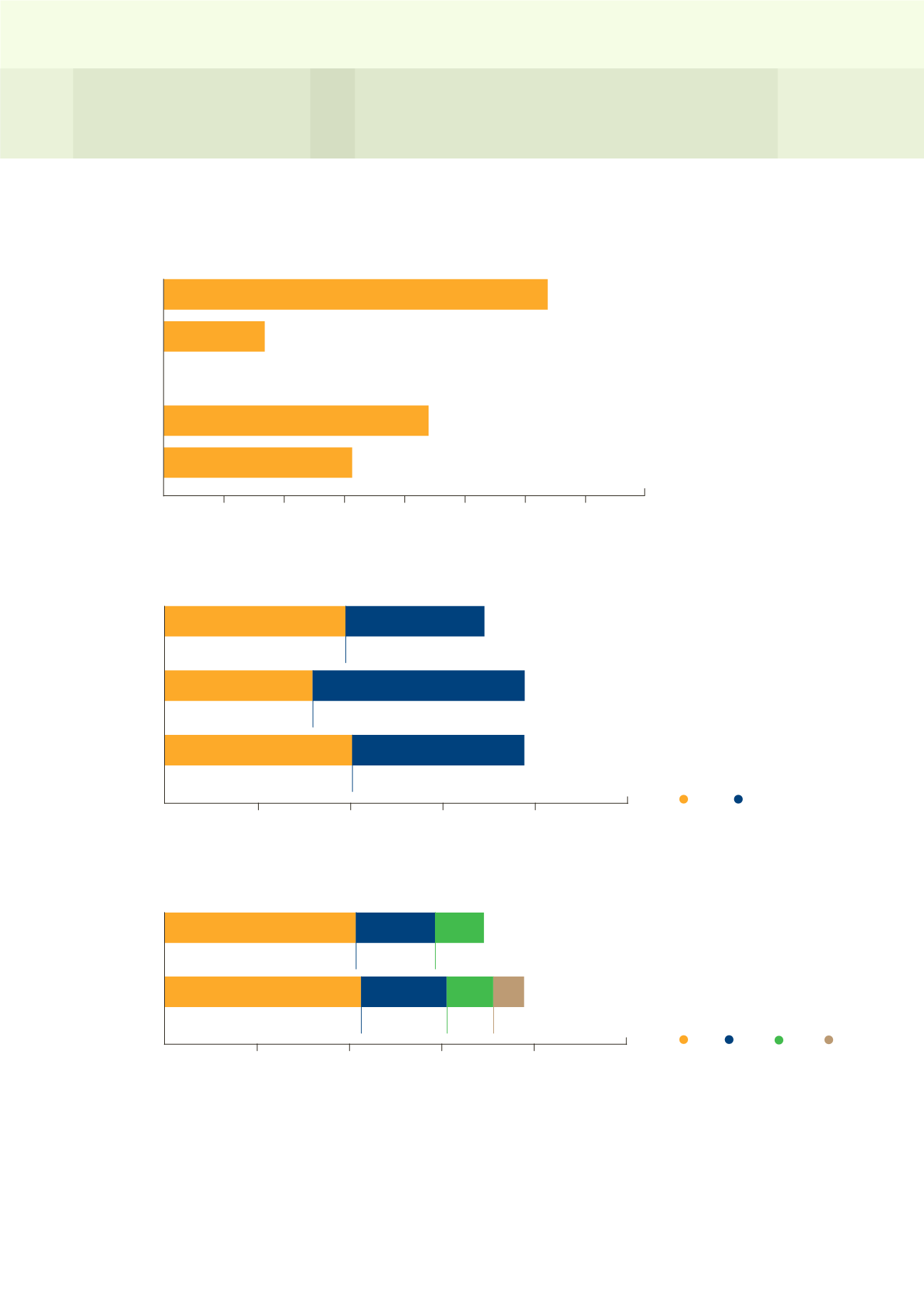

Fixed Versus Floating Rate Profile

(1)

Debt Currency Profile

S$'000

317,914

83,600

219,232

156,002

2015

2016

2017

2018

2019

0

50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000

As at

31 Dec

2013

As at

31 Dec

2014

Post

Balance

Sheet

Date

S$'000

56.6%

690,093

43.4%

299,692

390,401

776,748

41.1%

58.9%

457,204

319,544

776,748

52.2%

47.8%

371,203

405,545

Fixed Float

SGD USD AUD JPY

0

0

200,000

400,000

600,000

800,000

1,000,000

As at

31 Dec

2013

As at

31 Dec

2014

S$'000

59.9%

690,093

413,600

171,140

24.8%

105,353

15.3%

776,748

54.7%

424,493

185,234

23.8%

100,311

12.9%

66,710

8.6%

0

200,000

400,000

600,000

800,000

1,000,000