97

Annual Report 2015

STATEMENT OF POLICIES AND PRACTICES IN

RELATION TO THE MANAGEMENT AND GOVERNANCE

OF CDL HOSPITALITY BUSINESS TRUST

Under the HBT Trust Deed, if the value of the HBT deposited property is at least S$50.0 million, a maximum of 0.1% per

annum of the value of the HBT's deposited property (if any), subject to a minimum fee of S$10,000 per month, excluding

out-of-pocket expenses and goods and services tax, is payable to the HBT Trustee-Manager as trustee fee. For the purpose

of calculating the management fee, if HBT holds only a partial interest in any of HBT deposited property, such HBT deposited

property shall be pro-rated in proportion to the partial interest held.

The trustee fee is payable in arrears on a monthly basis in the form of cash.

The HBT Trustee-Manager is also entitled to a maximum of 0.1% of the acquisition price of any authorised investment acquired

directly or indirectly by HBT (pro-rated if applicable to the proportion of HBT’s interest in the authorised investment acquired).

The acquisition fee is payable to the HBT Trustee-Manager in the form of cash and/or Stapled Securities or (as the case may

be) HBT Units as the HBT Trustee-Manager may elect, and in such proportion and for such period as may be determined by

the HBT Trustee-Manager.

Any increase in the rate or any change in structure of the HBT Trustee-Manager’s management fee and trustee fee, or in the

maximum permitted level of the acquisition fee, must be approved by an extraordinary resolution passed at a meeting of HBT

Unitholders duly convened and held in accordance with the provisions of the HBT Trust Deed.

