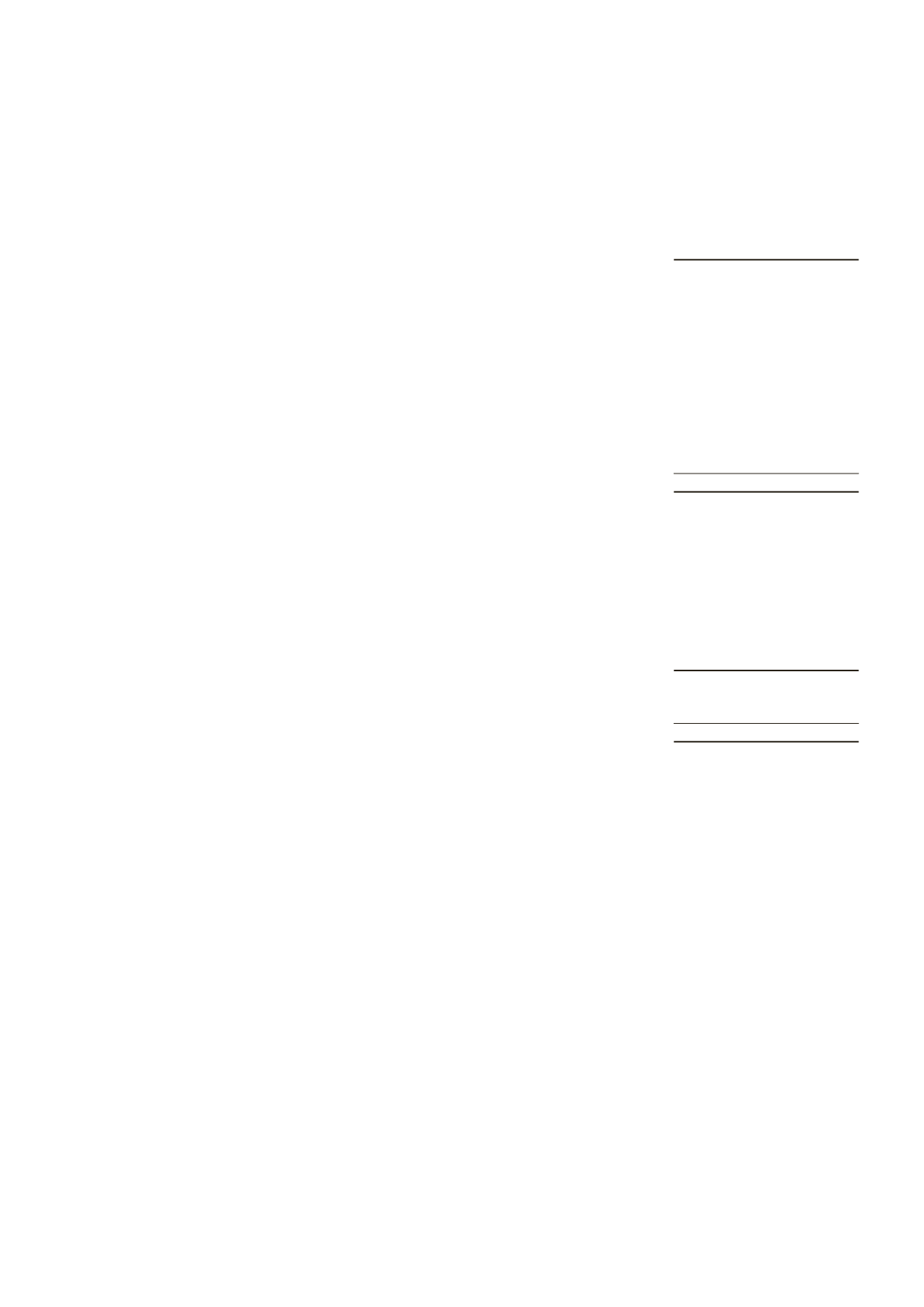

8 REVENUE

2014

2013

$

$

Management fee from a related entity

23,651

–

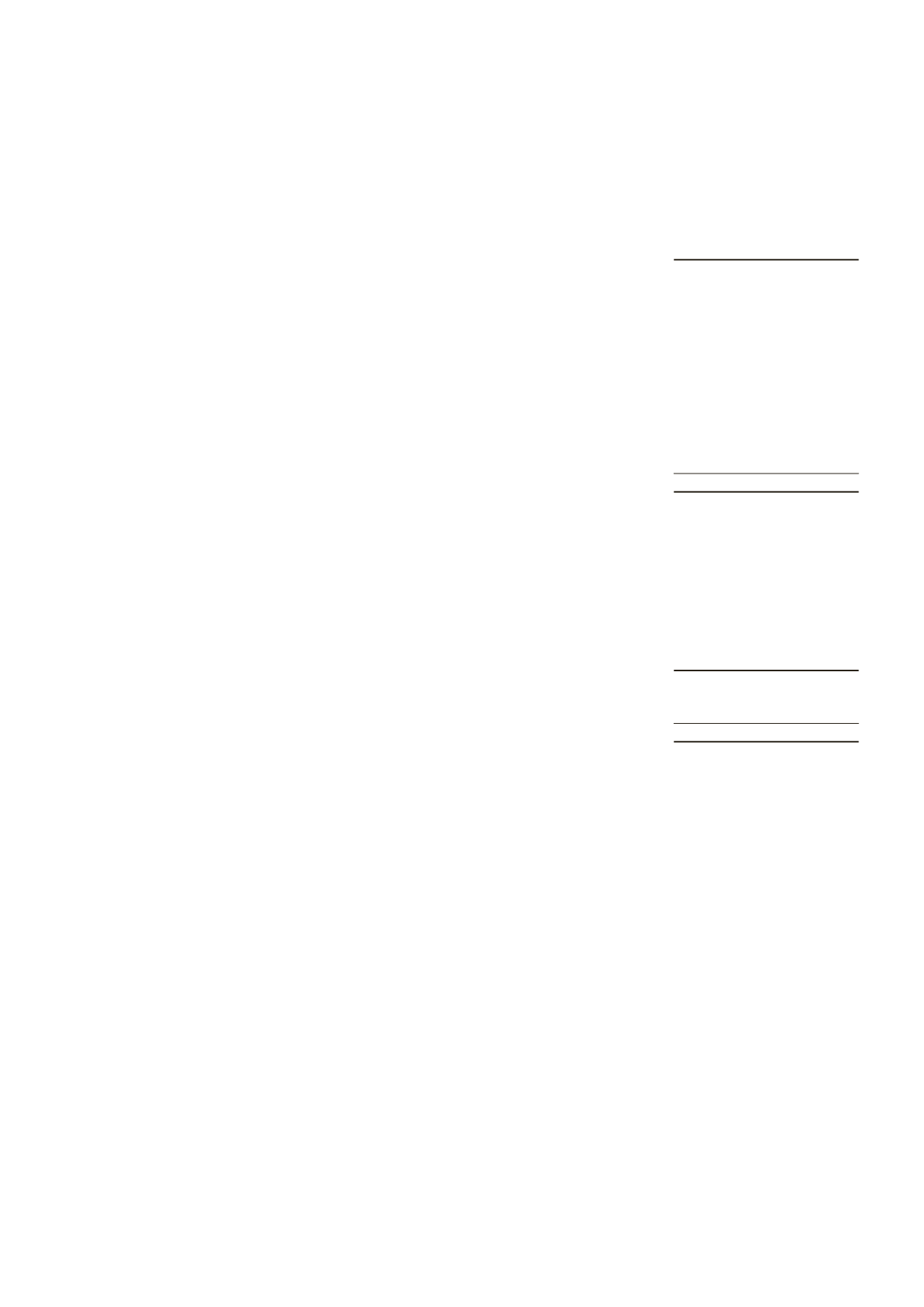

9 OTHER OPERATING EXPENSES

2014

2013

$

$

Secretarial fees

48,100

3,950

Tax fees

3,800

–

Accounting fees

2,400

–

Audit fees

2,248

2,560

Other professional fees

14,932

1,683

71,480

8,193

10 TAX EXPENSE

Reconciliation of effective tax rate

2014

2013

$

$

Loss before tax

(47,829)

(8,193)

Tax calculated using Singapore tax rate of 17%

(8,131)

(1,393)

Non-deductible expenses

8,131

1,393

–

–

11 FINANCIAL RISK MANAGEMENT

Risk management is integral to the whole business of the Company. The Company has a system of controls in place to

create an acceptable balance between the cost of risks occurring and the cost of managing the risks. The management

continually monitors the Company’s risk management process to ensure that an appropriate balance between risk and

control is achieved. Risk management policies and systems are reviewed regularly to reflect changes in market conditions

and the Company’s activities.

The Board of Directors oversees how management monitors compliance with the Company’s risk management policies and

procedures and reviews the adequacy of the risk management framework in relation to the risks faced by the Company.

Exposure to credit and liquidity risks arises in the normal course of the Company’s business. These risks are limited by the

Company’s financial management policies and practices described below.

Credit risk

At the reporting date, the amount due from related entity represents a significant portion of the financial assets. The

maximum exposure to credit risk is represented by the carrying amount of each financial asset in the statement of financial

position.

NOTES TO THE FINANCIAL STATEMENTS

14

ANNUAL REPORT 2014