43

ANNUAL REPORT 2014

(1) The property was valued by Knight Frank Pte Ltd using a combination of the Capitalisation

and Discounted Cash Flow approaches.

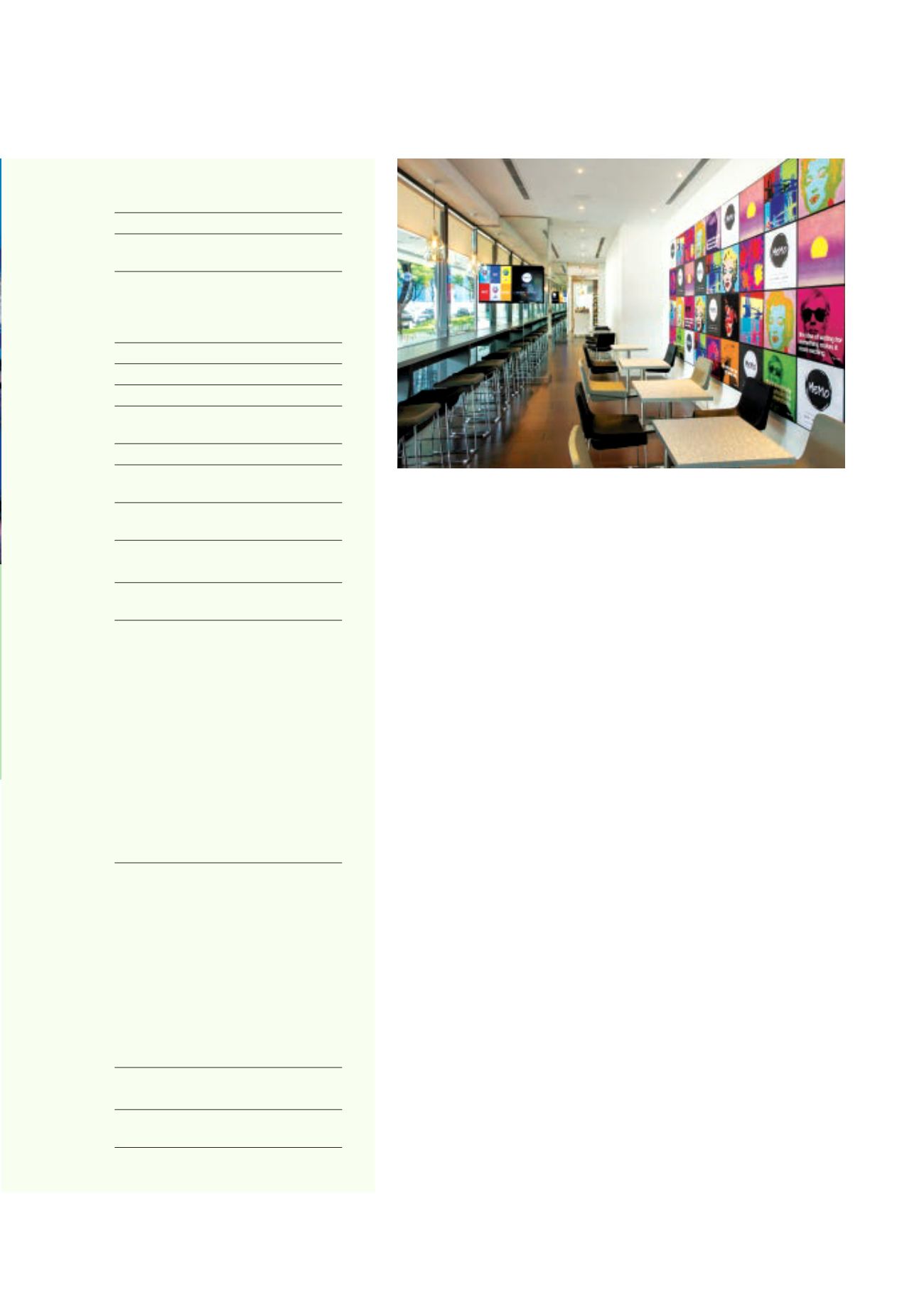

Studio M Hotel is a unique and stylised hotel in Singapore that blends modern

design with functionality. Designed by Italian style maestro and architect, Piero

Lissoni, it is the first fully loft-inspired Singapore hotel that also occupies a prime

and vibrant location in the city; within easy reach of both the Central Business

District and Orchard Road. The hotel offers a great leisure getaway or business stay

in the iconic entertainment precinct of Robertson Quay. Studio M Hotel has 360

stylish guest rooms and facilities include an open-air tropical oasis deck, 25-metre

lap pool, a jet pool, well-equipped open-air gymnasium and a food and beverage

outlet – MEMO.

The hotel has within the short time since commencement of business won the

AsiaOne’s People’s Choice Awards 2010: Top 3 Boutique Hotels in Singapore,

Travellers’ Choice 2012: Top 20 Trendiest Hotels in Singapore awarded by

TripAdvisor, Rakuten Travel Rising Star Award 2012 and Booking.com's Outstanding

Hotel Partner Award 2012. Other accolades include the BCA Green Mark (Gold) for

2015, PUB Water Efficiency Building Award (Basic) for 2014 and the BizSAFE Level

3 Certification (2012).

PROPERTY DETAILS

Number of guest rooms:

360

Number of food & beverage outlets:

One outlet — MEMO

Other facilities:

Recreational facilities

incorporating a 25-metre lap pool,

a jet pool, an open-air gymnasium

and three cabanas

Car park facilities:

30 car park lots

Land area:

2,932.1 sq m

Gross floor area:

8,209.9 sq m

Title:

99-year leasehold interest

commencing from 26 February 2007

Vendor:

Republic Iconic Hotel Pte. Ltd.

