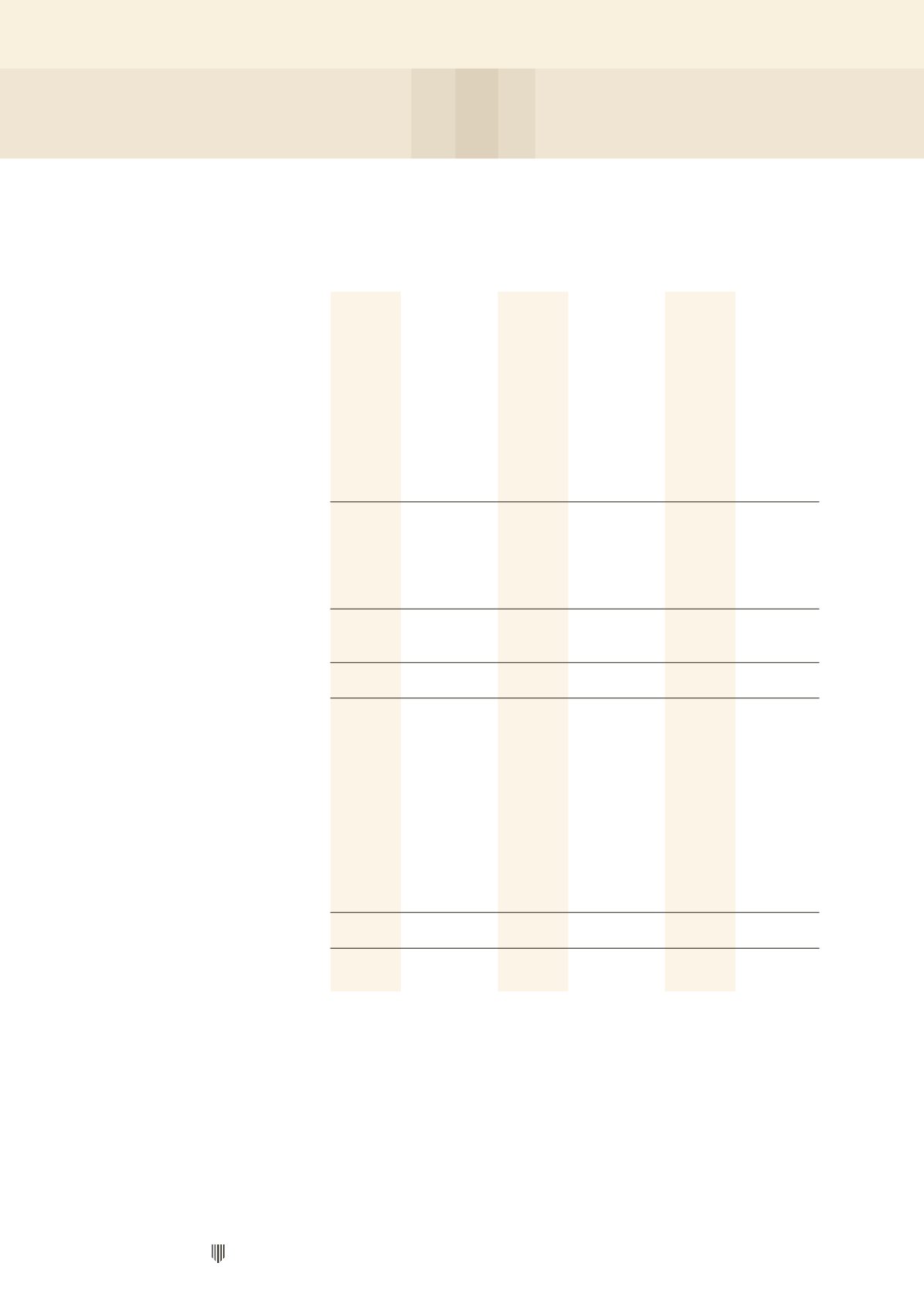

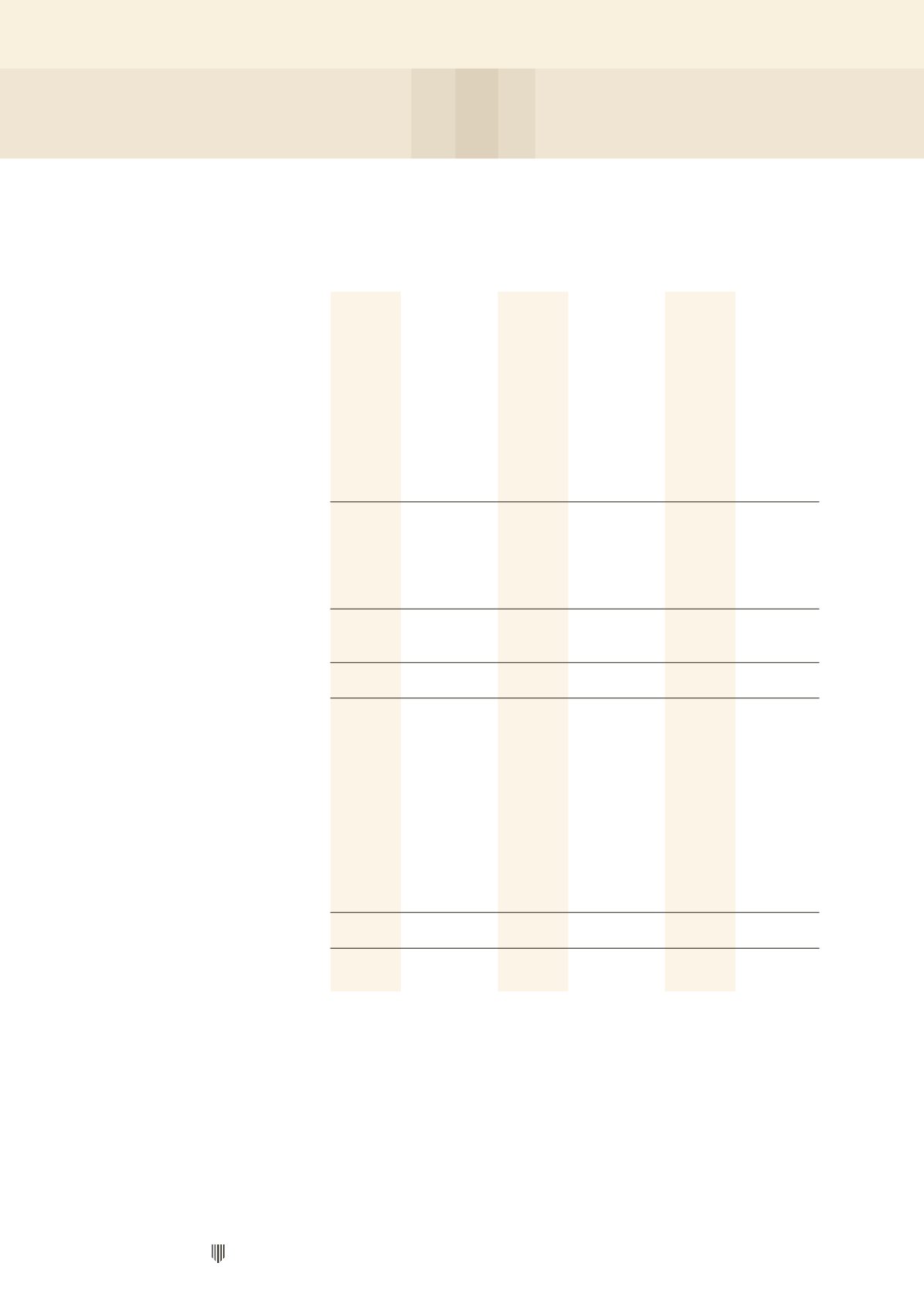

110

CDL

HOSPITALITY TRUSTS

HBT Group

H-REIT Group

Stapled Group

Note 2014

2013

2014

2013

2014

2013

$’000

$’000

$’000

$’000

$’000

$’000

Cash flows from operating activities

Net income/ (loss)

213

(31)

126,832

142,988

123,881 142,957

Adjustments for:

Depreciation and amortisation

–

–

–

–

2,825

–

Impairment loss on property,

plant and equipment

–

–

–

–

34

–

H-REIT Manager’s management

fees paid/payable in

Stapled Securities

–

–

10,278

9,924

10,278

9,924

Net finance expense

1

–

16,439

16,638

16,440

16,638

Net surplus on revaluation of

investment properties

–

–

(17,978)

(36,556)

(17,639)

(36,556)

Operating income/(loss) before

working capital changes

214

(31)

135,571

132,994

135,819 132,963

Changes in working capital:

Trade and other receivables

(3,323)

–

(4,393)

1,010

(6,742)

1,264

Trade and other payables

7,930

256

5,012

(3,177)

11,934

(3,175)

Inventories

(1,366)

–

–

–

(1,366)

–

Cash generated from

operating activities

3,455

225

136,190

130,827

139,645 131,052

Tax paid

–

–

(204)

(26)

(204)

(26)

Net cash generated from

operating activities

3,455

225

135,986

130,801

139,441 131,026

Cash flows from investing activities

Acquisition of property,

plant and equipment and

prepaid land lease

–

–

(65,528)

–

(311)

(77,077)

Acquisition of

investment properties

–

–

– (167,128)

–

(90,051)

Capital expenditure on

investment properties

–

–

(27,430)

(14,090)

(27,430)

(14,090)

Net cash flow from

acquisition of business

26

6

–

–

–

(65,211)

–

Interest received

–

–

342

455

342

455

Net cash (used in)/from

investing activities

6

–

(92,616)

(180,763)

(92,610)

(180,763)

Balance carried forward

3,461

225

43,370

(49,962)

46,831

(49,737)

STATEMENTS OF CASH FLOWS

Year ended 31 December 2014

The accompanying notes form an integral part of these financial statements.