8

CDL

HOSPITALITY TRUSTS

(1) 90.0% of income available for distribution was distributed to Security holders. The remaining undistributed income of S$11,952,000 comprising solely

of tax exempt income was retained for working capital needs.

(2) The fair value of the derivatives as at 31 December 2014 is disclosed under Note 13 on page 137 of the Annual Report.

(3) The net revaluation surplus of S$17,639,000 has been recognised in the Statement of Total Return. The revaluation surplus has no impact on the

taxable income or income available for distribution to Security holders. Included in Investment Properties as at 31 December 2014 is a net translation

loss of S$4,238,000 relating to its overseas properties. All properties, excluding Jumeirah Dhevanafushi and the Japan Hotels, are accounted for as

Investment Properties.

(4) In CDLHT’s consolidated financial statements as at 31 December 2014, Jumeirah Dhevanafushi is accounted for at cost as Property, Plant and

Equipment and Prepaid Land Lease while the Japan Hotels are accounted for at cost as Property, Plant and Equipment.

(5) The borrowings are presented before the deduction of unamortised transaction costs.

(6) Subsequent to the financial year end, H-REIT exercised its option to convert a 5-year US$65.0 million (S$86.0 million) floating rate term loan into a

5-year fixed rate term loan, as allowed under the terms of the loan facility. The weighted average cost of debt, after this conversion, is about 2.4%.

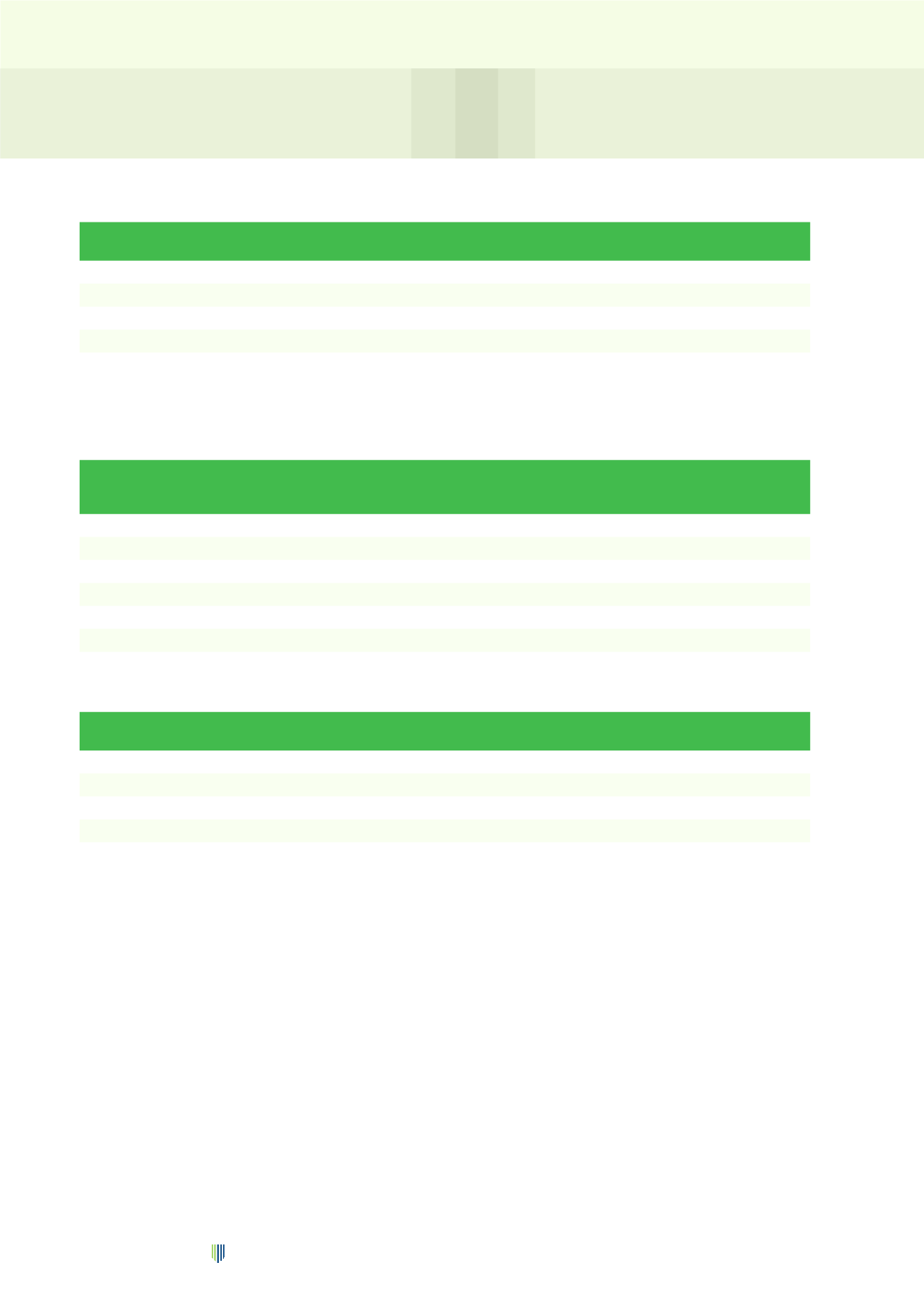

STATEMENT OF TOTAL RETURN

FY 2014

S$’000

FY 2013

S$’000

Variance

Net property income

140,526

137,389

+2.3%

Net income before revaluation

106,242

106,401

-0.1%

Income available for distribution

119,515

118,554

+0.8%

Income distributed

107,563

(1)

