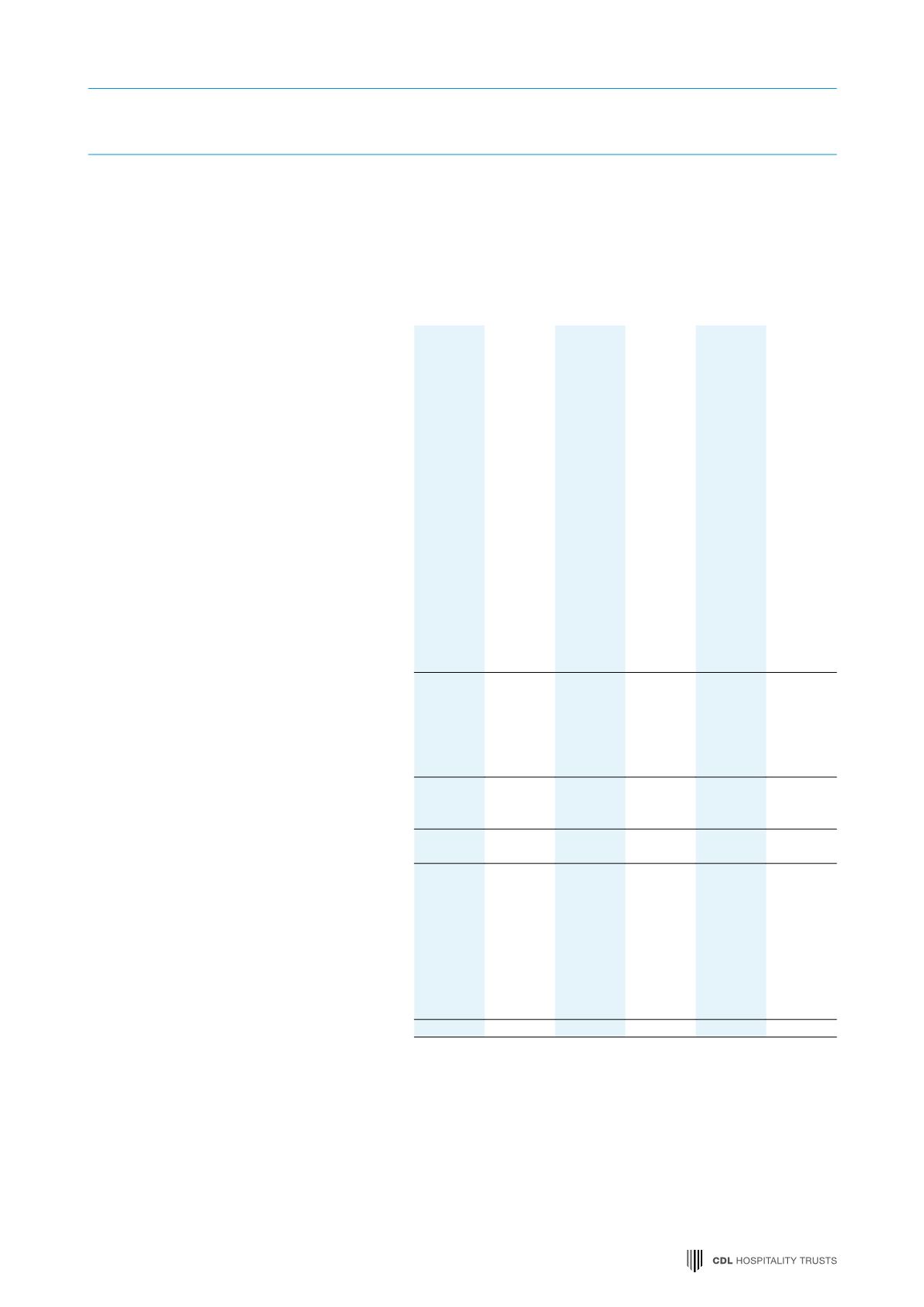

STATEMENTS OF CASH FLOWS

REPORTS

HBT Group

H-REIT Group

Stapled Group

Note 2016 2015 2016 2015 2016 2015

$’000 $’000

Restated

$’000 $’000 $’000 $’000

Restated

Cash flows from operating activities

Net income/(loss) before tax

1,579 (9,408)

48,767 57,555 50,346 51,565

Adjustments for:

H-REIT Manager’s and HBT Trustee-

Manager’s fees paid/payable in Stapled

Securities

350

–

9,931 10,210 10,281 10,210

Depreciation of property, plant and

equipment

3,769 1,049 1,774 1,511 8,586 5,479

Amortisation of prepaid land lease

–

–

–

–

272

253

Impairment loss on:

- trade receivables

223

42

153

470

376

512

- property, plant and equipment

–

–

–

–

7,330 1,557

- prepaid land lease

–

–

–

–

750

166

- goodwill

26

–

7,775

–

–

–

7,775

Property, plant and equipment

written off

–

142

–

–

–

142

Net fair value loss on investment

properties

–

– 33,018 38,534 21,623 30,221

Transaction costs for acquisition of a

subsidiary

–

2,442

–

–

–

2,442

Net finance costs

2,650

572 30,266 21,073 32,916 21,654

Operating income before

working capital changes

8,571 2,614 123,909 129,353 132,480 131,976

Changes in working capital:

Inventories

246

245

–

–

246

245

Trade and other receivables

151 (1,924)

(2,012)

1,945 (6,357)

2,887

Trade and other payables

(242)

(404)

3,617

375 7,871 (2,905)

Cash generated from operating

activities

8,726

531 125,514 131,673 134,240 132,203

Tax paid

(235)

(154)

(534)

(850)

(769)

(1,004)

Net cash generated from operating

activities

8,491

377 124,980 130,823 133,471 131,199

Cash flows from investing activities

Additions to property, plant and

equipment and prepaid land lease

(2,174)

(512)

(823)

(335)

(3,994)

(2,304)

Capital expenditure on investment

properties

–

– (15,201)

(16,924)

(14,204)

(15,466)

Net cash outflow from acquisition of a

subsidiary

26

– (133,564)

–

–

– (133,564)

Interest received

–

–

1,417

318

148

318

Net cash used in investing activities

(2,174) (134,076)

(14,607)

(16,941)

(18,050) (151,016)

Year ended 31 December 2016

The accompanying notes form an integral part of these financial statements.

130