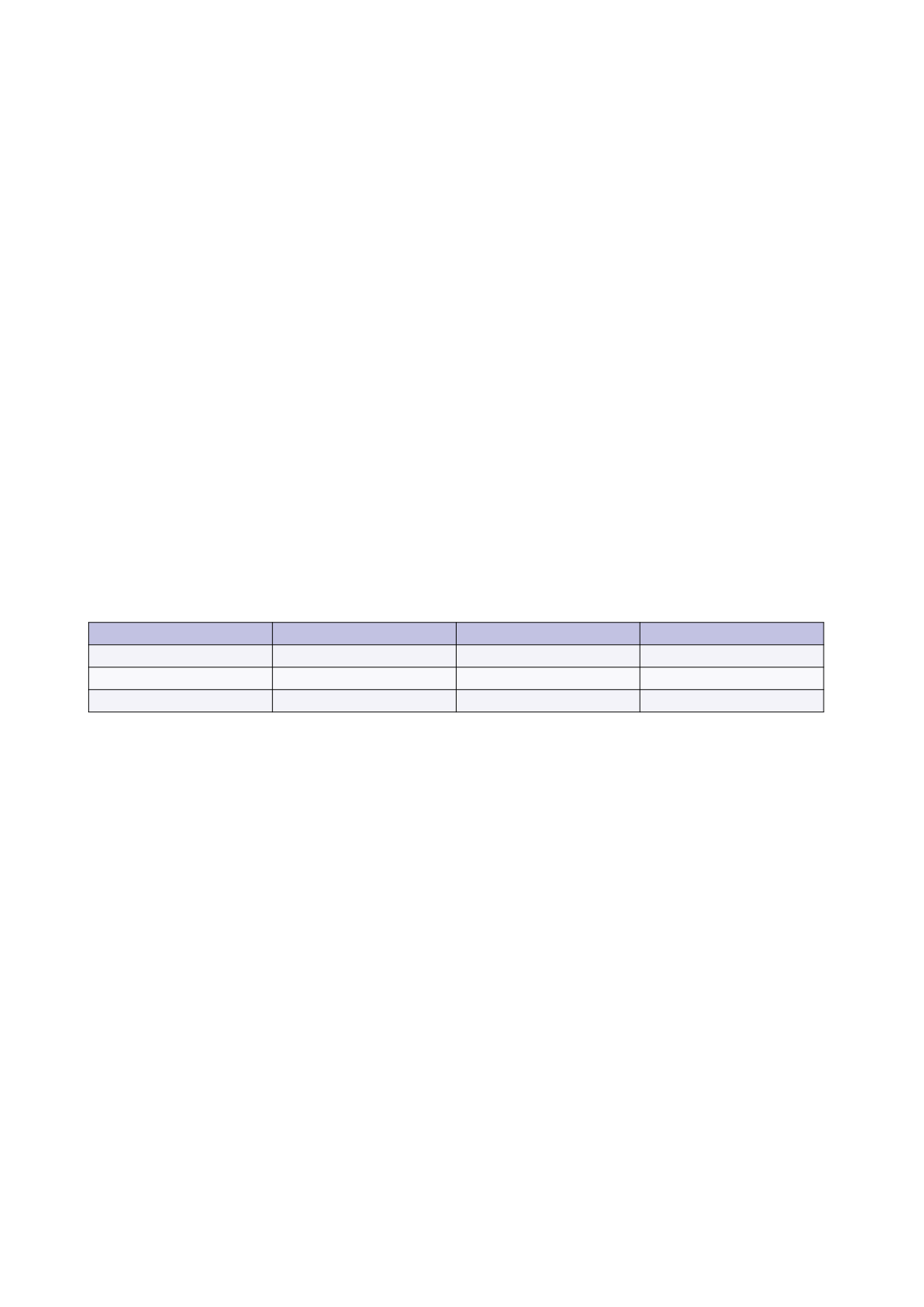

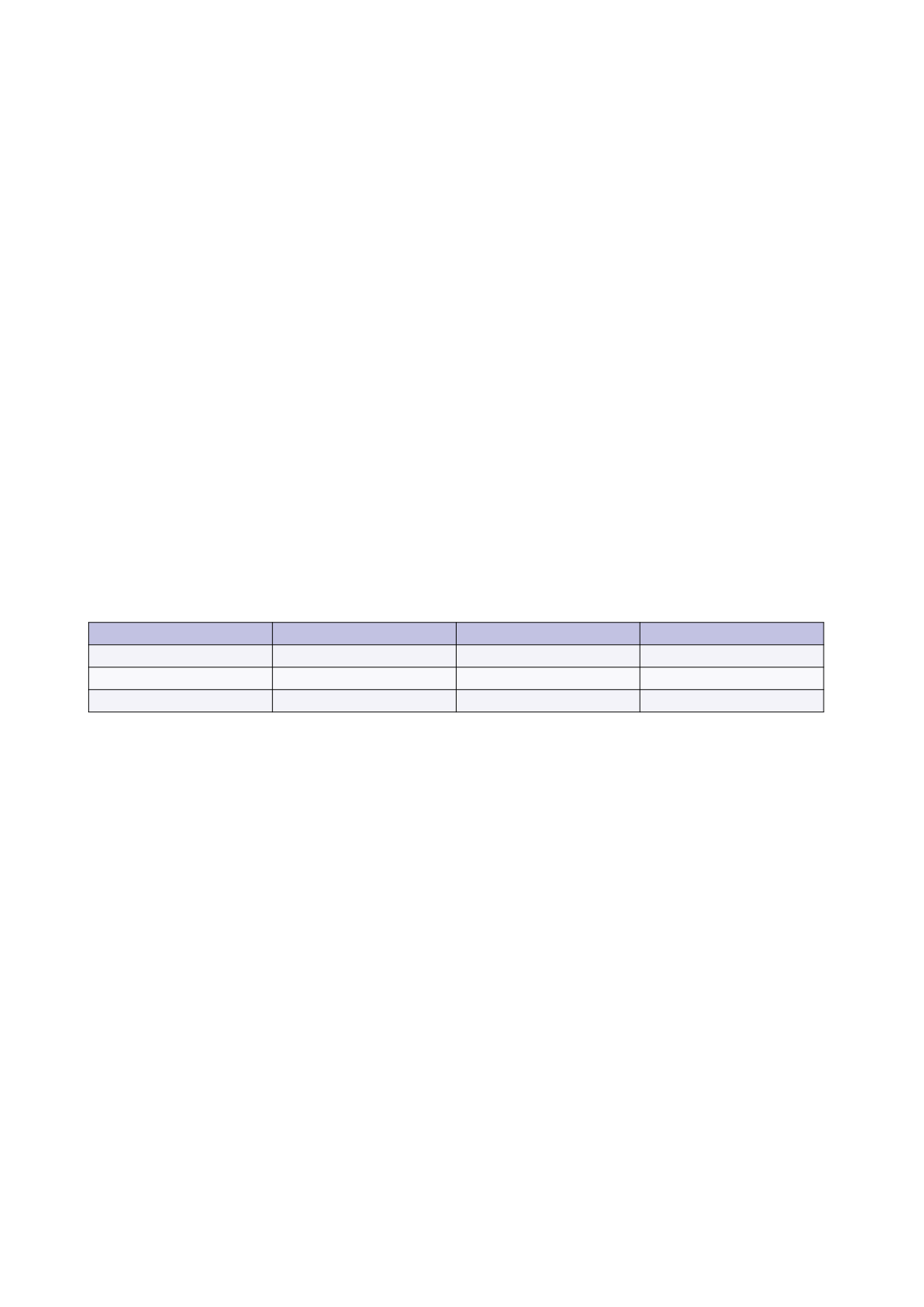

The table below sets out the fees earned by the HBT Trustee-Manager for the financial year ended 31 December 2015.

Fee

Amount (S$’000)

% in Cash

% in Units

Management Fee

–

–

–

Acquisition Fee

132

100%

0

Trustee Fee

37

100%

0

During the financial year ended 31 December 2015, the HBT Trustee-Manager has received 100% of the acquisition and trustee

fees in cash. No expenses were paid to the HBT Trustee-Manager during the financial year ended 31 December 2015 and any

out-of-pocket expenses incurred were funded by HBT’s working capital.

Fees payable to the HBT Trustee Manager by HBT will be put up to the HBT Trustee-Manager Board for approval every quarter.

The HBT Trustee-Manager Board will meet every quarter to review the material expenses and fees charged to HBT and

to ensure that the expenses payable to the HBT Trustee-Manager out of the HBT Trust Property are appropriate and in

accordance with the HBT Trust Deed.

Compliance with the Business Trusts Act and Listing Manual

The Company Secretary and Compliance Officer monitor HBT’s compliance with the BTA and the Listing Manual. The HBT

Trustee-Manager has an internal compliance manual which serves to summarise all the applicable rules and regulations as well

as key internal policies and processes which HBT needs to comply with. The manual will be consistently updated whenever

there are changes to the rules and regulations and such policies and processes, and this will help management to check that

applicable rules and regulations are being complied with.

The HBT Trustee-Manager will also engage the services of and obtain advice from professional advisers and consultants from

time to time to ensure compliance with the requirements of the BTA and the Listing Manual.