Purchase price at 3 May 2011:

S$154.0 million

Valuation

(1)

as at 31 December 2014:

S$164.0 million

MASTER LEASE DETAILS

Master lessee:

Republic Iconic Hotel Pte.

Ltd., a subsidiary of M&C

Term of lease with master lessee:

20 years from 3 May 2011 with:

(i) an option to extend the lease for

a first additional term of 20 years

commencing immediately after the

expiry of the initial term;

(ii) an option to extend the lease for a

second additional term of 20 years

commencing immediately after the

expiry of the first additional term; and

(iii) an option to extend the lease for

a third additional term of 10 years

commencing immediately after the

expiry of the second additional term.

Minimum rental income:

For the nine

years after the first year of the lease, a fixed

rent of S$5 million per annum. On the

tenth anniversary date (the "

Rent Revision

Date

") of the commencement of the lease,

the fixed rent amount will be revised to an

amount equivalent to 50% of the average

annual aggregate fixed rent and variable

rent for the five fiscal years preceding the

Rent Revision Date (the "

Revised Fixed

Rent

") . This amount would thereon be the

Revised Fixed Rent amount.

KEY FINANCIALS

Rental income from the property for FY

2014:

S$9.0 million

Net property income from the property

for FY 2014:

S$8.5 million

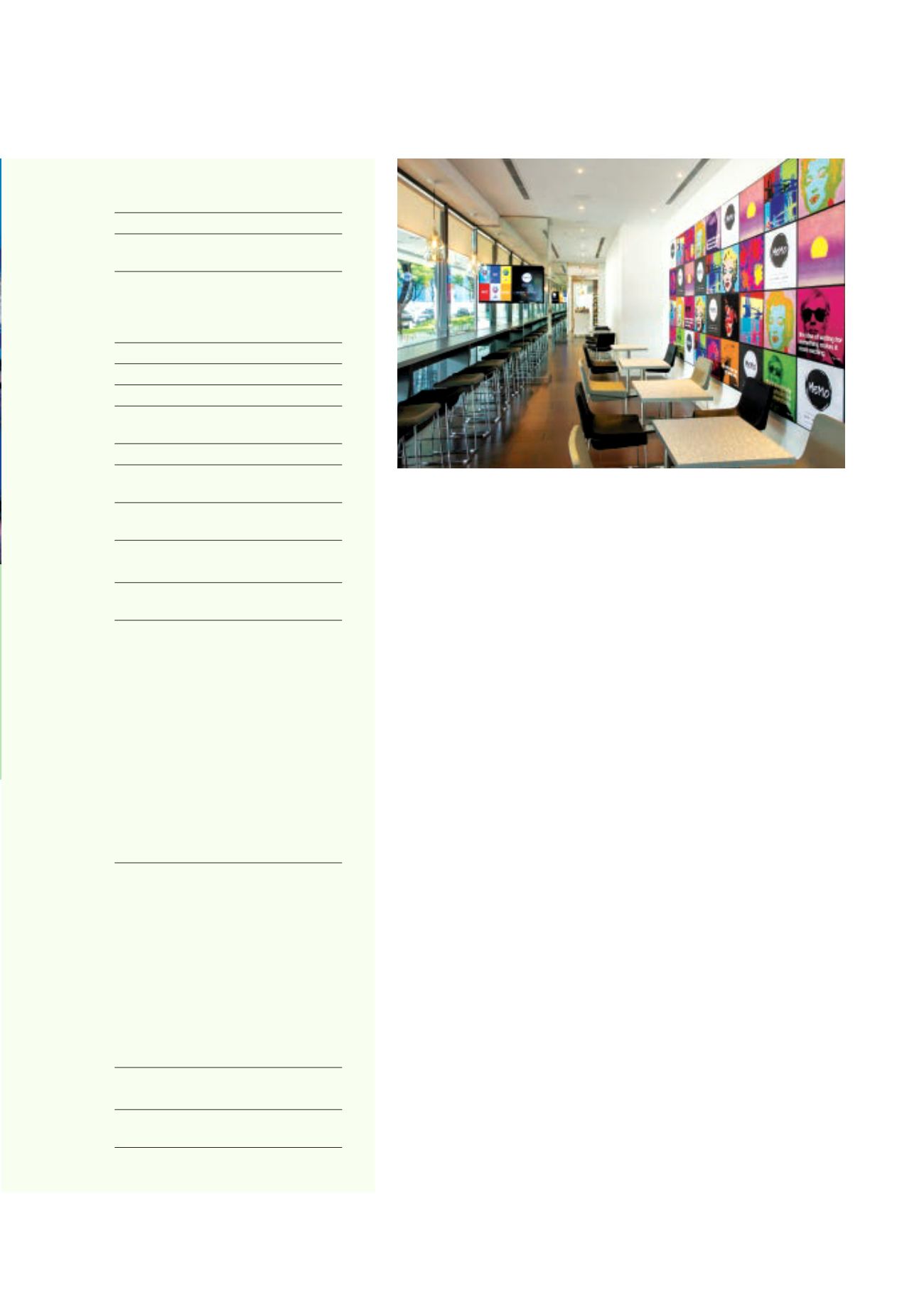

MEMO