106,699

+0.8%

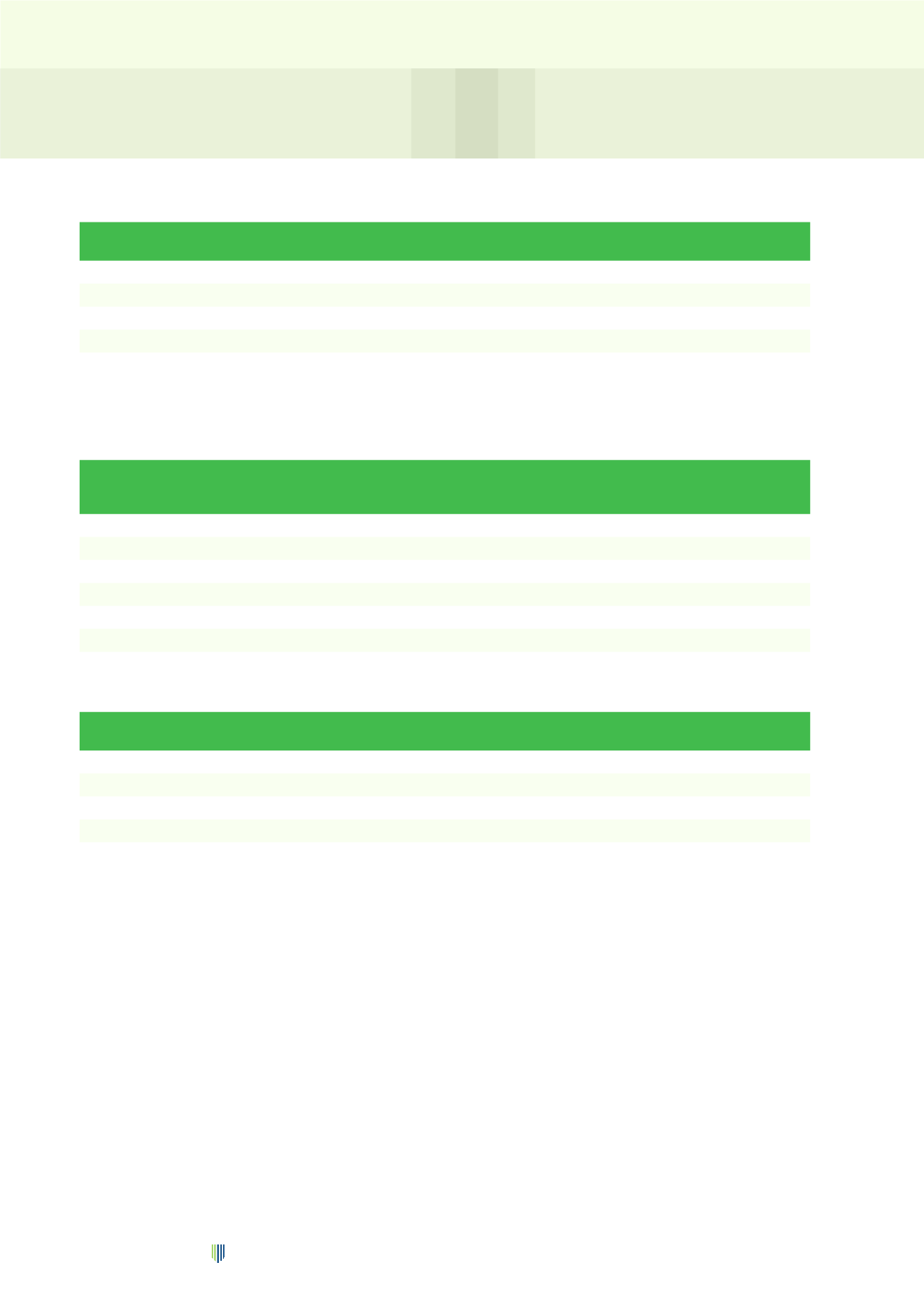

FINANCIAL

HIGHLIGHTS

KEY FINANCIAL INDICATORS

As at

31 Dec 2014

As at

31 Dec 2013

Variance

Gearing

31.7%

29.7%

+2.0pp

Weighted average cost of debt

2.3%

(6)

2.4%

-0.1pp

Weighted average debt to maturity (years)

2.5

2.6 -0.1

Interest coverage ratio

8.6x 8.8x -0.2x

Net asset value per unit

S$1.65

S$1.63 +1.2%

BALANCE SHEET

As at

31 Dec 2014

S$’000

As at

31 Dec 2013

S$’000

Variance

Investment properties

2,206,423

(3)

2,161,693

+2.1%

Property, plant and equipment

138,260

(4)

71,490

+93.4%

Non-current assets

2,352,334 2,238,846

+5.1%

Total assets

2,450,186 2,323,068

+5.5%

Borrowings

776,748

(5)

690,093

(5)

+12.6%

Net assets

1,616,127 1,595,382

+1.3%

Prudent capital management has resulted in a healthy balance sheet for CDLHT. As at 31 December 2014, CDLHT's

exposure to derivatives

(2)

represents a negligible percentage of its net asset and market capitalisation.